A large Bitcoin investor, often referred to as a “whale,” is betting hundreds of millions on a short-term decline in Bitcoin’s value, just as a week filled with critical economic reports approaches. These reports may greatly influence Bitcoin’s price movement and investor risk appetite.

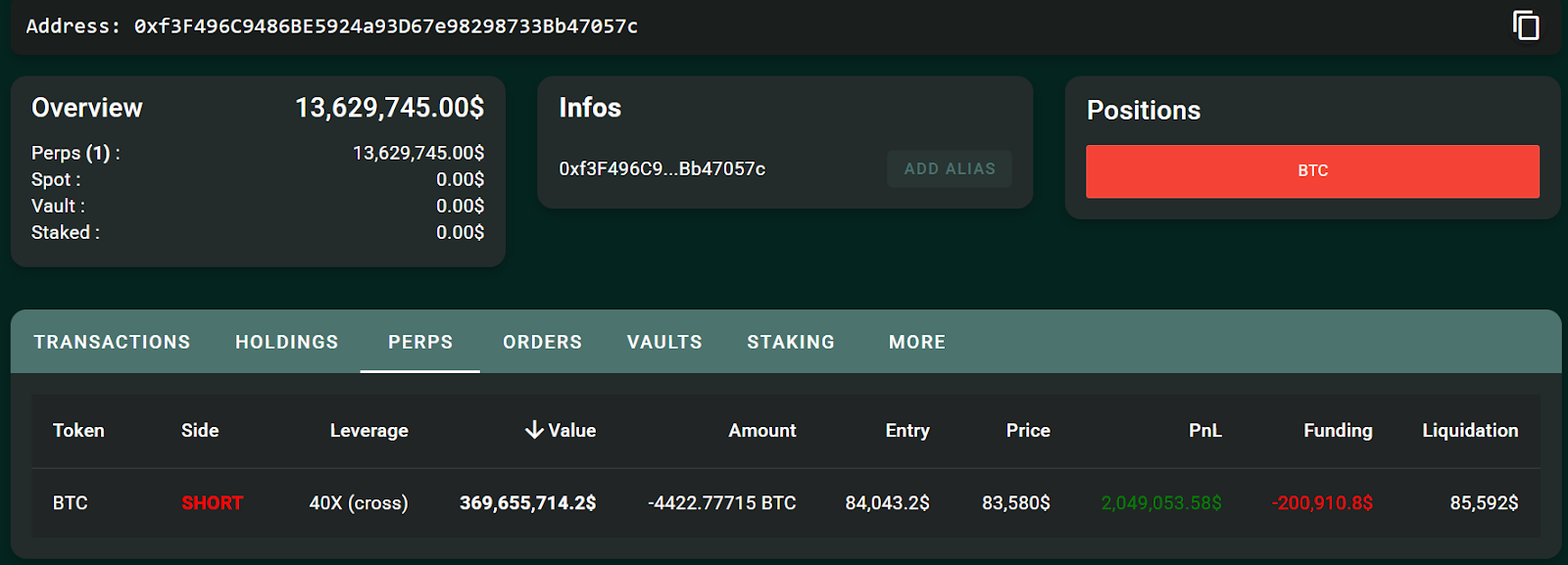

This substantial investor has taken a 40x leveraged short position with over 4,442 Bitcoin (BTC), amounting to more than $368 million, effectively making a wager on a drop in Bitcoin’s price.

Leveraged positions utilize borrowed funds to amplify the investment size, increasing potential gains but also risks, making this strategy more perilous than conventional investments.

The position was initiated at a price of $84,043 and faces liquidation if Bitcoin’s price exceeds $85,592.

Source: Hypurrscan

The investor has realized more than $2 million in unrealized profits; however, they currently face over $200,000 in losses due to funding fees, according to data available.

Despite the increased risks associated with leveraged trading, some crypto traders find significant success with this approach. Earlier this month, an astute trader managed to earn $68 million from a 50x leveraged short position, betting on an 11% decline in Ether’s (ETH) price.

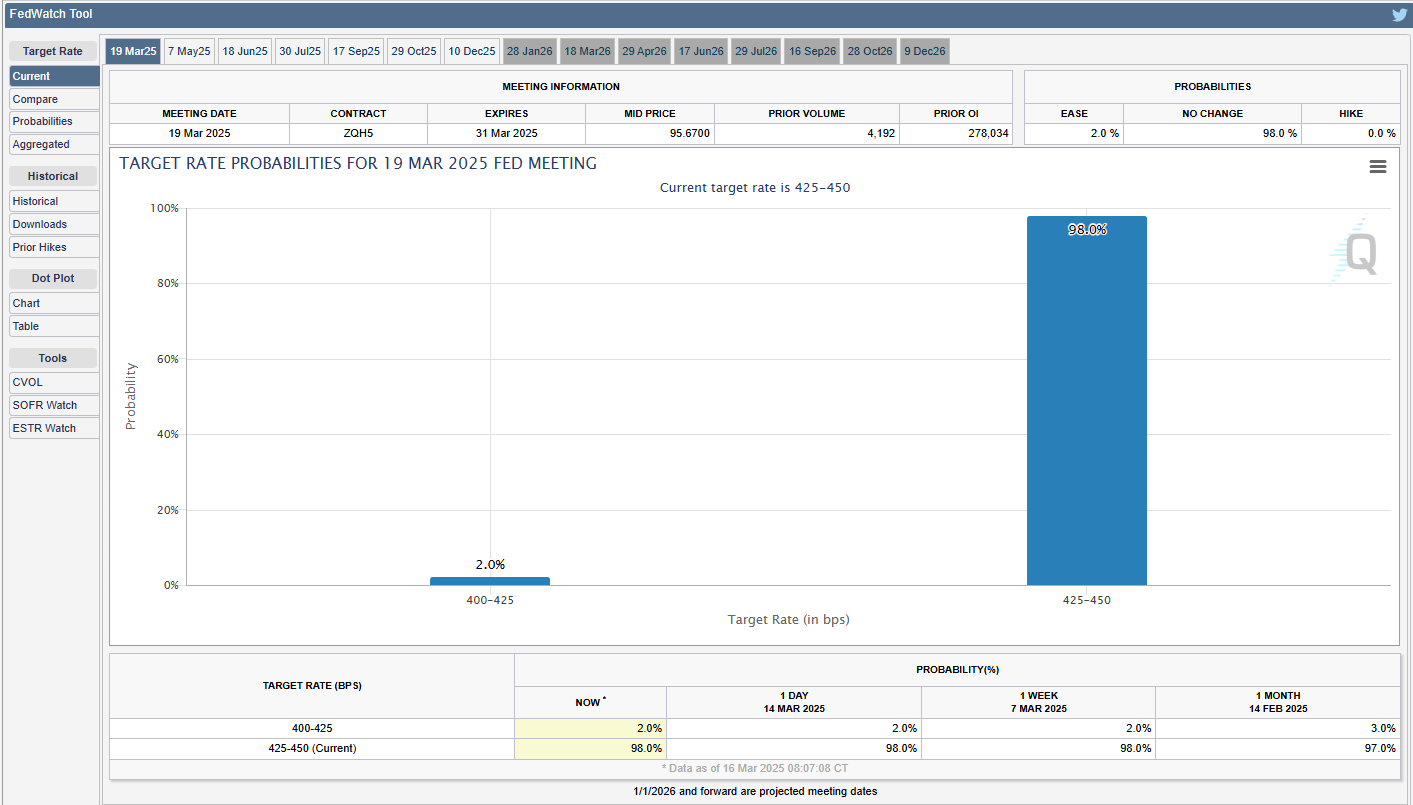

This leveraged position arrives just before a week filled with notable macroeconomic data releases, including the Federal Open Market Committee (FOMC) meeting set for March 19, which may influence the risk tolerance of investors in assets like Bitcoin.

Related: Bitcoin’s next catalyst: End of $36 trillion US debt ceiling suspension

To avert pre-FOMC dips, Bitcoin should close weekly above $81k: analysts

Bitcoin’s price continues to be vulnerable to substantial downward fluctuations due to increasing macroeconomic uncertainties regarding global trade tariffs.

To mitigate the risk of falls ahead of the FOMC meeting, Bitcoin must achieve a weekly close above $81,000, as noted by the head analyst at Bitget Research.

The analyst commented:

“The crucial level to monitor for the weekly close is the $81,000 range; maintaining above this indicates strength, but a drop below $76,000 might trigger more short-term selling pressure.”

Related: Bitcoin witnessing a ‘shakeout,’ and not the end of a 4-year cycle: Analysts

Source: CME Group’s FedWatch

“The market predominantly anticipates the Fed will maintain steady rates, but any unexpected hawkish signals could exert pressure on Bitcoin and other risk-related assets,” the analyst added.

Magazine: SCB forecasts $500K BTC, SEC postpones Ether ETF decisions, and more: Hodler’s Digest, Feb. 23 – Mar. 1