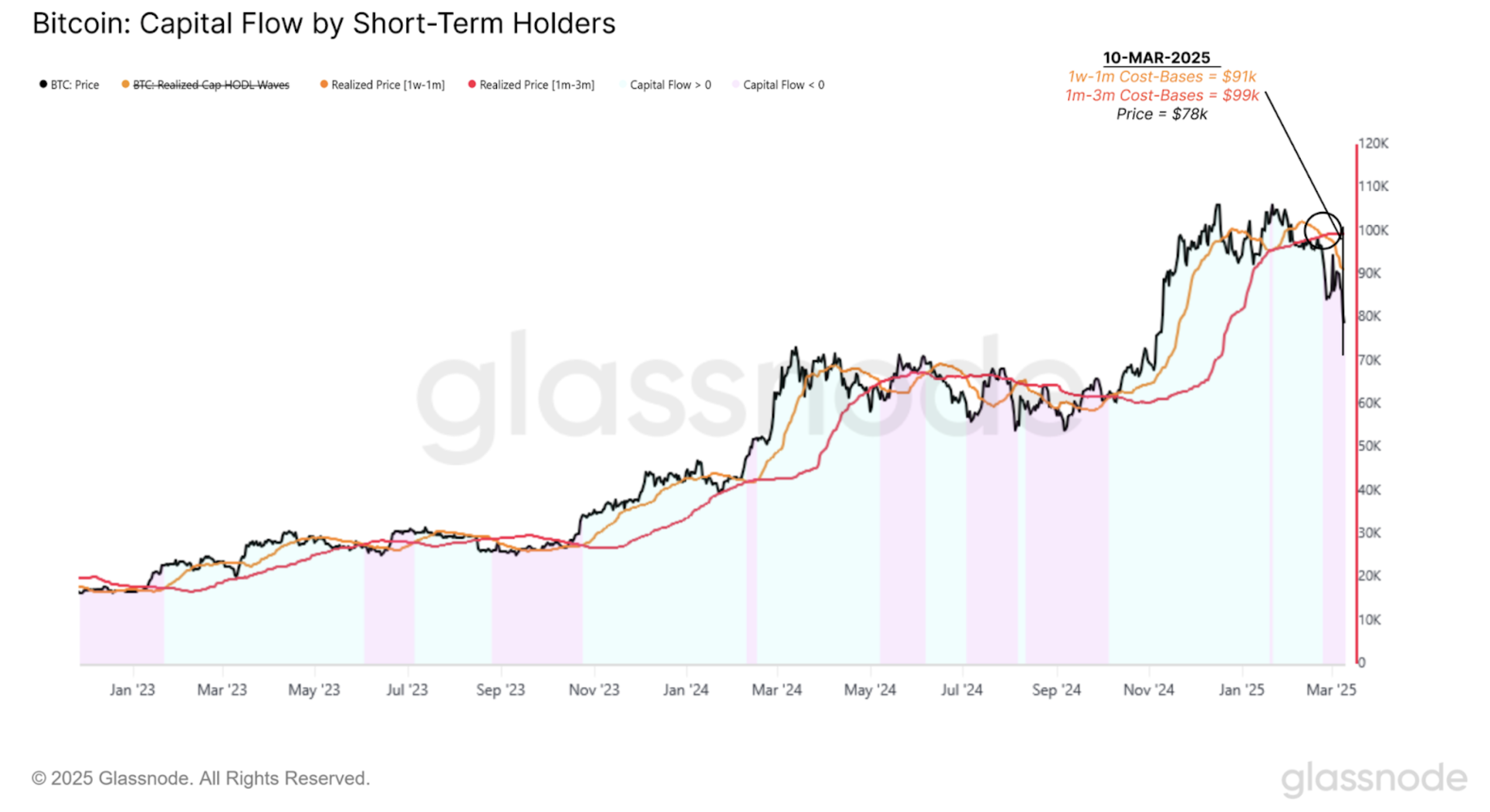

Bitcoin (BTC) has experienced its second-largest pullback of the current bull run, as noted by analysts from a leading cryptocurrency exchange. The decline, which occurred after reaching an all-time high of $109,590 on January 20, saw the price drop to a low of $77,041 in the week of March 9-15, marking a 30% retracement driven by selling pressure from those who held their assets for a shorter duration.

The exchange categorizes short-term holders as individuals who have acquired Bitcoin within the past seven to 30 days. These investors have encountered net unrealized losses and are generally more vulnerable to capitulating under market stress.

Furthermore, the exchange reports that the continued outflows from Bitcoin ETFs, amounting to approximately $920 million during the week of March 9-15, indicate that institutional investors have not yet returned in significant numbers to counteract selling pressure.

Capital flow in Bitcoin among short-term holders.

Currently trading at around $84,357, Bitcoin has rebounded by 9.5% from its recent low. Analysts believe that a crucial factor moving forward will be whether institutional demand increases at these lower price levels, which may lead to supply absorption and a stabilization of prices.

“While the flow of institutional investments and the broader economic landscape are key to determining market direction in the near term, historically, a 30% decline often signals a low point before a potential upward trend,” said the analysts. “If Bitcoin manages to stabilize around this price, history indicates that a robust recovery may be on the horizon.”

Bitcoin ETPs Experience $5.4B in Outflows Over Five Weeks

Weekly outflows from crypto exchange-traded products (ETPs) have now continued for five weeks, amounting to a total of $6.4 billion as of March 14. Reports indicate that Bitcoin ETPs have experienced the most significant outflows, suffering $5.4 billion in losses.

The current macroeconomic situation may be impacting the markets, as per the analysis. Consumer confidence in the US has dropped to its lowest level in two years, with concerns about rising inflation and economic uncertainty. A Federal Reserve model forecasted a 2.8% contraction of the US economy in the first quarter of 2025.

Additionally, ongoing discussions about trade wars continue to make headlines, casting doubt on Bitcoin’s role as a safe-haven asset, raising alerts among miners, and potentially jeopardizing the bull market—despite the recent announcement from the White House regarding a US Bitcoin strategic reserve and digital asset stockpile.

Magazine: X Hall of Flame, Benjamin Cowen: Bitcoin dominance will fall in 2025