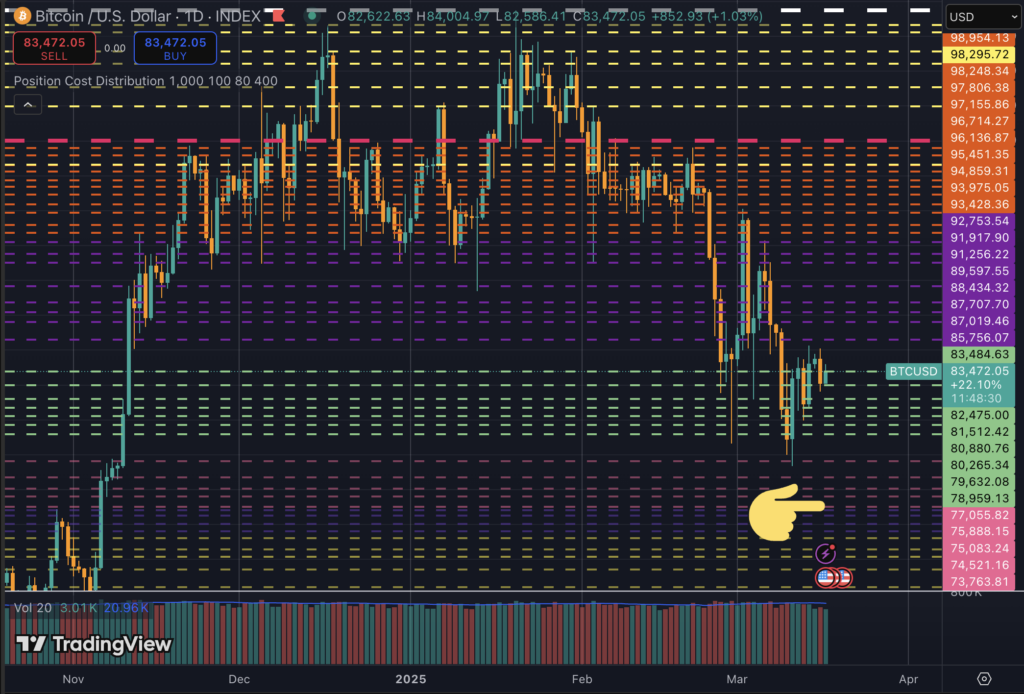

Currently, Bitcoin is trading around a crucial support level of approximately $83,000, as investors remain cautious. The cryptocurrency has frequently tested resistance zones at the peak of a historical price channel.

Data revealed by Nic Puckrin, CEO of CoinBureau, indicates that Bitcoin’s supply is relatively sparse between $70,000 and $80,000. If prices drop into that range, the lack of supply could suggest limited buying activity in the market.

This aligns with my analysis. Bitcoin continues to test the upper limit of a historical price channel, indicating it could either break out or consolidate further. On March 14, I noticed signs of exhaustion at the channel’s peak, anticipating consolidation in the following days, which has since occurred.

Bitcoin is currently having difficulty breaking into the $85,700 range, as it tests support levels at the top of the green channel below.

On a broader scale, Bitcoin shows relative strength compared to the declining US Dollar Index (DXY). On March 13, I remarked on Bitcoin’s resilience, noting its stable performance despite recent price declines in relation to the weakening dollar.

Reflecting on historical price movements, I’ve previously highlighted a post-halving cycle peak that typically occurs about 500–600 days following halving events. I issued a caution on January 20, coinciding with President Trump’s inauguration—when Bitcoin hit its all-time high of $109,300. At that moment, I noted the potential for volatility spikes and liquidity sweeps aimed at clearing leveraged positions before any sustained upward trend could emerge.

As we’ve observed most of the gains from the ‘Trump Trade’ diminish, I would expect this retracement to bring prices down to around $73,000, the level Bitcoin was at in November before the election. This movement would complete the cycle and mitigate market ‘hype’, enabling Bitcoin to progress based on fundamentals and global perception.

The insights shared here should not be interpreted as financial advice. I am analyzing possible catalysts and market trends. Bitcoin’s movement will ultimately depend on market dynamics, though I believe these factors will influence its trajectory.