- Tokenized Gold assets reached a market cap of $1.8 billion on Monday, coinciding with Gold (XAU) prices hitting unprecedented levels above $3,000.

- Since Trump’s inauguration, the cryptocurrency markets have seen a decline of 28%, while Gold prices have increased by 11%, indicating investor responsiveness to geopolitical and macroeconomic uncertainties.

- In an exclusive interview, the CEO of RAAC, Kevin Rusher, discusses how the tokenized Gold sector might influence the next phase of recovery in the cryptocurrency market.

On Monday, tokenized Gold assets achieved a market capitalization of $1.8 billion as Gold (XAU) prices surged to new record highs exceeding $3,000 per troy ounce. In an exclusive interview, RAAC’s CEO Kevin Rusher elaborates on the potential effects of tokenized Gold assets on the upcoming crypto market recovery phase.

Gold surges to $3,000 amid crypto market turbulence following Trump’s policies

Since the inauguration of President Donald Trump on January 20, the global cryptocurrency market has undergone a steep decline, with total capitalization decreasing by 30%.

Bitcoin (BTC) dropped by 31% from its peak on inauguration day, currently sitting around $83,325.

Conversely, Gold has reached new heights. On Monday, Gold traded at an all-time high of $3,005 per troy ounce, showcasing investor concerns regarding economic growth in light of trade policies and a precarious geopolitical environment.

Gold (XAU) price action compared to Bitcoin (BTC), March 2025.

With the upcoming US Federal Reserve rate decision on Wednesday casting a bearish shadow, investors are reallocating their assets to adapt to the market slowdown.

The cryptocurrency market is experiencing stagnation amid uncertainties related to various regulatory changes and active policy discussions.

Trump’s extensive tariffs are raising concerns in financial markets as analysts speculate they could lead to a recession or slowed growth.

As Gold’s ascent to above $3,000 captivates investor interest and influences capital distribution, it could have short-term repercussions on global market momentum.

RAAC CEO targets $1 trillion as XAU rally boosts tokenized Gold sector to $1.8 billion

Cryptocurrency markets remain apprehensive as the first quarter of 2025 nears its conclusion.

Having lost over $1 trillion in market cap since Bitcoin hit a record high of $109,000 before Trump’s inauguration, many investors are bracing for further outflows ahead of the US Fed’s upcoming rate decision.

Analysts at Goldman Sachs recently revised their forecasts, predicting Gold prices could exceed $3,100 per ounce in 2025, influenced by various economic and geopolitical factors. UBS has also raised their Gold price target to $3,200 on Monday.

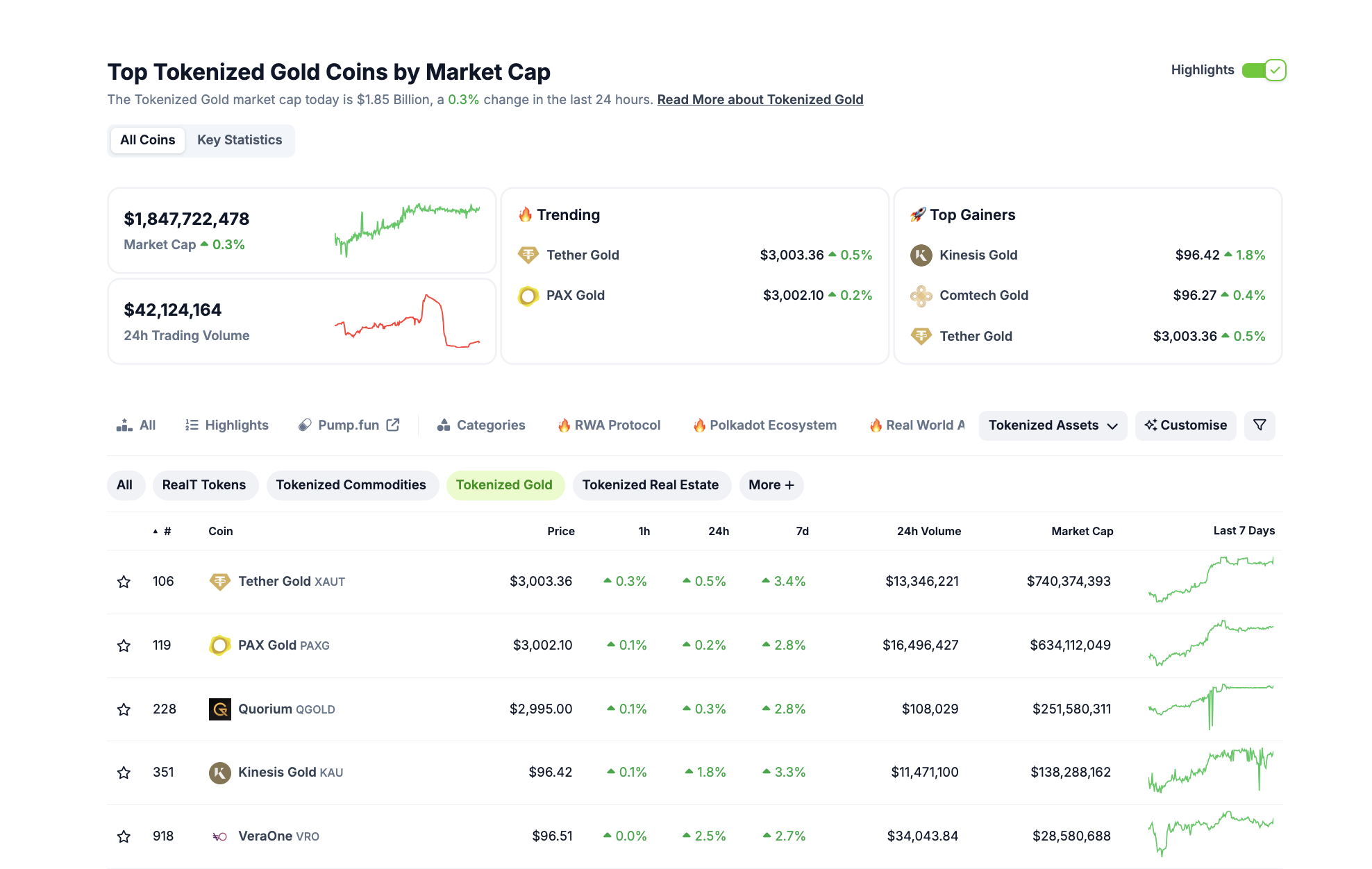

Performance of Tokenized Gold Assets, March 17, 2025.

Performance of Tokenized Gold Assets, March 17, 2025.

Nevertheless, the Real World Asset (RWA) lending and borrowing ecosystem presents creative solutions to maintain liquidity in the cryptocurrency market during times of geopolitical instability or stringent monetary policies.

According to data from Coingecko, the total value of the tokenization sector reached $1.8 billion as Gold prices surpassed the $3,000 threshold on Monday.

In an exclusive interview, ahead of its latest testnet launch that could facilitate $235 million in Gold-backed deposits from one of North America’s largest Gold reserves, RAAC’s CEO Kevin Rusher provides insights on how crypto traders can capitalize on the current Gold rally:

- Question 1 (Q1): The U.S. Crypto Strategic Reserve essentially pits Bitcoin against other commodities and traditional treasury assets like Gold. How might this influence the future demand of Gold among sovereign and institutional investors?

Kevin Rusher: “Central banks and sovereign wealth funds are likely to continue holding physical Gold due to its historical security and legal recognition. However, tokenized Gold could provide a more liquid and cost-effective alternative, appealing to institutions looking for quicker transactions or opportunities to diversify into digital assets.

“As time goes on, this may lead to a portion of institutional liquidity shifting towards tokenized Gold, especially for trading or yield-generating activities, although physical Gold will probably continue to serve as a cornerstone for sovereign reserves.”

- Q2 : Transparency is a critical concern for Gold-backed tokens. What standards should investors expect to ensure clarity and prevent fractionalization?

Kevin Rusher: “Investors should demand verifiable proof of reserves for tokenized Gold, supported by regular third-party audits conducted by reputable firms, as well as transparent reporting and on-chain verification systems.

It is essential that these audits validate a 1:1 ratio between Gold reserves and issued tokens to avoid any hidden fractionalization.”

- Q3: The provenance of Gold is increasingly relevant due to ethical supply chain and sustainability issues. How does the RAAC team and the tokenization sector tackle these challenges? Are there any internal governance, industry standards, or decentralized solutions in place?

Kevin Rusher: “Through our partnership with the Pretio DAO Treasury, we ensure that mining operations and suppliers follow rigorous ethical and sustainability protocols.

These sources are verified through standardized audits, and blockchain tracking provides a verifiable record of all Gold extracted, refined, and securely stored.

This method guarantees complete transparency in the supply chain, allowing stakeholders to verify that the Gold is responsibly sourced and aligned with established ESG criteria.”

- Q4: The Gold market has historically dealt with price manipulation via paper contracts. Can blockchain-based reserves enhance transparency in global Gold pricing?

Kevin Rusher: “In contrast to paper markets, anything recorded on-chain is permanent and cannot be altered.

Tokenized Gold provides the opportunity for real-time oversight and verifiable proof of the physical Gold backing each token.

With tokenized Gold, traders can also eliminate broker fees, storage costs, and other third-party expenses, reducing exposure to additional handling costs or custody risks.”

- Q5: Traditional Gold traders are accustomed to working with spot XAU and ETF markets. What aspects of tokenized Gold would be most attractive to them?

Kevin Rusher: “Tokenized Gold offers several advantages over traditional markets, including faster settlement processes, instant access, and real-time price discovery. Having Gold on-chain provides traders with much greater flexibility to earn yield without compromising the asset’s inherent security and reliability.”

- Q6: In 2025, meme coins and AI have dominated the crypto conversation. How can Gold-backed investments leverage these trends for broader acceptance?

Kevin Rusher: “As demonstrated by the current Gold prices, Gold-backed investments continue to serve as a trusted stable asset for many investors. Consequently, we are open to the possibility of integrating AI and meme culture into the tokenized Gold ecosystem.

Our team is committed to enhancing access to the world’s most stable assets in one of the most volatile sectors. We aspire not just to introduce the next billion users into decentralized finance but also to attract the next $100 billion.”

- Q7. With Gold reaching $3,000, the market cap for tokenized Gold assets climbed to $1.8 billion, composing less than 1% of the total cryptocurrency market.

Kevin Rusher: “In looking ahead, what do you envision for the valuation and market share of the Gold Real World Asset (RWA) sector within the cryptocurrency landscape over the next five years?

Currently, RAAC reserves are estimated at about $400 million, which reflects 20% of a discounted spot price of $2,000 per troy ounce. Over a production cycle of 10 to 15 years, the total estimated value of the tokenized asset could potentially reach $3 billion, depending on market conditions and future Gold prices.

If the tokenized Gold market emulates the trajectory of gold ETFs, capturing even 5% of Gold’s $15 trillion total market cap would effectively boost the cryptocurrency sector’s valuation by over $1 trillion.”

In summary:

Since Trump’s inauguration, the cryptocurrency market has dropped by 28%, while Gold prices have surged by 11% to reach $3,000, signaling that investors are increasingly withdrawing liquidity from the crypto sector as economic uncertainties mount.

As the impending US Federal Reserve rate decision approaches, amid pressure from Trump’s recent tariff measures, RAAC CEO Kevin Rusher views innovations in tokenized Gold assets as a potential $1 trillion catalyst for recovery, bridging liquidity gaps between traditional Gold markets and the crypto landscape.

By merging Gold’s price stability with blockchain’s efficiency, transparency, and round-the-clock trading capabilities, the RWA sector may draw new institutional investors and traditional Gold traders toward crypto-based offerings.

Moreover, by shifting into tokenized Gold assets, crypto-oriented traders can maintain greater capital on-chain during periods of geopolitical turmoil or contractionary monetary cycles.