Bitcoin (BTC) has predominantly remained above $80,000 since March 11, suggesting that buyers are not waiting for a substantial correction to make their purchases. Nonetheless, the inability to push the price past $86,000 indicates that sellers are still active and continue to offload during rallies.

According to a recent report, cryptocurrency exchange-traded products (ETPs) experienced $1.7 billion in outflows last week, bringing the total outflows over the past five weeks to a staggering $6.4 billion. This marks a 17-day consecutive outflow period, the longest downturn recorded since 2015.

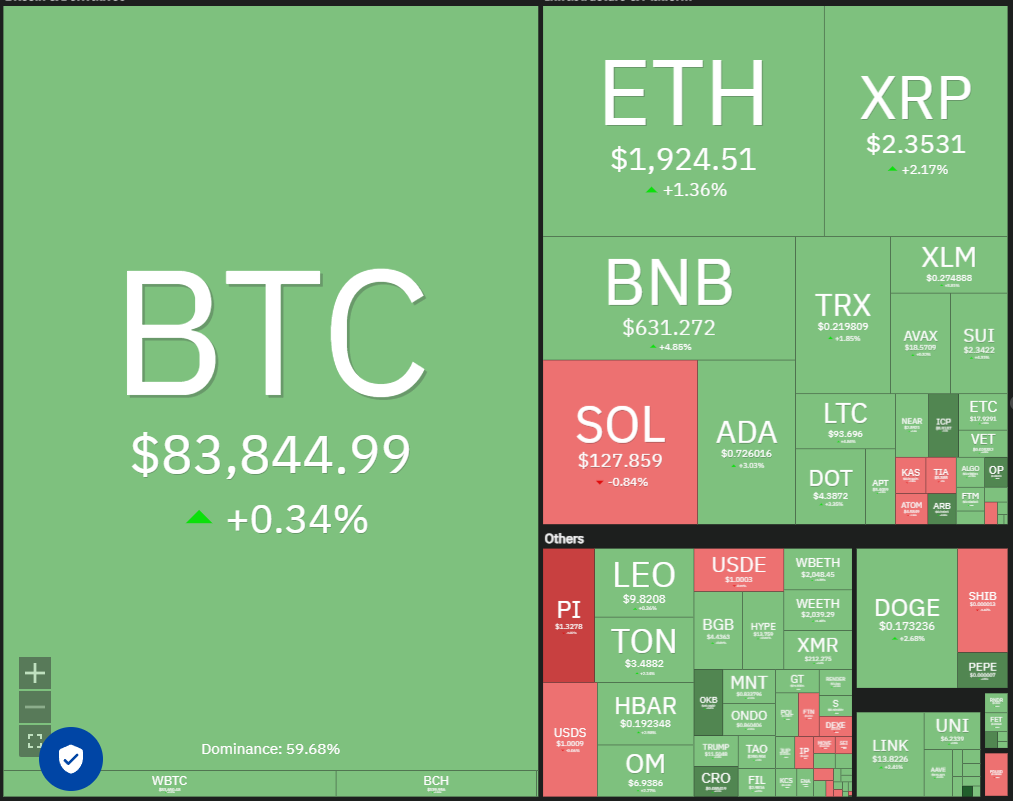

Daily cryptocurrency market performance. Source: Coin360

However, there are still positive signs for long-term investors. An analyst noted that those who invested in Bitcoin between three to six months ago are showing patterns of accumulation. Historically, similar accumulation has been pivotal in establishing market bottoms and sparking new upward trends.

Will buyers manage to push Bitcoin above the current resistance levels? How are altcoins positioned? Let’s delve into the charts for insights.

Analysis of S&P 500 Index Pricing

The S&P 500 Index (SPX) is currently navigating a strong corrective phase. The drop to 5,504 on March 13 pushed the relative strength index (RSI) into oversold territory, suggesting a potential short-term relief rally is on the horizon.

SPX daily chart.

Sellers are likely to attempt to impede any recovery in the resistance range of 5,670 to 5,773. Should they succeed, it would indicate that negative sentiment persists and traders are selling during rallies, increasing the risk of a decline to 5,400. The bulls are anticipated to protect the 5,400 level vigorously, as a breach could result in a drop to 5,100.

Conversely, a break and close above the 20-day exponential moving average (5,780) would indicate bullish strength, potentially propelling the index towards the 50-day simple moving average (5,938).

Analysis of the US Dollar Index Pricing

The modest rebound off the 103.37 support level in the US Dollar Index (DXY) suggests persistent pressure from sellers.

DXY daily chart.

Sellers are aiming to push the index below 103.37. If successful, the decline could extend to 102, and then down to 101.

On the other hand, if the price rises from its current level and breaks above 104, it would indicate a resurgence of buyers. The index might subsequently rise to the 20-day EMA (105), a level likely to attract selling pressure. If buyers maintain their ground, the likelihood of surpassing the 20-day EMA improves, potentially sending the index to the 50-day SMA (107).

Analysis of Bitcoin Pricing

Bitcoin is attempting to establish a higher low in the near term, building momentum to surpass the 200-day SMA ($84,112).

BTC/USDT daily chart.

The positive divergence noted on the RSI indicates that bearish momentum is weakening. If buyers succeed in pushing the price above the 20-day EMA ($85,808), the BTC/USDT pair could advance to the 50-day SMA ($92,621).

In contrast, if the price sharply declines from the 200-day SMA, it would signify that sellers are converting that level into resistance, leading to a potential drop to $80,000 and subsequently to $76,606.

Analysis of Ether Pricing

Ether (ETH) is currently fluctuating between $1,963 and $1,821, indicative of a lack of aggressive purchasing at these levels.

ETH/USDT daily chart.

A drop below the $1,821 to $1,754 support zone would indicate a resumption of the downtrend, with the ETH/USDT pair possibly plummeting to the next major support at $1,550.

This negative perspective will be challenged if the price rises and surpasses the 20-day EMA ($2,107), allowing the pair to ascend toward the 50-day SMA ($2,514), where selling pressure is likely to intensify. If bulls break through the 50-day SMA, the pair may rally to $2,857.

Analysis of XRP Pricing

XRP (XRP) declined from the 50-day SMA ($2.51) on March 15, signaling that sellers are active at elevated levels.

XRP/USDT daily chart.

The flattening of the 20-day EMA ($2.34) alongside the RSI hovering near the midpoint implies a balance between supply and demand. Currently, the XRP/USDT pair could remain within a range between the 50-day SMA and $2.

If the price bounces back from the present level and breaks above the 50-day SMA, it would open the possibility for a rally towards $3. Conversely, if it breaks below $2, it could complete a head-and-shoulders formation, resulting in a drop to $1.28.

Analysis of BNB Pricing

BNB (BNB) has rebounded from the 20-day EMA ($598) and crossed above the 50-day SMA ($620), signaling a potential end to its correction.

BNB/USDT daily chart.

The uptick in the 20-day EMA and an RSI in positive territory indicate a slight upper hand for bulls. If the price maintains above the 50-day SMA, the BNB/USDT pair might surge to $686 and ultimately to $745.

Watch closely for the 20-day EMA as a critical support level. A drop and close below this point would indicate that bears have taken control, potentially leading the pair to fall to the solid support of $500.

Analysis of Solana Pricing

Solana (SOL) reversed course from the 20-day EMA ($139) on March 16, highlighting the bears’ aggressive defense of that level.

SOL/USDT daily chart.

The SOL/USDT pair could slide to $120 and then to $110, where buyers are expected to step in. Should the price rebound from that support area, the bulls will again attempt to push the SOL/USDT pair above the 20-day EMA, with potential to rise to $180.

This optimistic outlook will be invalidated if the price continues to decline and breaks below the support zone, which may trigger a downward move to $100 and then to $80.

Related: Ethereum onchain data suggests $2K ETH price is out of reach for now

Analysis of Dogecoin Pricing

Dogecoin (DOGE) has been steadily moving towards the 20-day EMA ($0.19), a significant resistance level to monitor closely.

DOGE/USDT daily chart.

If the price declines sharply from the 20-day EMA, it indicates sellers are taking advantage of every slight rally, increasing the likelihood of a drop below the $0.14 support level. If that occurs, the DOGE/USDT pair could fall to $0.10.

Alternatively, a break and close above the 20-day EMA would signify that selling pressure is easing. The pair might then climb to the 50-day SMA ($0.23) and subsequently to $0.29. If it breaks above $0.29, it would reflect the return of buyers’ control.

Analysis of Cardano Pricing

Cardano (ADA) has remained beneath the 20-day EMA ($0.76) since March 8, yet bears have been unsuccessful in driving the pair below the uptrend line, suggesting that selling pressure is diminishing at lower levels.

ADA/USDT daily chart.

Buyers must push the price above the moving averages to initiate a meaningful recovery. The ADA/USDT pair could move to $1.02, where bears are likely to mount another solid defense.

If, however, the price declines from the moving averages, it would suggest that bears remain in control, raising the chances of a drop below the uptrend line and possibly plummeting to $0.50.

Analysis of Pi Pricing

Pi (PI) has been gradually approaching the $1.23 support level, which is anticipated to attract buying interest from bulls.

PI/USDT daily chart.

If the price bounces strongly off $1.23, the PI/USDT pair could venture back toward $1.80. Sellers are likely to present a strong challenge around that mark, but if the bulls prevail, the pair could advance to $2 and then to $2.35.

Conversely, if the price retracts from $1.80, it would indicate a ranging pattern, with the pair fluctuating between $1.23 and $1.80 for a time. Sellers would strengthen their stance if the price drops below $1.23, potentially leading to a collapse to the 78.6% retracement level of $0.72.

This article is not intended as investment advice or recommendations. All investment and trading decisions come with risks, and readers are advised to perform their own research before making any choices.