The online brokerage has introduced a betting markets hub, marking its expansion into new asset classes beyond its well-known stock trading services. This was announced on March 17.

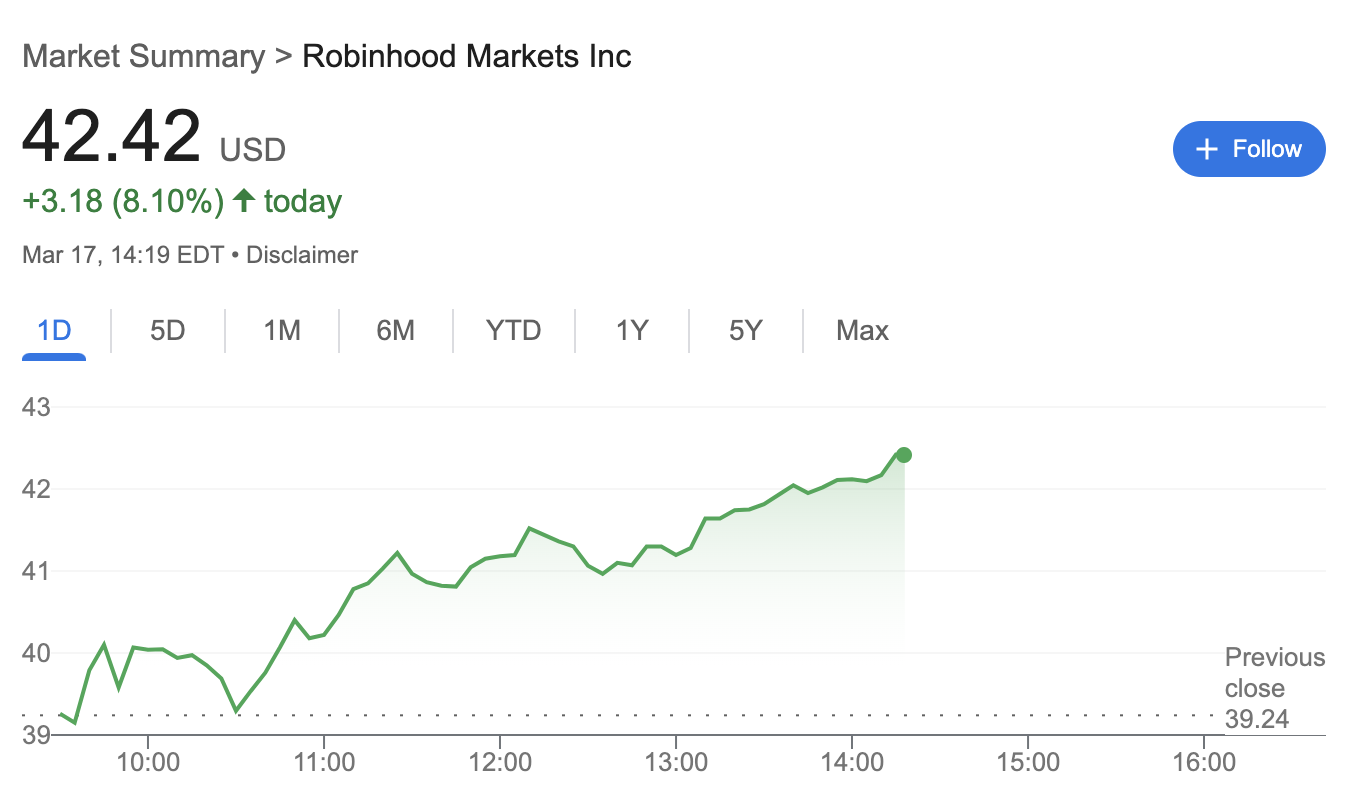

Following the announcement, the company’s stock saw a boost, increasing approximately 8% on the Nasdaq, as reported by Google Finance.

This new betting feature will allow users to “trade contracts based on projected upper limits of the target federal funds rate in May, in addition to forecasts related to the upcoming men’s and women’s College Basketball Tournaments,” according to their statement.

HOOD’s intraday trading performance on the Nasdaq on March 17.

The brokerage is collaborating with the first CFTC-regulated prediction platform in the U.S. to run the event contract platform.

This partner already has the registration to list a variety of event contracts, addressing predictions that range from election outcomes to movie ratings on Rotten Tomatoes.

According to the vice president and general manager of futures and international at the brokerage, prediction markets are crucial at the crossroads of news, economics, politics, sports, and culture.

Experts have noted that political betting markets can often reflect public sentiment more accurately than traditional polls. For instance, platforms like this one predicted former President Donald Trump’s victory in the November elections, even when the polls suggested a closely contested race.

Related: Tips about a launch in Singapore and growing interest in memecoins: Report

Gaining Popularity

Prediction markets have seen a surge in interest in the U.S. since a favorable legal outcome for the platform in September 2024, which overturned a CFTC ban on political event contracts.

By November, trading volumes on prominent prediction markets approached $4 billion for contracts connected to U.S. elections.

The brokerage initially explored political event contracts in October by allowing select users to place bets on the outcome of the presidential race between former Vice President Kamala Harris and Trump.

However, in February, it had to pause Super Bowl betting after a request from the CFTC to withdraw access to those contracts for customers.

Expanding Beyond Stock Trading

The brokerage has been broadening its reach into emerging asset classes, including cryptocurrencies and derivatives.

On March 13, it added memecoins like Pengu (PENGU), Pnut (PNUT), and Popcat (POPCAT) to its offerings as part of its cryptocurrency expansion efforts. Earlier in January, it had already launched futures contracts linked to cryptocurrencies such as Bitcoin (BTC).

Recent earnings reports showed a staggering 700% increase in crypto revenues year-over-year for the fourth quarter of 2024, driven by Trump’s election victory and rising market prices that stimulated crypto trading.

X Hall of Flame: Memecoins may decline while DeFi stages a comeback — Sasha Ivanov