On March 17, Solana (SOL) futures were introduced for trading on the Chicago Mercantile Exchange Group’s US derivatives platform, reflecting the growing mainstream acceptance of the cryptocurrency.

In February, plans were announced to offer two types of SOL futures contracts: standard contracts that represent 500 SOL and more accessible “micro” contracts for 25 SOL each.

These are the first regulated Solana futures available in the US market, following the initial launch by Coinbase in February. Notably, these contracts are cash-settled rather than settled in physical SOL.

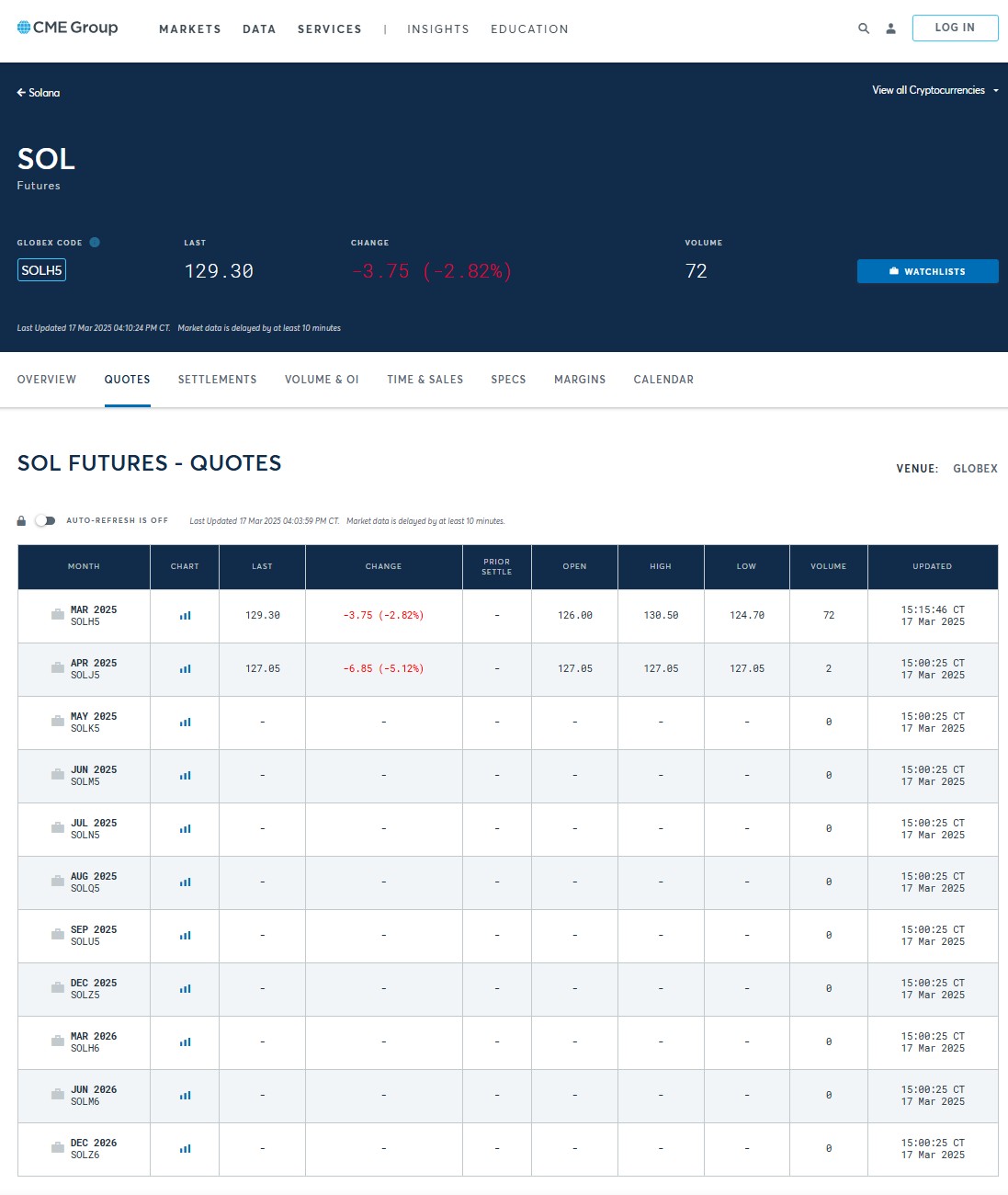

During the inaugural trading day on March 17, futures contracts amounting to a notional value of nearly 40,000 SOL—roughly $5 million at current rates—were traded on the exchange, according to preliminary information.

Price data collected early indicates a potentially bearish outlook on SOL among traders. The exchange typically releases finalized trading volume data the following business day.

The April futures contracts were priced at $127 per SOL, which is $2 lower than the contracts set to expire in March.

On March 16, trading entities FalconX and StoneX executed the first SOL futures trade on the exchange.

“Solana has made significant progress over the past five years,” remarked Chris Chung, founder of a Solana-based swap platform, on March 17.

“With the launch of Solana futures on the CME today, it’s likely that SOL exchange-traded funds will soon follow,” added Chung.

Solana futures were listed on March 17.

Related: Anticipation builds for Solana ETF approvals — Exec

Chances of ETF Approval

On March 13, Chung shared expectations that the US Securities and Exchange Commission (SEC) might approve proposed spot Solana ETFs from asset managers VanEck and Canary Capital as soon as May.

At least five ETF issuers have submitted applications to the SEC to list spot Solana ETFs. The regulator has until October 2025 to reach a final decision on these applications.

Bloomberg Intelligence estimates the chances of SOL ETF approval at around 70%.

Futures contracts are standardized agreements for the buying or selling of an underlying asset at a set date in the future.

They are widely used for hedging and speculating by both retail and institutional investors. Additionally, futures provide essential support for spot cryptocurrency ETFs by serving as a stable benchmark for assessing a digital asset’s performance.

The CME already offers futures contracts for Bitcoin and Ether, with US regulators approving ETFs for both cryptocurrencies last year.

Magazine: 5 practical applications for seemingly worthless memecoins