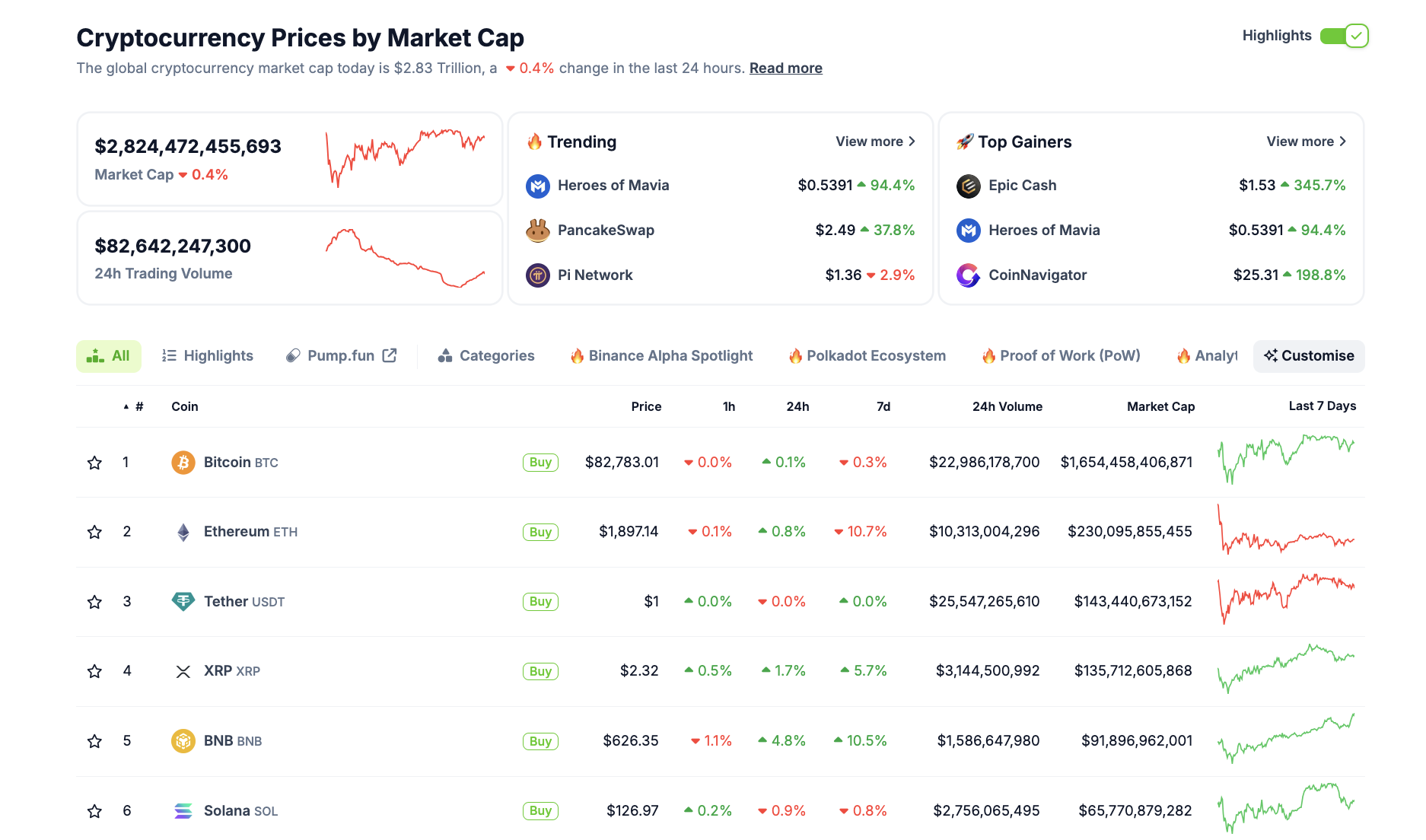

- Despite a 2% dip in market capitalization, cryptocurrency trading volume has surged by 42% to reach $87.2 billion in the past 24 hours, indicating a dynamic rotation of capital.

- Bitcoin’s price remains stagnant under $85,000 as Gold embarks on a historic rally, approaching $3,000 ahead of the Federal Reserve’s interest rate decision.

- The launch of Solana futures ETFs and updates on Ethereum’s “Hoodi” have captured considerable attention in the crypto news cycle this Monday.

Bitcoin Market Insights:

- Bitcoin (BTC) is experiencing a slight increase of 1%, briefly touching $84,000 thanks to a rebound in US equity markets following the government’s avoidance of a shutdown.

- The overall market capitalization has decreased approximately 1.07%, settling at $2.82 trillion, though trading volume has seen a notable rise of 42% to $66.68 billion, signaling active engagement from traders.

- Bitcoin continues to hover below $85,000, with media focus on Gold (XAU) reaching unprecedented highs above $3,000 capturing the attention of investors on Monday.

Altcoin Market Developments: Solana and Ethereum Lead with BNB, XRP, and LTC Reflecting Strong Price Action

The global altcoin market is buzzing as investors pull their assets across various sectors to maneuver through the current market slowdown.

Within major altcoins, Solana (SOL) and Ethereum (ETH) are in the spotlight, propelled by significant developments within their ecosystems.

For Solana, the CME Group has confirmed its launch of Solana ETF futures on Monday, coinciding with the blockchain’s fifth anniversary, creating a dual bullish scenario.

Solana 5th Anniversary Stats, March 17

Ethereum’s “Hoodi” testnet launched on Monday, marking an essential milestone aimed at enhancing DeFi capabilities and scalability.

ETH’s price has risen 1.7%, reclaiming the $1,900 mark, reflecting broader market optimism surrounding this network upgrade.

Market Movers: Top Gainers vs. Top Losers

A comprehensive view of the market reveals the day’s standout performances and underperformers:

Top Gainers:

- BinaryX (BNX) saw an impressive gain of over 30%, surpassing $1.68 on Monday, buoyed by favorable momentum surrounding an anticipated token swap event, making it the top gainer among the top-100 cryptocurrencies.

- PancakeSwap (CAKE) surged 30% to reach $2.50, riding the wave of heightened DeFi staking interest amid an uncertain macroeconomic backdrop as the US Federal Reserve’s interest rate decision approaches. PancakeSwap also outperformed Uniswap in trading volume for the day.

- Berachain (BERA) experienced a rise of 7.83%, drawing interest from investors shifting towards commodity-backed Real-World Assets and yield-bearing tokenized securities.

- Binance Coin (BNB) gained 5% on Monday, firmly holding above the $625 level, supported by increasing demand for exchange tokens.

Top Losers:

- PI Network (PI) has faced a decline of 5% as it confronts bearish pressure from investors impacted by the mainnet upgrade deadline scheduled for Monday.

Celestia Price Action (TIA), March 17

- Celestia (TIA) decreased by 3%, landing at $3.30, pulling back from a recent rally that saw TIA reach $3.70 last week. However, TIA remains up 19% over the past week.

Chart of the Day: Investors Shift Attention to LTC, XRP, and Solana

The price fluctuations among significant altcoins illustrate a mixed sentiment in the market:

- Solana (SOL) is down 1%, trading below the $130 resistance level.

- Ripple (XRP) stands out against the negative market trend with a modest gain of 2.99%, reaching $2.30.

- Litecoin (LTC) registered a gain of 4%, surpassing the $90 resistance mark on Monday.

Crypto market performance, March 17

The prevailing market conditions suggest that despite the positive triggers from Solana’s anniversary and the SOL futures ETF launch, concerns regarding the FXT estate’s recent token unlocks continue to exert pressure on SOL’s short-term price trajectory.

In light of this, investors are increasingly directing their funds towards Solana’s tier-1 competitors, XRP and LTC, as ETF filings are underway.

Crypto News Highlights:

- Pavel Durov Returns to Dubai Amid Ongoing Telegram Inquiry

Pavel Durov, the founder and CEO of Telegram, has announced his return to Dubai after spending several months in France due to an ongoing investigation into criminal activities associated with the messaging platform.

Durov expressed appreciation to the investigative judges for allowing his return and thanked his legal team and the Telegram community for their support.

He reiterated that Telegram has always gone above and beyond in terms of legal compliance regarding moderation and cooperation with law enforcement.

The investigation, which commenced following Durov’s arrest in August near Paris, revolves around allegations that Telegram was involved in facilitating illegal activities such as the distribution of child sexual abuse material and drug trafficking.

- VanEck Submits Application for AVAX ETF to Provide Direct Market Access

VanEck has filed with the US Securities & Exchange Commission to create an Avalanche (AVAX) ETF, aiming to offer investors direct market exposure to the smart contract platform.

The proposed fund will track the performance of AVAX while accounting for operational costs.

According to the application, the ETF will price its shares based on the MarketVector Avalanche Benchmark Rate.

If approved, this would mark one of the first AVAX-focused ETFs in the US, enhancing institutional access to the Avalanche ecosystem.

- OKX Suspends DEX Aggregator Following Detection of Misuse Linked to Lazarus Group

OKX has temporarily suspended its decentralized exchange (DEX) aggregator after uncovering misuse associated with the North Korean hacking group, Lazarus.

The exchange announced this precautionary halt while conducting an internal review and implementing enhanced security measures.

Despite the suspension, OKX will continue to offer wallet services but will limit new wallet creation in certain jurisdictions.

These security improvements aim to bolster defenses against hacking activities and prevent further exploitation of its DeFi services.