Although many analysts predict that the cryptocurrency bull market will persist until the close of 2025, fears about a potential economic downturn in the United States, along with the “circular” economy of crypto, could pose risks to valuations in the space.

In spite of the recent market pullback, most crypto experts foresee that the bull market will reach its peak after the third quarter of 2025, with Bitcoin (BTC) price forecasts varying from $160,000 to over $180,000.

In addition to external issues like a possible recession in the largest global economy, a significant industry-specific threat lies in the “circular” aspect of the crypto economy, as pointed out by a co-founder of a prominent blockchain project.

“The main risk within the industry is that it remains quite ungrounded. Everything is still very cyclical,” the co-founder shared in a recent interview.

“Take DeFi as an example—the essence of finance is to support something tangible […] but if the only purpose of DeFi is to fund more DeFi, it becomes a cycle,” they noted, adding:

“If the sole motivation for purchasing your token is the belief that others will also buy it, that’s a circular situation.”

This sharply contrasts with the stock market, which is “anchored on revenue-generating companies,” thus rendering the crypto sector’s “lack of grounding” a major potential danger, according to them.

Other experts have echoed concerns about the current state of the cryptocurrency economy, particularly regarding recent setbacks involving memecoins that are diverting liquidity from more established digital currencies.

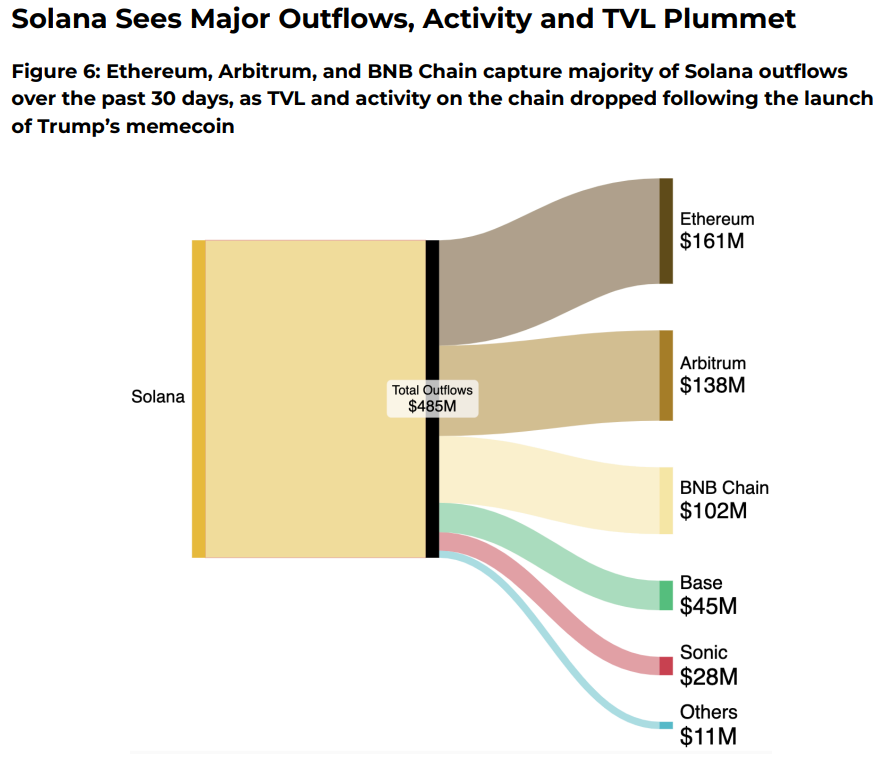

Solana outflows. Source: deBridge, Binance Research

Solana experienced more than $485 million in outflows in February, spurred by a recent series of memecoin scams that drove investors to seek “safer” options, with some of that capital migrating to memecoins on the BNB Chain, such as the Broccoli token, which was inspired by Changpeng Zhao’s dog.

Related: Increasing $219B stablecoin supply suggests mid-bull cycle, not a market peak

Fears of a US recession represent the largest external threat to crypto

Apart from industry-specific incidents, broader macroeconomic worries, including a potential recession in the US, pose risks to both traditional and crypto markets.

“From a macro perspective, I still believe a recession could be on the horizon,” said the co-founder, adding:

“While there are many factors pushing the market upwards, numerous traditional recession indicators have been signaling this possibility for some time. Therefore, I don’t think we should dismiss it.”

Furthermore, the cryptocurrency markets tend to correlate significantly with technology stocks, which means a recession would likely initiate a widespread sell-off, they further elaborated.

Related: Creator of the ‘Wolf of Wall Street’ memecoin sees a 99% crash

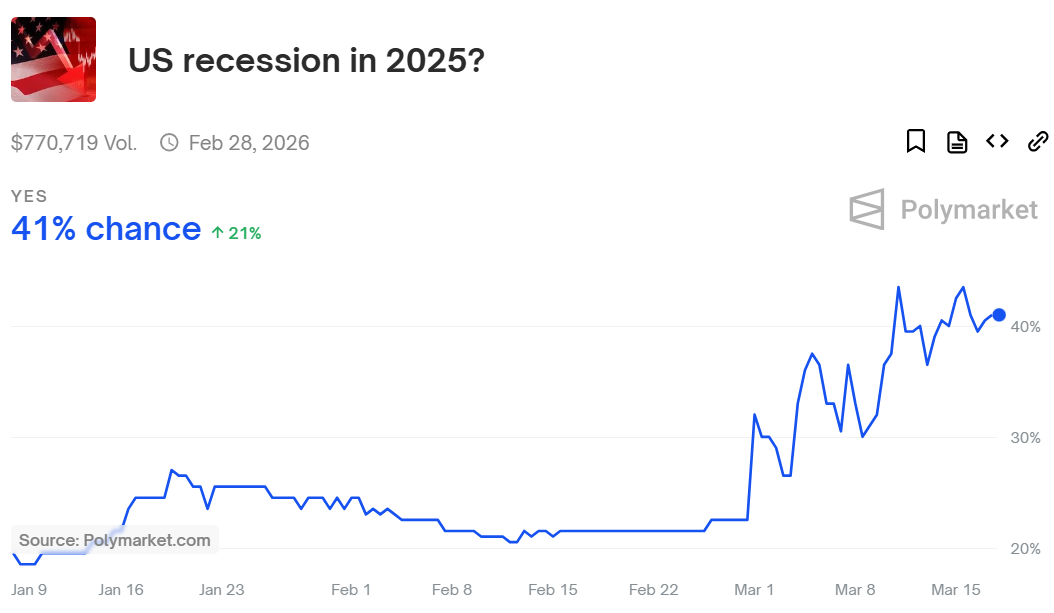

Current trade war tensions, heightened by import tariffs and retaliatory actions initiated by the US administration, have stirred fresh concerns about a potential recession.

Source: [source link]

Over 40% of market participants now anticipate a recession in the US this year, a notable increase from just 22% a month prior.

Magazine: Crypto enthusiasts are fascinated by longevity and biohacking: Here’s the reason why