Most spot Bitcoin exchange-traded funds (ETFs) in the United States experienced negative performance throughout March, as analysts predict a bearish Bitcoin trend lasting up to a year.

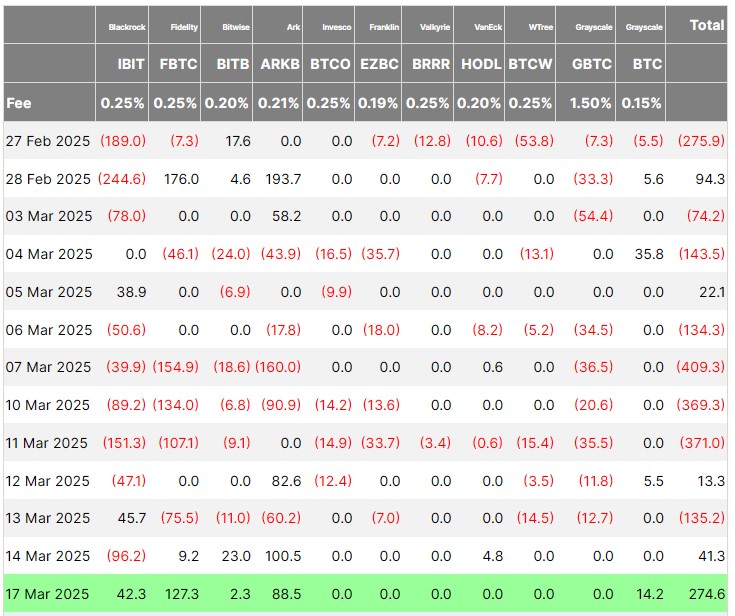

Data from Farside Investors indicated that spot Bitcoin ETFs faced challenges in March, with net outflows exceeding their monthly inflows. Among these, BlackRock’s iShares Bitcoin Trust ETF (IBIT) was hit hardest, reporting $552 million in outflows against just $84.6 million in inflows.

The data reveals that Fidelity’s Wise Origin Bitcoin Fund (FBTC) experienced outflows exceeding $517 million while only attracting $136.5 million in inflows. Additionally, Grayscale’s Bitcoin Trust ETF (GBTC) reported more than $200 million in outflows with no inflows at all.

In contrast, Grayscale’s Bitcoin Mini Trust ETF (BTC) stood out as the only one bucking the downward trend, with no net outflows for March and over $55 million in net inflows.

Spot Bitcoin ETF flows in millions.

US Spot Bitcoin ETFs Recorded Outflows Exceeding $1.6 Billion in March

Collectively, spot Bitcoin ETFs experienced outflows totaling more than $1.6 billion during the first 17 days of March, alongside only $351 million in inflows. This imbalance resulted in a net outflow of nearly $1.3 billion.

Likewise, Ether-based investment products are facing similar struggles. BlackRock’s iShares Ethereum Trust ETF (ETHA) recorded the largest outflows, amounting to $126 million, with no monthly inflows. Fidelity’s Ethereum Fund (FETH) experienced around $73 million in outflows and only $21 million in inflows.

Throughout March, Ether ETFs showed poor performance with the exception of March 4, when inflows reached $14 million. However, for the remainder of the month, spot Ether ETFs faced significant challenges, accumulating over $300 million in total outflows.

Spot Ether ETF flows in millions.

CryptoQuant CEO Declares End of BTC Bull Cycle

The underwhelming performance of crypto exchange-traded products comes as sentiment within the Bitcoin and broader crypto market turns negative.

On March 18, the founder and CEO of CryptoQuant, Ki Young Ju, stated that the “Bitcoin bull cycle is over.” He anticipates up to a year characterized by bearish or stagnant price movements, arguing that on-chain metrics suggest a bear market is underway. He noted that new whales are selling at lower prices as liquidity diminishes.