The head of CryptoQuant has suggested that the Bitcoin bull market may have reached its end, altering his previous outlook from earlier this month when he indicated that while the Bitcoin bull cycle would progress slowly, it was “still intact.”

In a post on March 17, he stated, “The Bitcoin bull cycle is over, expecting 6-12 months of bearish or sideways price action.”

All indicators currently signal bearishness, according to him

He noted that all on-chain metrics for Bitcoin (BTC) suggest we are in a bear market. “With fresh liquidity drying up, new whales are offloading their Bitcoin at reduced prices,” he explained.

This announcement came just days after reports highlighted that Bitcoin funding rates—reflecting the expenses for maintaining long or short positions in crypto futures—have been close to 0%, signaling rising uncertainty among traders.

This viewpoint contrasts sharply with his earlier assertion on March 4, where he argued that the Bitcoin bull cycle would be slow but “is still intact,” citing neutral readings on significant indicators.

At that time, he remarked, “The fundamentals remain strong, with more mining rigs coming online.”

Other analysts, however, remain less pessimistic. A leading analyst from Swyftx commented that “there’s no reason to panic.”

He elaborated by saying that while investors are “spooked” by tariffs imposed by the U.S. President, “all the figures show a global economy that is moving in a positive direction.”

“Capital will flow into higher-risk assets when the market becomes ready to embrace risk.”

As of publication, Bitcoin’s value stands at $83,030, reflecting a 14.79% drop over the past month, according to market data.

Bitcoin has decreased by 14.89% in the last month.

Some analysts suggest that with the global M2 money supply hitting new highs, Bitcoin could be positioned for an upward trend.

One crypto analyst recently stated, “The Global Money Supply has just reached another all-time high. We are on the verge of seeing Bitcoin rally again.”

Similarly, the CEO of CoinRoutes mentioned that if historical patterns continue, Bitcoin might hit new all-time highs by late April.

“If the correlation of Bitcoin to the money supply remains consistent, expect it to achieve a new ATH within a month,” he remarked.

Related: Bitcoin price struggles to ascend parabolically as the US Dollar Index (DXY) declines – What’s the reason?

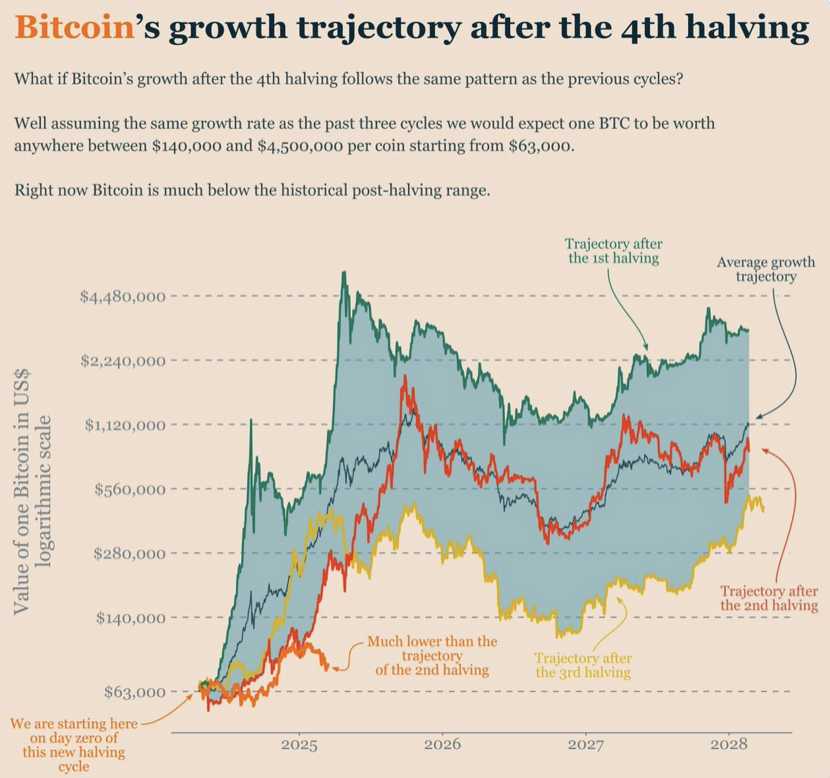

However, based on historical data, Bitcoin’s current price is 67% lower than where it should be considered the lower boundary, according to a former CEO of Phunware.

Source: Former Phunware CEO

Meanwhile, the CEO of Swan Bitcoin recently expressed that “there’s more than a 50% chance we will see all-time highs before the end of June this year.” The all-time high for Bitcoin of $109,000 was achieved on January 20, just hours prior to the U.S. President’s inauguration.

Magazine: Crypto enthusiasts are captivated by longevity and biohacking: Here’s the reason

This article is not intended to provide investment advice or recommendations. All forms of investment and trading carry risks, and readers are encouraged to conduct their own research before making any decisions.