The CEO of a prominent analytics firm, Ki Young Ju, suggests that the recent bullish cycle for Bitcoin has come to an end, indicating a potential transition to bearish or sideways movement over the next six to twelve months.

Recent readings from the Profit and Loss (PnL) Index Cyclical Signals show a peak that corresponds to historical milestones indicating the conclusion of growth periods. After reaching a record high of $109,300 during President Trump’s second inauguration on January 20, Bitcoin might now be heading for a correction or a period of consolidation.

Historical data from previous Bitcoin cycles consistently reveal a trend of price peaks succeeded by extensive consolidation phases. Young Ju asserts that current indicators closely resemble those seen during earlier cycle tops, suggesting muted performance in the near future.

After Trump’s election victory in November 2024, Bitcoin experienced a rapid increase. However, as optimism diminished and market conditions changed, the momentum gradually lessened, leading to the current cycle peak.

The PnL Index chart implies that Bitcoin investors might face extended periods of price stagnancy or declines throughout much of 2025.

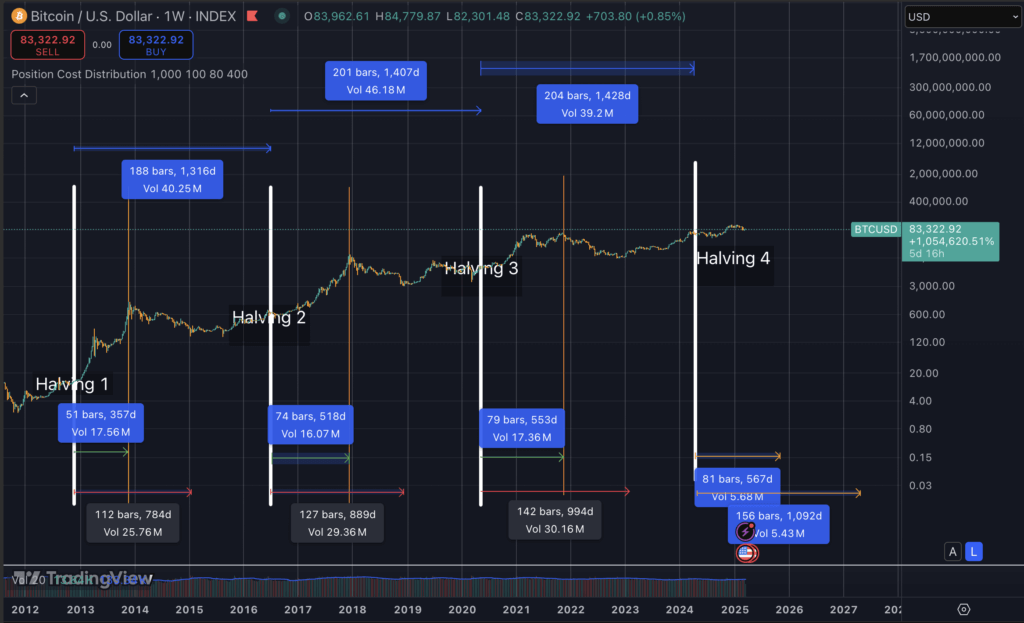

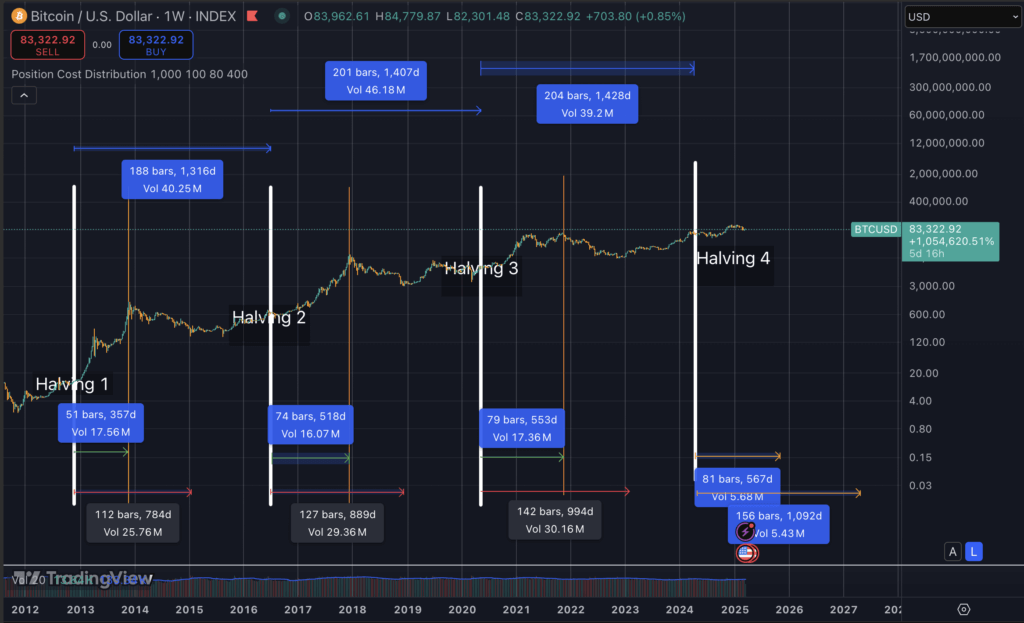

If Bitcoin adheres to its historical halving cycle timelines, the peak might be anticipated around September 2025. Typically, it has taken Bitcoin about 500 to 550 days to hit the cycle peak after the last halving, and 780 to 990 days to arrive at the cycle bottom, positioning the market bottom around May 2027.