At the beginning of the week, the price of Bitcoin (BTC) faced selling pressure, dropping from $84,500 on March 17 to $81,300 as of this writing. This decline is likely tied to a sell-off ahead of the Federal Open Market Committee’s (FOMC) two-day meeting taking place on March 18-19.

Meetings of the FOMC often serve as catalysts for market shifts. Each time the FOMC convenes to discuss U.S. monetary policy, cryptocurrency markets prepare for potential volatility.

Traditionally, traders reduce risk and leverage in anticipation of the announcement, and following the meeting and the subsequent press conference by the Federal Reserve Chair, markets can react strongly.

The press release from this FOMC meeting is set for Wednesday, March 19, at 2:30 pm ET, which might instigate significant movements in the Bitcoin market. Observing market behavior leading up to this announcement may provide insights into Bitcoin’s next direction.

FOMC is a signal of volatility for traders

Traders are attentively watching the FOMC minutes for any changes in the Fed’s perspective on inflation and interest rates.

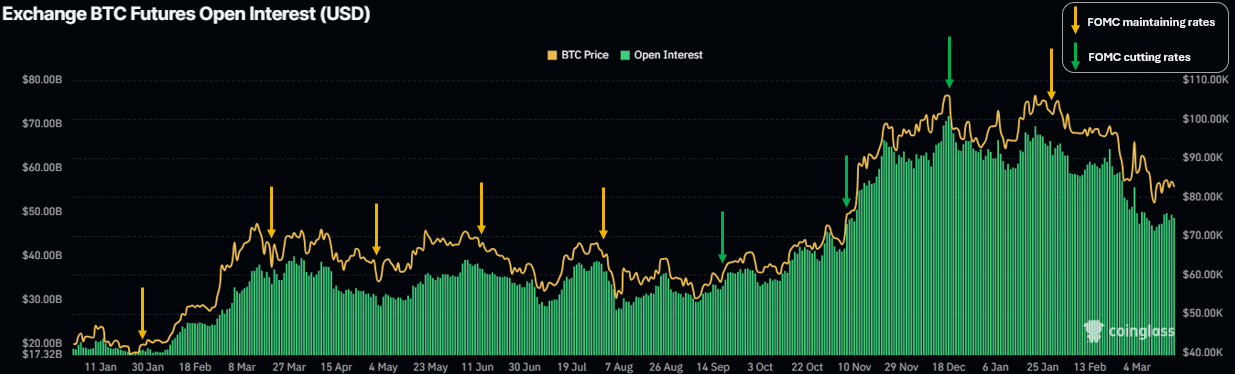

After FOMC announcements, the Bitcoin price often shows sharp reactions. Since the start of 2024, BTC prices have generally decreased following the FOMC’s decision to keep rates steady, as depicted in the accompanying chart.

An important exception occurred during the pre-halving rally in February 2024, coinciding with the launch of the first spot Bitcoin ETFs. When interest rates were cut on September 18, 2024, and November 7, 2024, Bitcoin saw a price surge.

However, the subsequent rate cut on December 18, 2024, had a different impact. The modest reduction of 25 basis points to the range of 4.50%–4.75% marked a local peak in Bitcoin’s price at $108,000.

BTC/USD 1-day chart highlighting FOMC dates.

Markets tend to deleverage before FOMC meetings, but this time it’s different

A significant metric that sheds light on market sentiment is Bitcoin open interest—the total of outstanding derivative contracts, primarily perpetual futures, that remain unsettled.

Historically, Bitcoin open interest dips prior to FOMC meetings, indicating that traders are pulling back on leverage and risk exposure, as shown in the graph using CoinGlass data.

Bitcoin futures open interest alongside FOMC dates.

This month, however, a different trend has emerged. Despite a $12 billion open interest shakeout earlier this month, there was no significant decline in Bitcoin’s open interest leading up to the FOMC meeting. Conversely, the Bitcoin price continued to drop, which is atypical and may suggest a strong directional bet.

This could indicate that traders are feeling less apprehensive about the Fed’s decision, possibly anticipating a neutral outcome. Supporting this notion, CME Group’s FedWatch tool shows a 99% likelihood that the Fed will keep rates within the 4.25%–4.50% range.

If rates remain unchanged, Bitcoin’s price may persist in its current downtrend. This could align with the intentions of a prominent trader who recently took a 40x leveraged short position valued at over $500 million at its peak—though that position has since been closed.

Related: Bitcoin remains below $85K— Key BTC levels to monitor ahead of FOMC

Spot Bitcoin ETFs: How are they reacting?

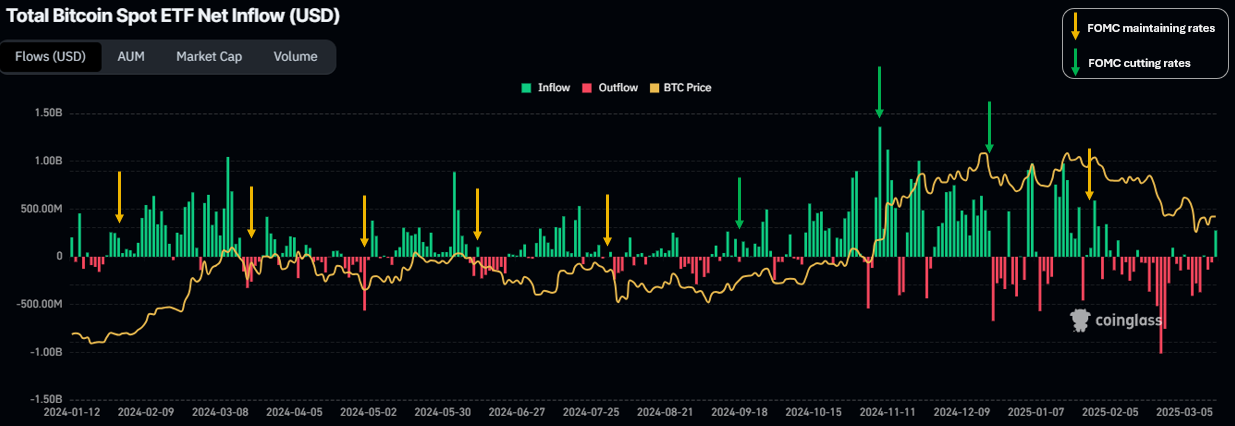

In contrast to Bitcoin whales, investors in spot Bitcoin ETFs have historically tended to sell off BTC holdings prior to FOMC meetings.

Since the launch of spot BTC ETFs in January 2024, most FOMC events have been accompanied by ETF outflows or, at best, slight inflows, according to CoinGlass data. The notable exception occurred during the previous all-time high in January 2025, when even spot ETF investors could not resist buying.

Net inflows of Bitcoin spot ETFs and corresponding FOMC dates.

On March 17, spot Bitcoin ETFs experienced $275 million in net inflows, marking a notable change from a month of outflows. This might indicate a shift in investor sentiment and expectations regarding the Fed’s policy decisions.

If spot ETF inflows are increasing ahead of the FOMC, investors could be anticipating a more accommodative stance from the Fed, potentially suggesting future rate cuts or a continuation of liquidity-friendly policies.

Investors might also be acquiring Bitcoin as a safeguard against uncertainty, implying that some institutional stakeholders believe Bitcoin will fare well regardless of the Fed’s outcome.

Additionally, there might be an expectation of a potential short squeeze. Should traders have been betting on Bitcoin’s decline and positioned themselves short, a sudden influx of ETF buying could influence trader behavior and trigger a short squeeze.

After the FOMC announcement, BTC’s price movement, along with on-chain data and spot ETF flows, will reveal whether the recent activity was part of an extended accumulation trend or merely speculative positioning.

One thing that many traders seem to agree upon is that BTC may experience considerable price fluctuations following the FOMC announcement. As one crypto analyst put it recently,

“The FOMC is tomorrow, and a significant move is expected.”

Even without rate cuts, the prospect of the Fed issuing dovish statements could buoy markets, while their absence might push prices downward.

This article does not constitute investment advice. Every investment and trading strategy involves risk, and readers should perform their own research before making any decisions.