The price of Bitcoin (BTC) encountered yet another setback in its attempt to surpass the resistance level at $85,000 on March 17. Since March 12, Bitcoin’s daily candle highs have fluctuated between $84,000 and $85,200, but it has struggled to settle above $84,600.

Bitcoin 1-hour chart.

Currently, Bitcoin is in a state of uncertainty on the lower time frame (LTF) of the 1-hour chart, often referred to as “no man’s land.” This term represents a range of prices marked by lack of clarity, increased risk, and heightened tension stemming from external factors and mixed market sentiments.

As the Federal Open Market Committee (FOMC) meeting approaches on March 18-19, significant price volatility could be expected in the coming days as traders eye key Bitcoin price levels. The pivotal announcement regarding interest rates will occur on March 19 at 2 pm ET.

99% likelihood of stable interest rates

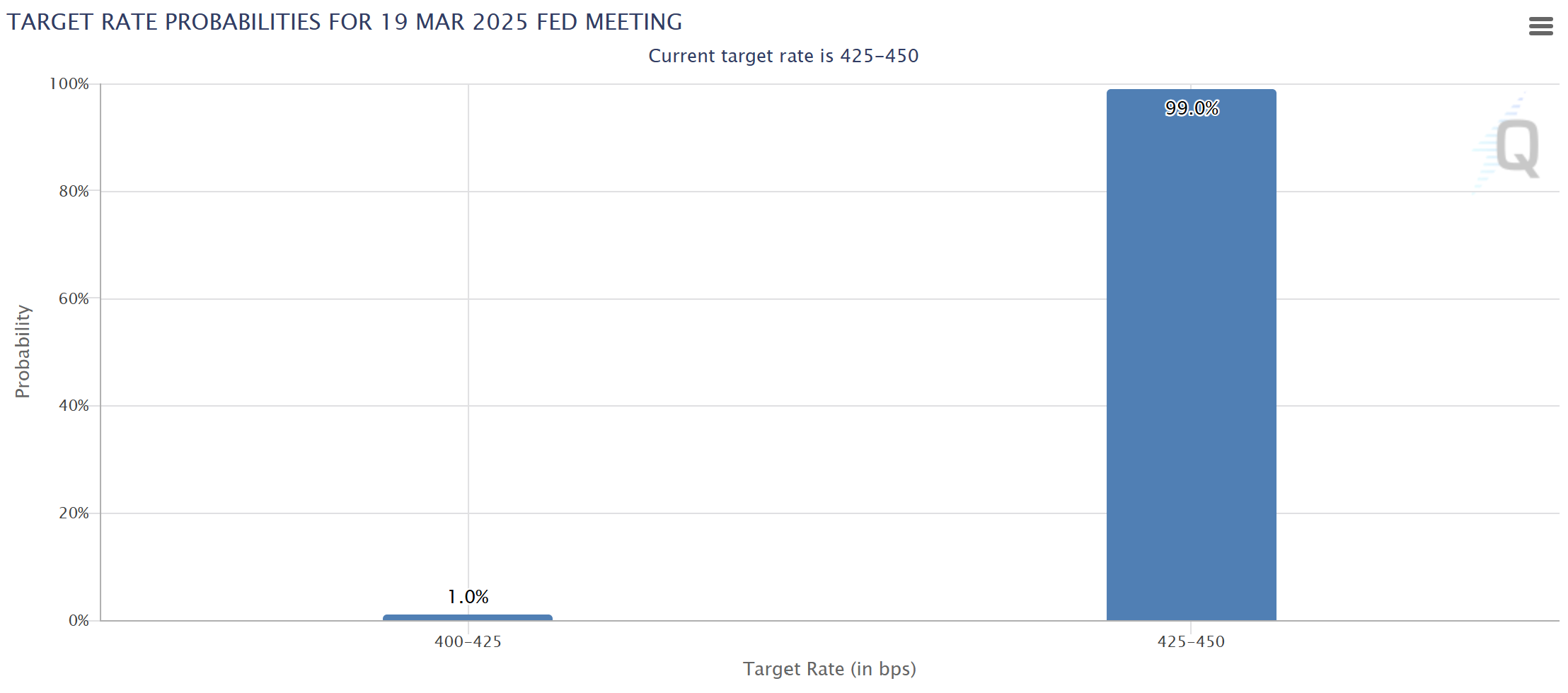

Data from the CME’s FedWatch suggests there is a 99% probability that the current interest rates will hold steady between 4.25% and 4.50%, leaving only a 1% chance for a 0.25% decrease.

CME’s FedWatch tool showcasing interest rate expectations.

Despite this, a prevailing sentiment in the market is that any negative price movement resulting from unchanged rates has already been factored in.

Related: Bitcoin price struggles to surge as the US Dollar Index (DXY) declines—What’s happening?

Consequently, attention is on Jerome Powell, the U.S. Federal Reserve Chair, during the FOMC meeting. Given the latest economic data, it is anticipated that Powell may adopt a hawkish tone. This expectation is supported by the following observations:

-

The Consumer Price Index (CPI) remains at 2.8%, still above the Fed’s 2% target, while the Personal Consumption Expenditures (PCE) price index is around 2.5%-2.6%. Although CPI was slightly lower than projections last week, it does not indicate a need for immediate rate cuts.

-

Unemployment remains low at 4.1%, with GDP growth of 2.3% reported for Q4 2024, suggesting the economy does not require immediate stimulus measures.

In addition, Polymarket currently indicates a 100% probability that the Federal Reserve will conclude its quantitative tightening (QT) by April 30, potentially raising the chances of a rate cut as early as this summer.

Key Bitcoin price levels to monitor

For Bitcoin to aim for higher targets around $90,000, it is essential to convert the $85,000 resistance into support.

This will require Bitcoin (BTC/USD) to regain its position above the 200-day exponential moving average (marked by the orange line) on the daily chart. The price fell below this indicator on March 9, marking the first time since August 2024.

Bitcoin 1-day chart.

On the bullish side, increased demand for spot Bitcoin ETFs could serve as a positive catalyst. On March 17, Bitcoin ETFs saw inflows of $274 million, marking the largest inflow since February 4.

Conversely, bearish traders will strive to maintain the $85,000 resistance, raising the probability of further declines below $78,000. The immediate downside target beneath previous lows is $74,000, the former all-time high from early 2024.

Bitcoin 1-day chart.

If Bitcoin falls below $74,000, the next significant area to watch lies between $70,530 and $66,810, where a daily order block is located. Reaching $69,272 would signify a retest of the price on U.S. election day, effectively wiping out the gains from the so-called “Trump pump.”

An anonymous analyst in the Bitcoin community has pointed out that the most pessimistic scenario for Bitcoin would be around $71,300 and $73,800, which could serve as potential support across all time frames from daily to quarterly.

Bitcoin 1-day chart analysis by a notable analyst.

Another respected analyst emphasizes that the FOMC meeting is an unpredictable element, advising that Bitcoin must reclaim $86,250 to solidify a bullish outlook on the shorter time frame.

Related: ‘The Bitcoin bull cycle has ended,’ cautions an industry leader based on on-chain data.

Regardless, as seen in the charts, there is an expectation of a possible retest near the $70,000 mark in the upcoming weeks.

This article does not provide investment advice or recommendations. All investments and trading actions carry risks, and readers should perform their own research before making any decisions.