The price of Dogecoin (DOGE) has plummeted over 70% since reaching $0.48 in December 2024. Interestingly, the wealthiest holders of this memecoin have been accumulating more during the downturn, reflecting their belief in a possible recovery in the near future.

Onchain indicators suggest a rebound for Dogecoin

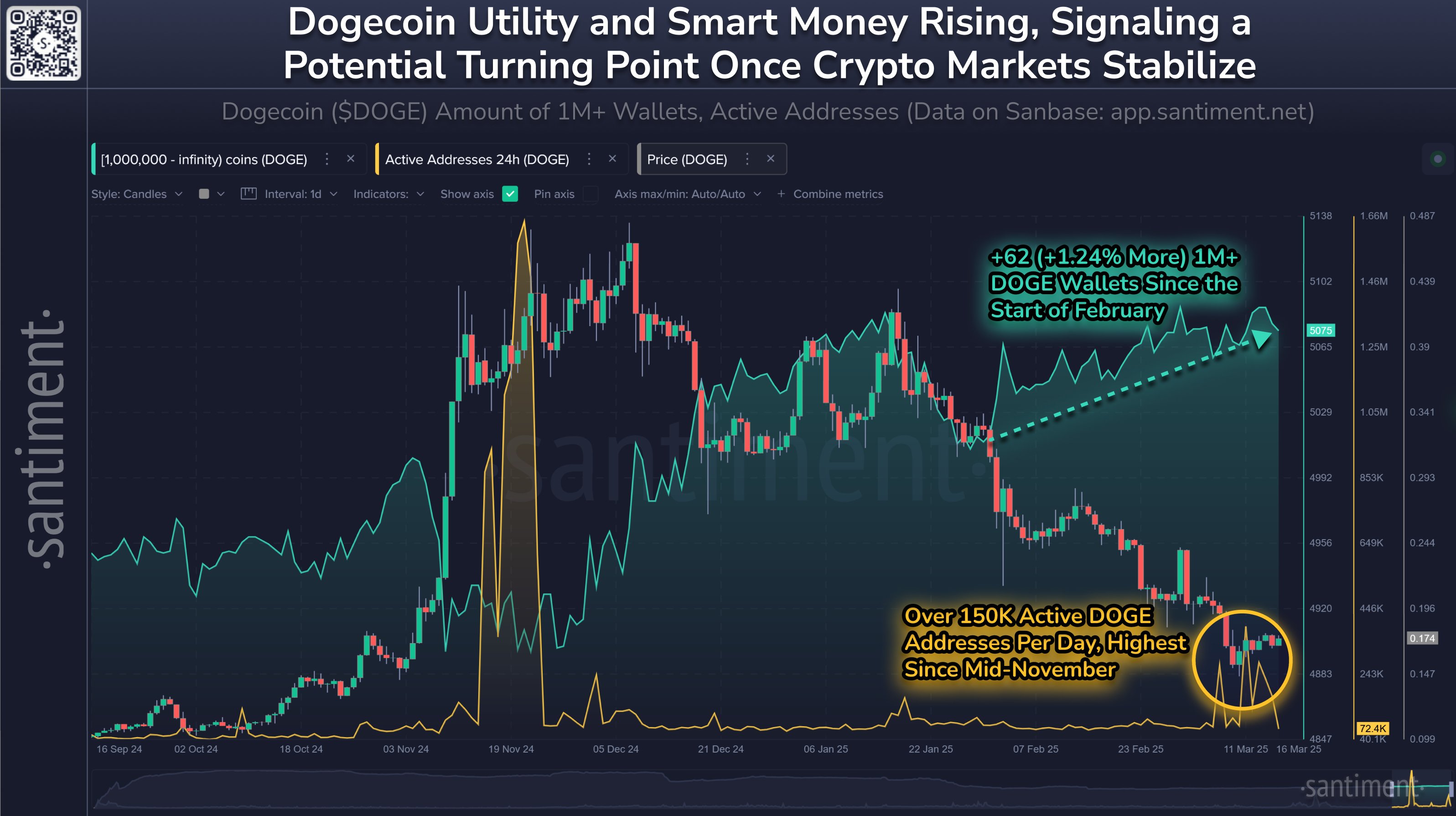

Recent onchain insights reveal that wallets holding at least 1 million DOGE have seen a 1.24% increase since early February, despite the falling prices. Additionally, the number of active addresses has reached a four-month high, indicating heightened network activity.

Addresses with at least a million DOGE versus price. Source documentation unavailable.

Generally, when substantial holders are buying into an asset amid price declines, it suggests they perceive it as undervalued and are preparing for an upcoming rise.

Moreover, an uptick in active addresses implies increasing engagement on the network—potentially a sign of growing interest from retail investors.

If this rise in user activity is driven by genuine adoption rather than mere speculation or panic selling, it could establish the necessary onchain support for a price recovery. A similar trend was noted during the significant price increase of DOGE in November, where it rallied over 200%.

Dogecoin appears oversold, with the potential for a 30% increase

Dogecoin is currently testing a key support area, combining a long-standing ascending trendline and the 200-week exponential moving average (200-week EMA), which is situated around $0.13. This level has historically been a catalyst for strong bullish reversals.

Weekly price chart for DOGE/USD. Source documentation unavailable.

Additionally, the Stochastic RSI—an indicator that assesses momentum and overbought/oversold conditions—has produced a bullish cross in the oversold region (below a reading of 0.30).

This particular signal often suggests that selling pressure is diminishing. In the case of DOGE, this crossover at low levels has historically led to significant price recoveries, including a 400% rally in 2024 and an 88% increase in 2023.

Related: Insights on market conditions suggest a ‘tactical retreat, not a reversal’ — CEO of a major exchange

The first notable resistance level is around $0.22, which aligns with DOGE’s 50-week exponential moving average (50-week EMA) and the resistance zone from March to April 2024, as illustrated below.

Weekly price chart for DOGE/USD. Source documentation unavailable.

However, should DOGE fail to maintain this support area, the bullish outlook could be undermined, potentially leading to a deeper correction toward $0.12, which acted as support during the March-May 2024 timeframe.

This article does not offer investment advice or recommendations. Every investment and trading decision carries risk, and readers are encouraged to conduct their own research before making such decisions.