The native token of Ethereum, Ether (ETH), has repeatedly entered oversold conditions against Bitcoin (BTC) over the past few months, yet there are no indications that it has reached a price bottom. The current trading climate resembles a past situation, and ETH’s market dynamics imply that a similar scenario could unfold in the second to third quarter of this year.

Ether’s Recurring Declines Suggest More Loss Ahead

The relative strength index (RSI) for ETH on the three-day chart remains under 30, which typically implies a possible rebound.

Nonetheless, past trends have demonstrated that prior dips into oversold zones failed to signify a definite low point, with each instance leading to further declines, indicative of ongoing bearish pressure.

ETH/BTC three-day price chart.

Since mid-2024, the ETH/BTC pair has faced recurring breakdowns, with declines of approximately 13%, 21%, 25%, and 19.5% occurring in quick succession. Additionally, both the 50-day and 200-day EMAs are trending downward, reinforcing the absence of bullish momentum.

A market analyst noted ETH’s disappointing performance, pointing out that the ETH/BTC pair has not confirmed a bullish divergence on the weekly chart—a situation where prices hit lower lows while the RSI registers higher lows.

ETH/BTC weekly price chart.

ETH ETF Outflows and Onchain Insights Indicate Further Weakness

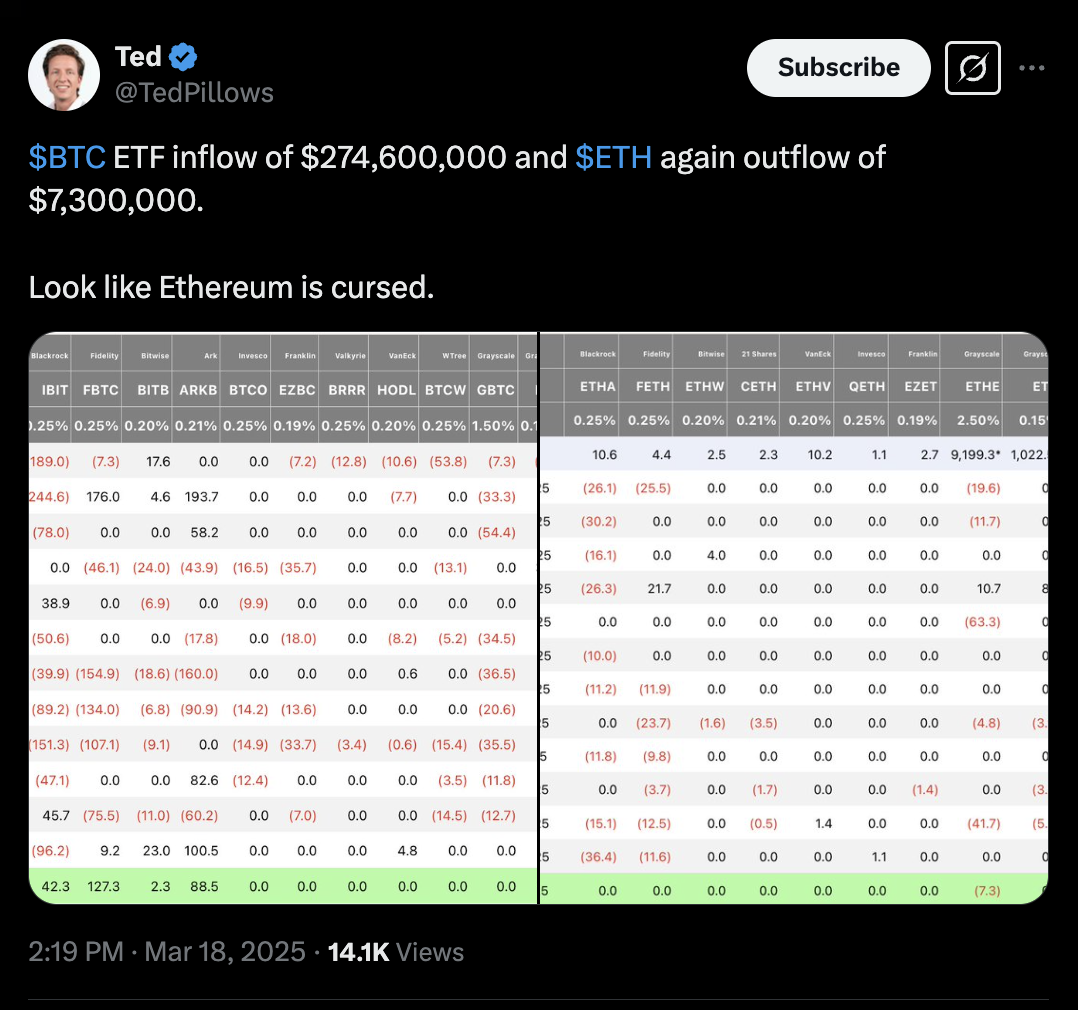

The ongoing downtrend in ETH/BTC is especially pronounced when compared to the wider cryptocurrency market, marked by consistent outflows in US-based spot ETH ETFs along with negative onchain data.

In March, net flows into spot Ether ETFs have decreased by 9.8%, totaling $2.54 billion. This contrasts with Bitcoin ETF net flows, which experienced a smaller decline of 2.35%, reaching $35.74 billion during the same period.

Source: Data Insights

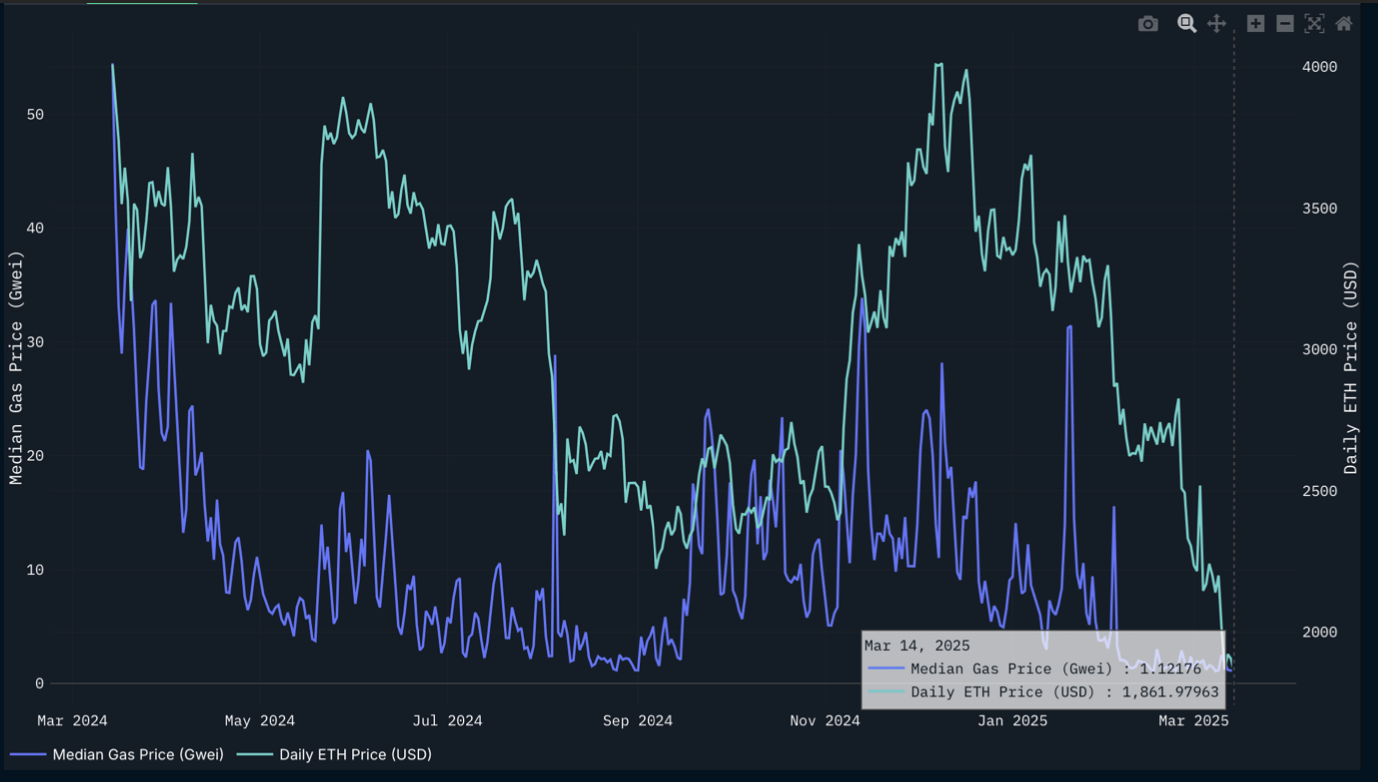

Additionally, Ethereum’s gas fees—assessed via daily median gas usage on the mainnet—hovered around 1.12 GWEI as of March, down nearly 50 times compared to the previous year.

Ethereum median gas fees vs. ETH price (in dollar terms).

“Even with the second surge in ETH price as 2024 draws to a close, mainnet activity as measured by gas usage has not fully rebounded,” remarked a data analytics platform, adding:

“This is influenced by several factors, but much of the activity has transitioned to Solana and Layer 2 solutions throughout 2024.”

The analysts maintained a cautiously bearish perspective on ETH, citing its unfavorable risk/reward ratio compared to Bitcoin and lesser-valued altcoins that focus on niche markets.

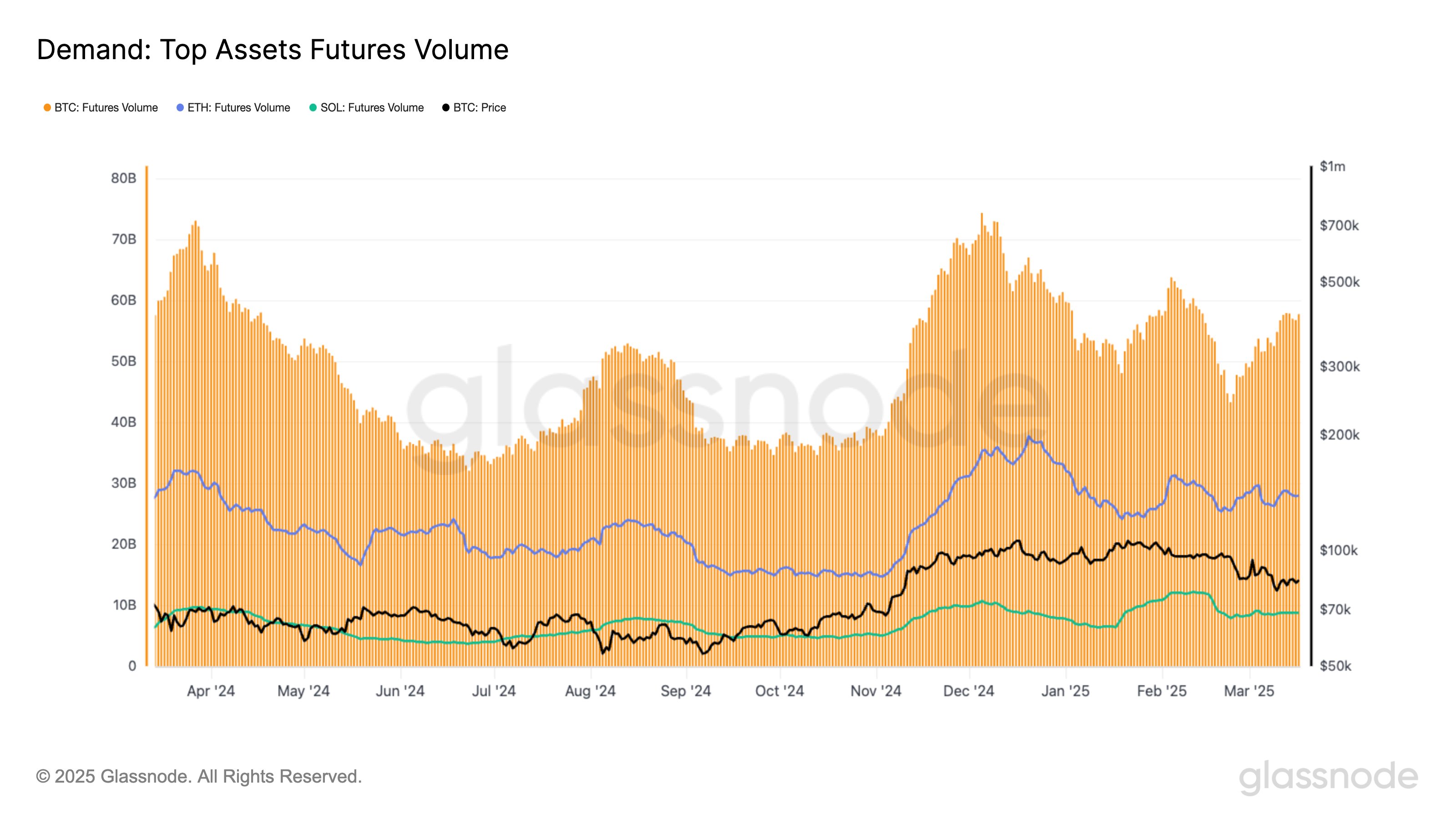

The lack of demand for ETH relative to Bitcoin is evident in future volume data as well.

Notably, Bitcoin futures volume has surged by 32% from its lows on February 23, reaching $57 billion by March 18, while ETH’s trading volume remains relatively stagnant, as indicated by onchain data.

Bitcoin, Ethereum, and Solana futures volume.

ETH/BTC Pair Could Decrease Another 15%

The ETH/BTC pair is forming a bearish pennant pattern on the daily chart, characterized by a consolidation phase within converging trendlines following a sharp decline.

Related: Market Analysis Projects a 60% Reduction in 2025 ETH Price Estimate to $4K

A bearish pennant typically resolves when the price falls below the lower trendline, dropping by an amount equal to the height of the preceding downtrend. Applying this method to ETH/BTC suggests a downside target of 0.01968 BTC by April, representing a 15% decrease from current values.

ETH/BTC daily price chart.

Furthermore, both the 50-day and 200-day EMAs are on a sharp downward trajectory, with the ETH/BTC pair trading significantly below these key indicators, suggesting a continuing bearish market environment.

Despite the potential risk of further downside, a bullish reversal could occur if the ETH/BTC pair breaks above the upper resistance of the pennant and transforms the 50-day EMA into a support level.

This content does not constitute investment advice or recommendations. Every investment and trading action carries risks, and readers are encouraged to perform their own research before making any decisions.