Ethereum’s value has plummeted over 53% from its 2024 peak, erasing $255 billion in market capitalization as it fell from $482 billion to $227 billion.

Concerns regarding the network have led to a decline in Ethereum (ETH). On Monday, analysts revised their price target for ETH downward, reducing it from $10,000 to $4,000, due to a perceived structural decline within the network.

Many investors in Ethereum have faced significant losses amid this ongoing downturn. Recent data indicates that only 47.6% of the total Ethereum supply is currently profitable, marking the lowest percentage since October 2023. Additionally, the network’s realized loss has reached its lowest point in nearly two years.

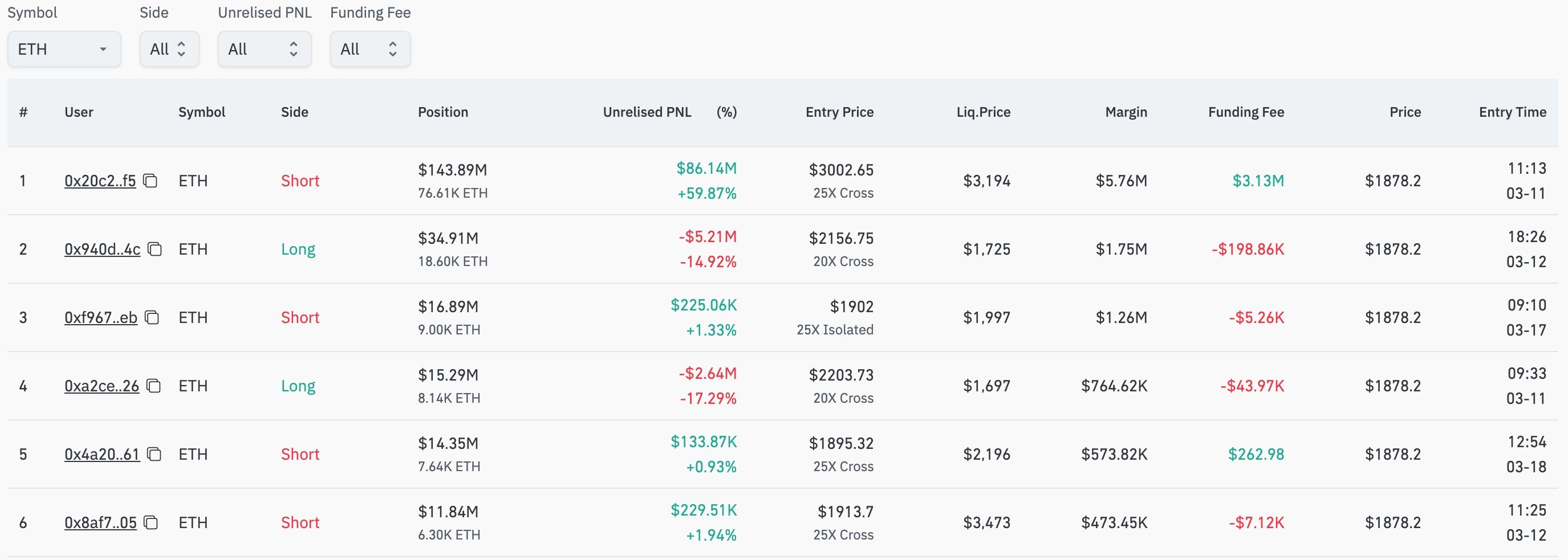

However, not all investors are incurring losses on Ethereum. Data reveals that one trader successfully profited $86 million by shorting ETH on Hyperliquid. This trader executed a $143 million short trade on March 3, when Ethereum was valued at $3,000.

Leveraging 25 times, this trader has benefited as ETH fell to $1,878 on Tuesday. His funding fee reached $3.13 million, while his margin stood at $5.76 million. His position is at risk of liquidation if Ethereum makes a rebound to $3,194.

Conversely, another trader has recorded a loss of $5.21 million from a long position on Ethereum. This individual purchased 18.6 ETH while utilizing 20x leverage, and their trade will be liquidated if ETH declines to $1,725.

Technical Analysis of Ethereum’s Price

Technical indicators suggest that Ethereum short-sellers may continue to find success, as signs point toward further declines. The daily chart reveals that Ethereum is trading below crucial support at $2,135, which is the neckline of a triple-top formation at $4,000.

A death cross pattern has also emerged, with the 50-day and 20-day moving averages crossing in February.

Currently, the coin is developing a bearish pennant pattern, characterized by a lengthy vertical line and a symmetrical triangle. As the triangle nears its confluence point, it indicates that a bearish breakout could lead Ethereum down to the psychological level of $1,500, which is approximately 20% less than its current value.