The decentralized finance (DeFi) realm is continually progressing, with Bitcoin-focused solutions gaining traction. BTCFi represents a burgeoning sector that converts Bitcoin (BTC) from a mere store of value into an actively engaged asset within DeFi.

A recent analysis delves into how Bitcoin’s security plays a crucial role in establishing trustless, scalable financial ecosystems.

The growing significance of Bitcoin in DeFi

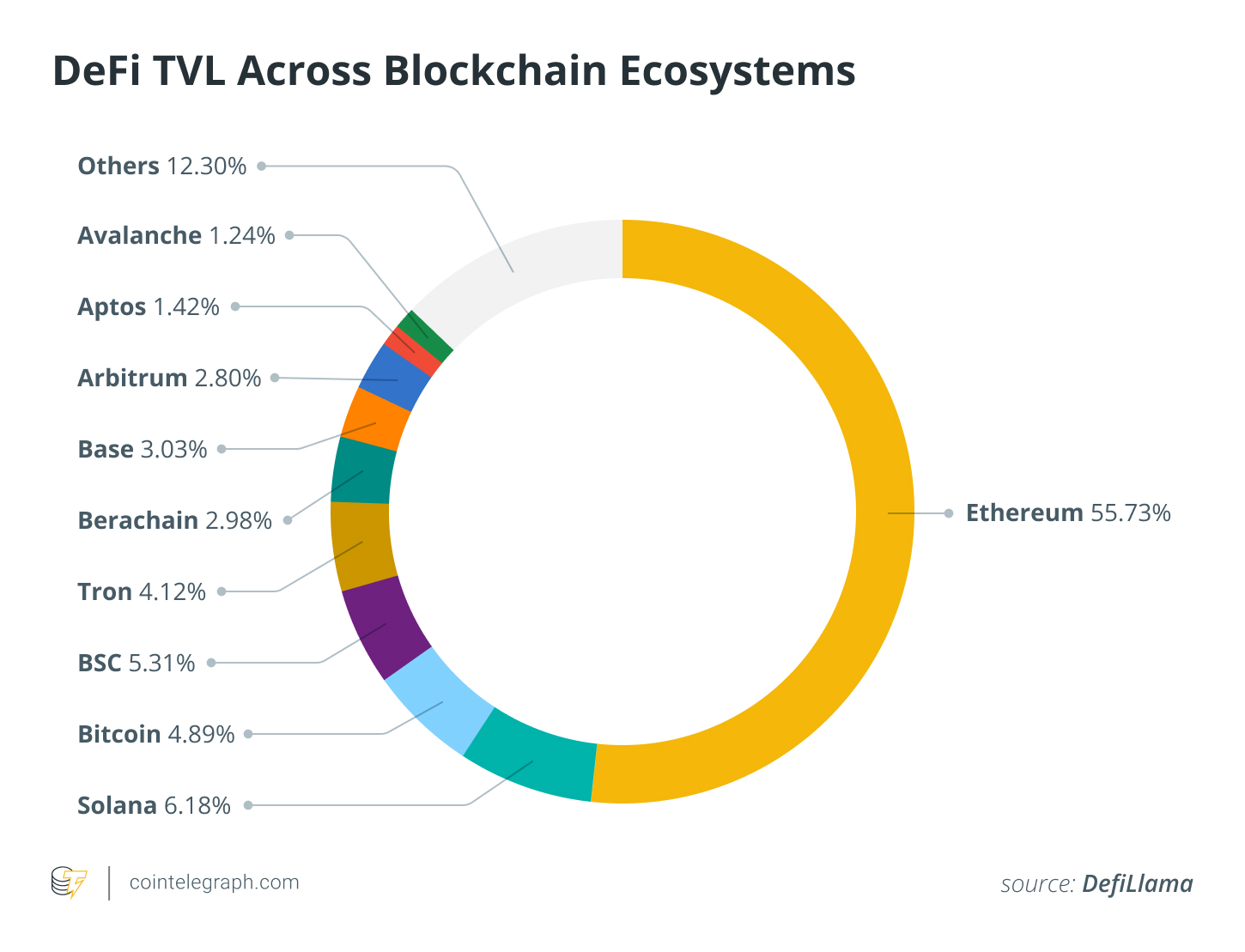

Historically, Ethereum has dominated the DeFi landscape, representing over 50% of the sector’s total $175 billion in total value locked (TVL). However, Bitcoin’s robust security and liquidity present a compelling foundation for innovation in DeFi.

Despite these advantages, Bitcoin’s absence of native smart contract capabilities has traditionally constrained its involvement in decentralized finance. The rise of Bitcoin-oriented DeFi solutions aims to fill this gap, enabling Bitcoin holders to engage in lending, stablecoin creation, and cross-chain interactions securely without custodial risks.

Leveraging Bitcoin’s security for decentralized apps

This evolution is exemplified by certain platforms that implement merged mining, a technique that allows secondary blockchains to capitalize on Bitcoin’s security.

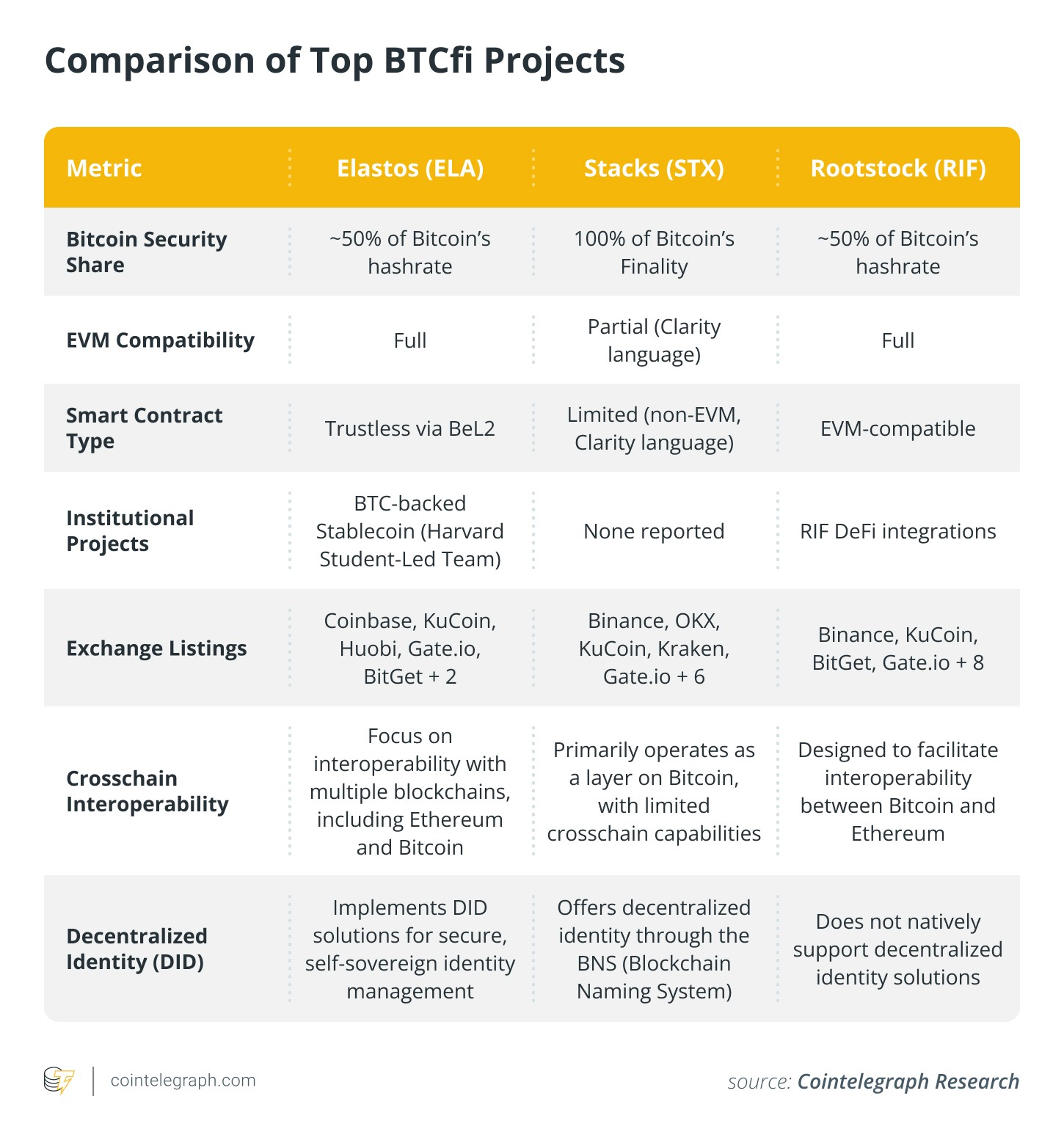

With roughly 50% of Bitcoin’s total 800 EH/s hashrate powering these networks, they position themselves as some of the most computationally resilient Bitcoin-linked frameworks available. This alignment ensures that the financial applications developed on these platforms uphold a security level comparable to Bitcoin itself.

At the foundation of this infrastructure lies a unique consensus model, a hybrid approach combining auxiliary proof-of-work, bonded proof-of-stake, and proof-of-integrity.

This multi-faceted strategy affords them the ability to offer secure, scalable financial services, which enhances their attraction for DeFi applications. A notable sidechain compatible with the Ethereum Virtual Machine facilitates the development of decentralized applications (DApps), ensuring a smooth integration with the larger DeFi ecosystem.

BeL2: A milestone for BTCFi

A significant highlight is the BeL2 Arbiter Network, crafted to facilitate trustless Bitcoin transactions within DeFi. BeL2 employs zero-knowledge proofs (ZKPs) to validate Bitcoin transactions across multiple networks without dependence on centralized custodians.

This innovation enables Bitcoin to be utilized within DeFi protocols minus synthetic assets or middlemen and addresses a long-standing issue within BTCFi.

This approach has already piqued institutional interest. An initiative by students and alumni from a prestigious university is working on a BTC-backed stablecoin utilizing BeL2. The platform also accommodates decentralized lending, allowing Bitcoin holders to use their assets as collateral for loans in stablecoins while maintaining exposure to Bitcoin’s value growth.

Market positioning and future of the initiative

This BTCFi strategy goes head-to-head with established Bitcoin DeFi solutions like Stacks and Rootstock. While Stacks benefits from Bitcoin finality and Rootstock emphasizes EVM compatibility, the featured approach distinguishes itself by merging high security (via merged mining) and cross-chain functionality. This positions it as a significant contender within the BTCFi arena.

However, the analysis also notes challenges such as regulatory uncertainties, ecosystem awareness, and some technical difficulties. Nonetheless, the combination of Bitcoin security, trustless smart contract execution, and institutional support places it in a favorable position for growth in the evolving BTCFi space.

Challenges and opportunities within Bitcoin DeFi adoption

As the blockchain sector transitions towards cross-chain interoperability and decentralized governance, Bitcoin-secured assets are anticipated to play a pivotal role in transforming both traditional and decentralized finance.

The innovations presented, particularly through BeL2 and its decentralized identity framework, aim to bolster the security, scalability, and institutional integration of Bitcoin in DeFi.

With Bitcoin-secured finance projected to experience significant growth, this infrastructure offers a strong groundwork for the next generation of decentralized financial applications.

This article does not constitute investment advice or recommendations. Every investment and trading decision carries risk, and readers should perform their own due diligence prior to making choices.

This content is meant for informational purposes only and should not be considered as legal or investment advice. The opinions expressed herein are solely those of the author and do not necessarily represent the views of any specific entity.

The information provided does not endorse any specific content or product mentioned. Readers are encouraged to conduct their own research before taking any actions related to the products or companies referenced and assume full responsibility for their decisions.