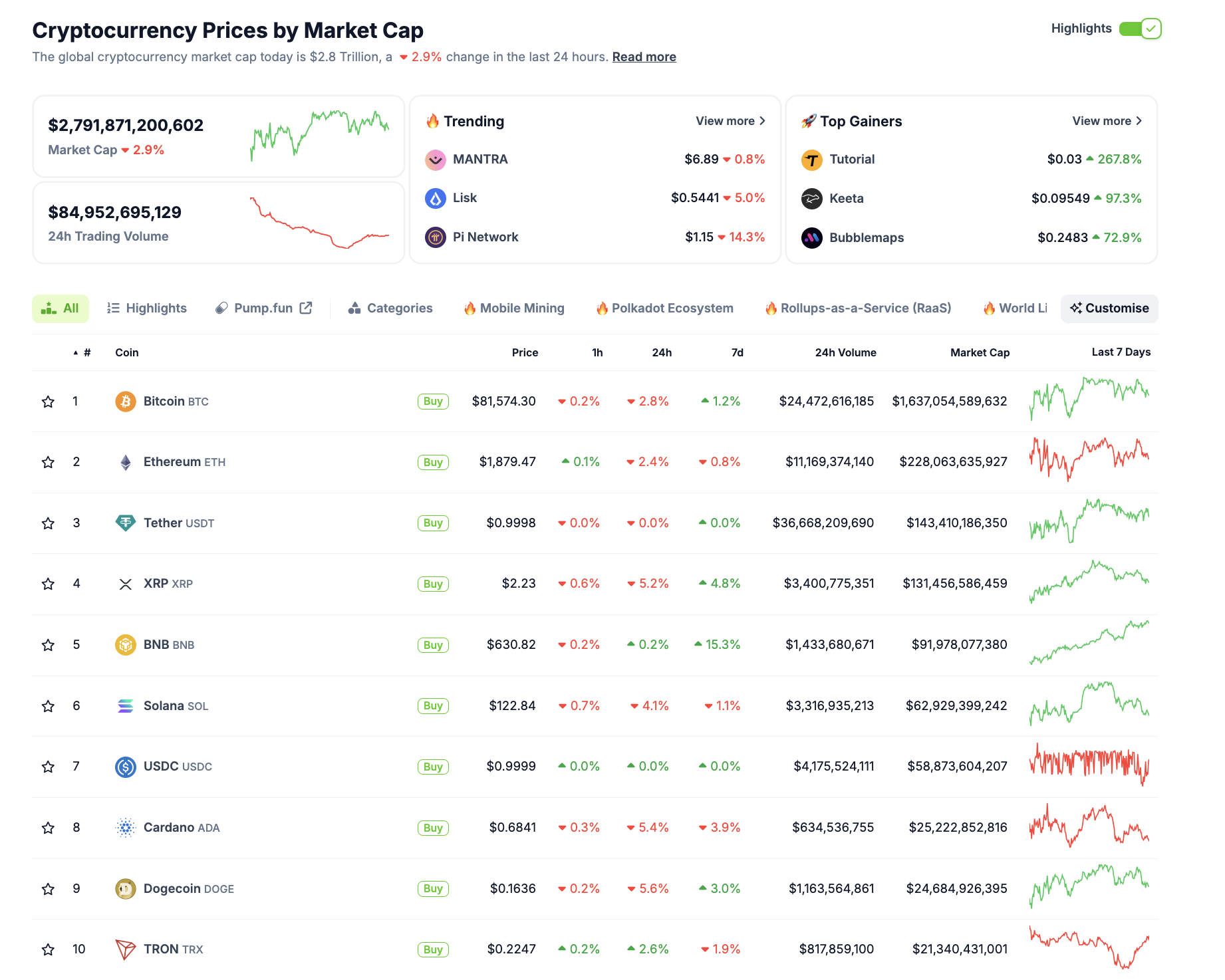

- Cryptocurrency markets experienced a 2.9% decline on Tuesday, reducing the total sector valuation to $2.79 trillion.

- Bitcoin is currently priced at $82,400, reflecting a 2% decrease from the prior close, with fluctuations between a peak of approximately $84,700 and a low of $82,281.

- Canary Capital has submitted a proposal to launch a SUI spot ETF, marking the firm’s sixth derivative filing related to altcoins.

Bitcoin market overview:

- Bitcoin’s price is stabilizing with a peak of $84,705 and a low of $82,281.

- The BTC price has been hovering around $84,000 as traders take a cautious stance ahead of the impending US FOMC meeting scheduled for Wednesday.

- Heightened interest surrounding Gold’s (XAU) record high could trigger further outflows from BTC if the Federal Reserve’s decision falls short of market anticipations.

- On March 17, Bitcoin ETFs recorded inflows of $234 million, marking the largest single-day deposit ever seen.

Bitcoin ETFs Flows, March 18 | Source: SosoValue

This also marks the first occasion in 42 days, dating back to February 4, that Bitcoin ETFs have witnessed two consecutive days of inflows. The total net value of Bitcoin holdings managed by ETF sponsors currently stands at $94.5 billion.

Updates on altcoin market: SUI and Polkadot ETF developments struggle to attract liquidity from XRP, ADA, and SOL

The overall cryptocurrency market capitalization fell by 2.9% in the last 24 hours, with trends revealing that assets that were recently performing well are now encountering liquidity outflows.

Crypto market performance, March 18 2025 | Source: CoinmarketCap

Recent reports suggested that the US SEC is contemplating classifying XRP as a commodity as part of settlement negotiations in its ongoing case against Ripple.

This sparked speculation about the possibility of ETF approvals for XRP, LTC, ADA, and HBAR, leading to double-digit gains for all four altcoins before a market correction over the weekend.

This week has seen further ETF developments, with Canary Capital filing for a SUI spot ETF — their sixth filing currently undergoing SEC evaluation. Additionally, NASDAQ has also filed for a Polkadot ETF, driving short-term rallies in DOT (+7%) and SUI (+3%) over the past week.

Nevertheless, a broader market analysis suggests that investors are reallocating their funds from last week’s top performers toward newer opportunities.

This shift is reflected in the declining prices and trading volumes of XRP, SOL, and Cardano, which have all been facing selling pressure in the last 24 hours.

Performance of XRP, SOL, and Cardano

- XRP: Priced at $2.23, down 0.6% in the past 24 hours, and 5.2% over the week.

- Solana (SOL): Currently at $122.84, reduced by 0.7% in the last 24 hours and 4.1% over the week.

- Cardano (ADA): Trading at $0.6841, a decrease of 0.3% in the past 24 hours and 5.4% over the week.

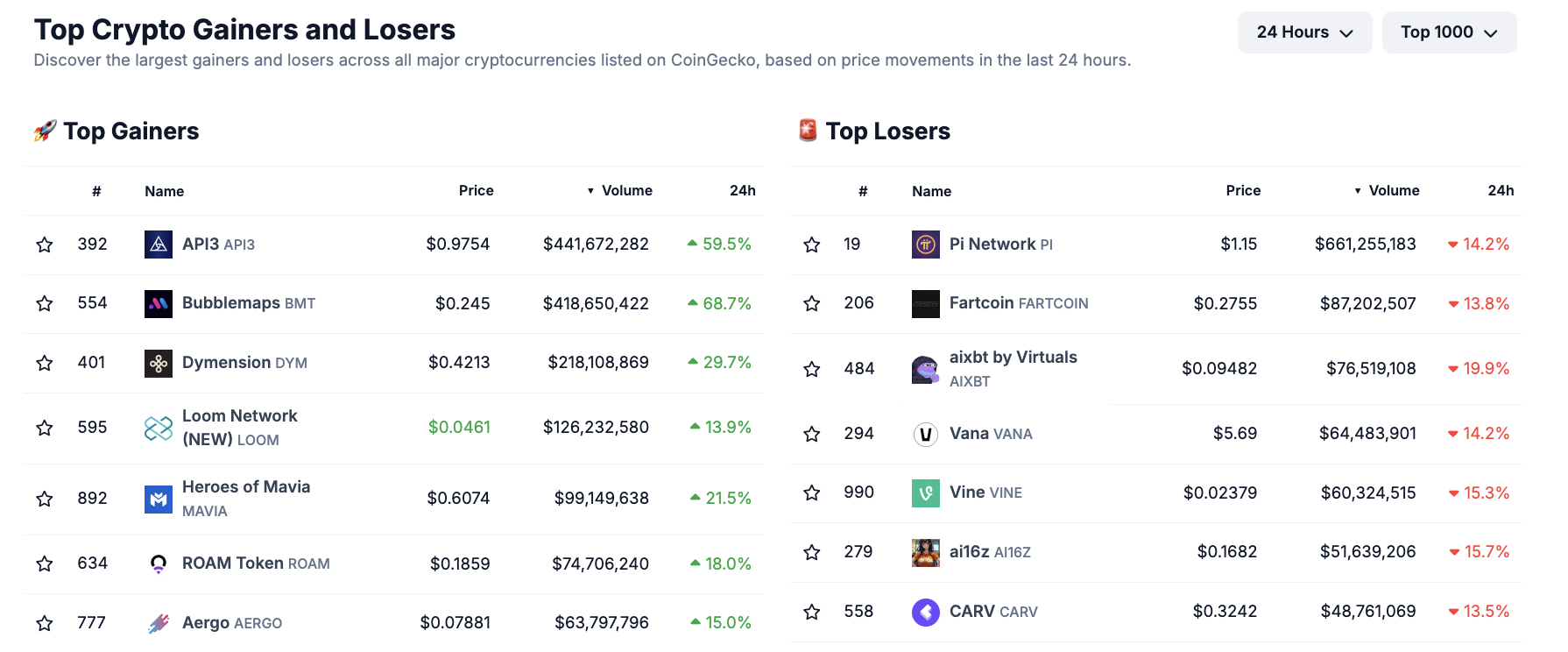

Chart of the day: Winners vs. Losers

The significant drop in trading volumes for these altcoins indicates a change in market sentiment, with traders reallocating resources to assets with new catalysts like the SUI and Polkadot ETF filings.

Winners vs. Losers

Today’s top gainers

- BubbleMaps (BMT): Up 68.7%, trading at $0.245.

- API3 (API3): Up 59.5%, priced at $0.9754.

- Dymention (DYM): Up 29.7%, trading at $0.423.

Today’s top losers

- Pi Network (PI): Down 14.2%, trading at $1.15.

- aixbt by Virtuals (AIXBT): Down 19.9%, priced at $0.09482.

- Vana (VANA): Down 14.2%, trading at $5.69.

The total cryptocurrency market capitalization has dipped to $2.79 trillion on Tuesday, reflecting a 2.9% decline over the past 24 hours.

Trading volume also fell to $84.95 billion, aligning with the downturn in major altcoins.

The current market trends illustrate a shift in liquidity as traders reposition their funds toward assets with fresh catalysts, moving away from the previous week’s leaders. ETF-related narratives dominate, with anticipated US Fed rate approvals likely to influence capital movements in the coming weeks.

Crypto news highlights:

VanEck plans Bitcoin investment fund launch in Vietnam

VanEck, an asset management firm based in the US with $113.8 billion in assets, is set to roll out a Bitcoin investment fund in Vietnam in collaboration with SSI Securities.

CEO Jan van Eck engaged with Vietnam’s State Securities Commission and Deputy Minister of Foreign Affairs to discuss the initiative and the evolution of the country’s digital asset marketplace.

VanEck aims to enhance its digital asset collaborations and technology transfer in Asia, fueled by rising institutional interest in regulated crypto investment options.

Confirmation of Paul Atkins as SEC chair postponed due to pending financial disclosures

The confirmation of Paul Atkins, former SEC commissioner and Trump’s nomination for SEC chair, has been postponed due to outstanding financial disclosure documentation from the White House, according to reports.

The Senate Banking Committee, headed by Tim Scott, has earmarked March 27 for a confirmation hearing, but Atkins’ intricate financial assets — particularly his connections to TAMKO Building Products LLC, a $1.2 billion roofing company associated with his wife’s family — have complicated the vetting process.

“No update yet on whether the committee has received Atkins’ documentation, but either way, this is the most progress we’ve observed thus far,”

– reported the source on a social media platform.

Meanwhile, the Senate Banking Committee has arranged a bipartisan meeting for this Friday to deliberate on his nomination.

Notwithstanding the delays, Atkins is still expected to confirm, following a timeline similar to previous SEC chairs, Gary Gensler and Jay Clayton, whose hearings also occurred in March.

Strategy launches $500M perpetual preferred share offering to boost BTC reserves

Strategy, the largest corporate holder of Bitcoin, has initiated a $500 million public offering for perpetual preferred stock, known as STRF (Strife), aimed at both institutional and select retail investors.

The company intends to issue 5 million shares of Series A Perpetual Strife Preferred Stock in this public offering to fund further Bitcoin acquisitions and bolster working capital.

The preferred stock will feature a 10% annual fixed dividend rate, with quarterly payments beginning June 30, 2025.

If dividends are unpaid, they will accumulate at a rate of 11% per annum, increasing by 100 basis points each quarter to a maximum of 18% annually until the obligation is fulfilled.