The CEO of ARK Invest, Cathie Wood, asserts that the administration is underappreciating the recession risk that looms over the US economy due to the tariff strategies implemented by former President Donald Trump — a misjudgment that may eventually necessitate the president and the Federal Reserve to adopt more growth-oriented policies.

During her virtual appearance at the Digital Asset Summit in New York on March 18, Wood noted that the US Treasury Secretary does not share concerns about a looming recession.

Contrarily, Wood expressed, “We are indeed concerned about a recession,” emphasizing, “We believe the velocity of money is significantly slowing.”

Cathie Wood speaks virtually at the Digital Asset Summit.

A decline in the velocity of money indicates that capital is being exchanged less frequently, a trend often correlated with a recession as consumers and businesses reduce their spending and investments.

“What I believe is that should a recession occur, resulting in a decrease in GDP, it may grant the president and the Fed more flexibility in terms of implementing tax cuts and adjusting monetary policy,” Wood remarked.

Market participants speculate that significant changes could take place in the coming months if the Federal Reserve decides to end its quantitative tightening program — an outcome that gamblers on Polymarket anticipate is a certainty before May.

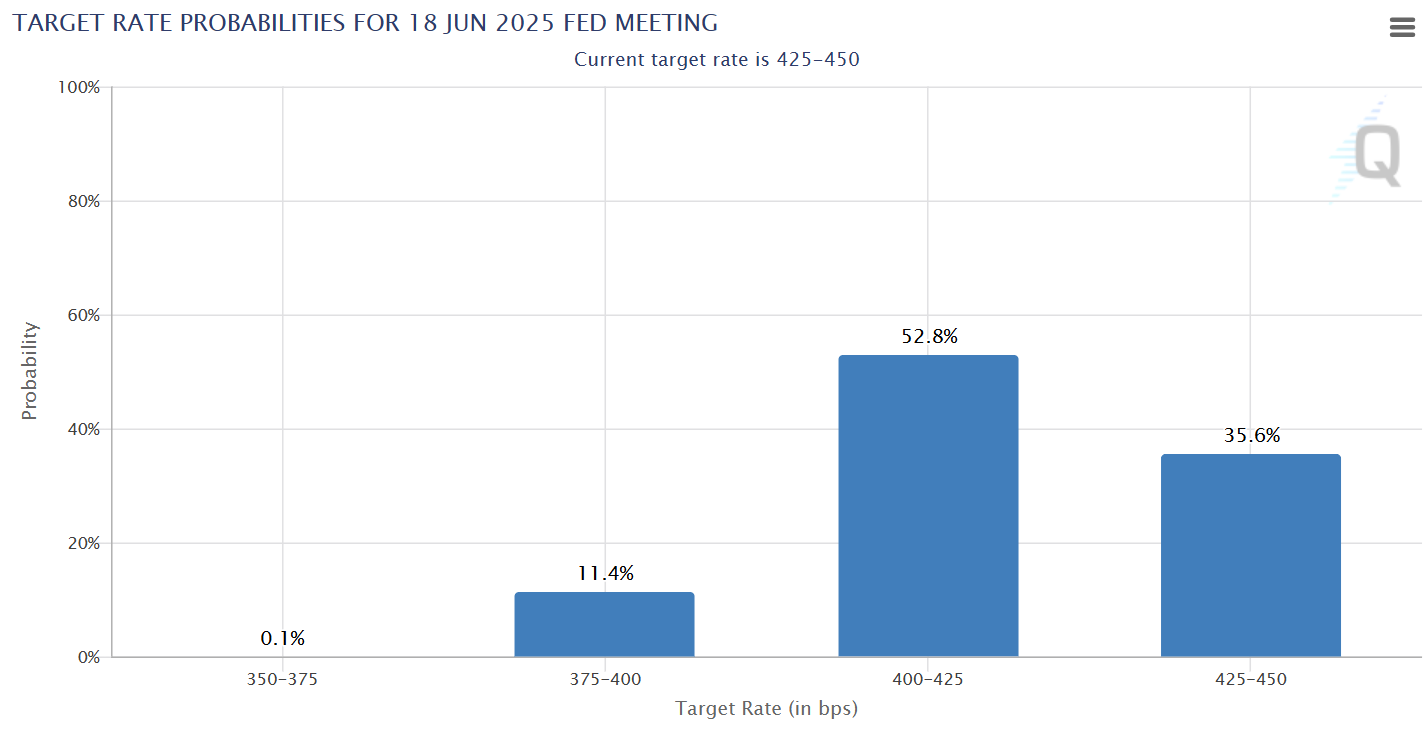

At the same time, expectations are rising for multiple interest rate cuts from the Fed in the latter half of the year, according to future price estimates from CME Group.

The chances of lower rates by the Fed’s June 18 meeting stand at nearly 65%.

Emphasis on Long-Term Vision

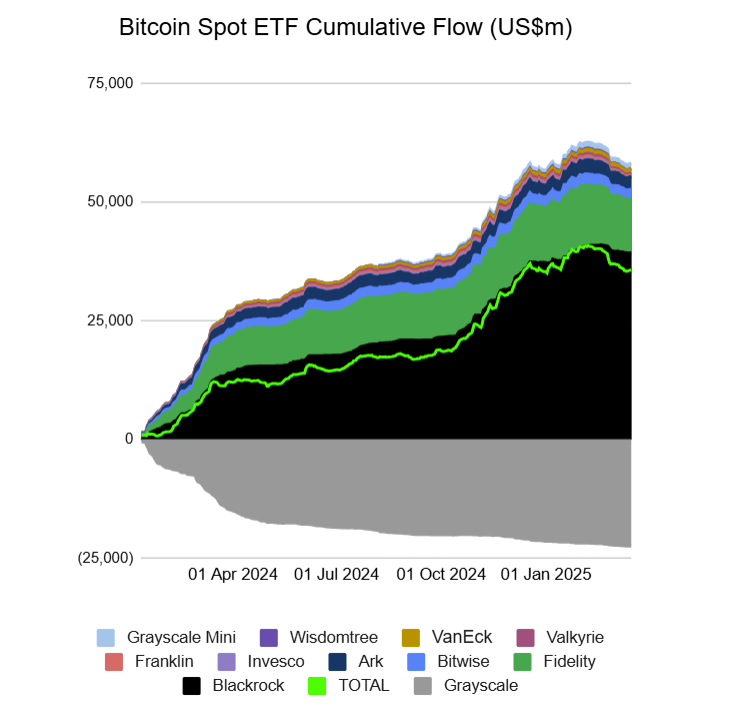

For many years, ARK and Wood have been significant players in the cryptocurrency investment sphere. Their spot Bitcoin (BTC) exchange-traded fund was approved on January 11, 2024, currently boasting over $3.9 billion in net assets, according to financial reports.

While spot Bitcoin ETFs have seen noteworthy outflows recently, the overall trend indicates that investors are maintaining their positions.

ARK also provides crypto portfolio solutions for wealth managers through a collaboration with Eaglebrook Advisors.

During her speech at the summit, Wood remarked that “long-term innovation prevails as we navigate these challenges,” alluding to the recent market downturn.

When questioned about the long-term investability of crypto assets, she affirmed that this approach is central to ARK’s investment philosophy.

“We have expanded our positions beyond just the leading three,” she noted, referring to Bitcoin, Ether (ETH), and Solana (SOL).

This long-term vision is bolstered by supportive regulations that have significantly enhanced the investment landscape.

Favorable legislative changes are “encouraging institutions to proceed, and if you review our research dating back to 2016, we published a paper titled ‘Bitcoin: Ringing the Bell for a New Asset Class,’ which many institutions initially dismissed outright,” Wood explained.

Now, institutions are reassessing ARK’s research and recognizing their “fiduciary responsibility to introduce clients to a new asset class.”