A global cryptocurrency-friendly bank based in Gibraltar is making a significant move in the crypto lending space by offering loans backed by Bitcoin in US dollars.

Clients who meet certain qualifications can now apply for Bitcoin (BTC) loans of up to $1 million, as announced on March 18.

This new product is aimed at long-term Bitcoin holders looking to access liquid funds without having to part with their BTC, as explained by the bank’s CEO.

“In contrast to traditional assets, Bitcoin serves as an optimal form of collateral — it transcends borders, is highly liquid, accessible around the clock, and easily divisible, making it exceptionally suited for lending,” the CEO stated.

No Re-usage of Collateral

A notable feature of this Bitcoin lending service is that the bank does not engage in rehypothecation of user collateral, ensuring that clients’ BTC assets are not reused within its lending model.

Instead, the Bitcoin collateral is securely stored in the bank’s vault, utilizing institutional multiparty computation (MPC) custody.

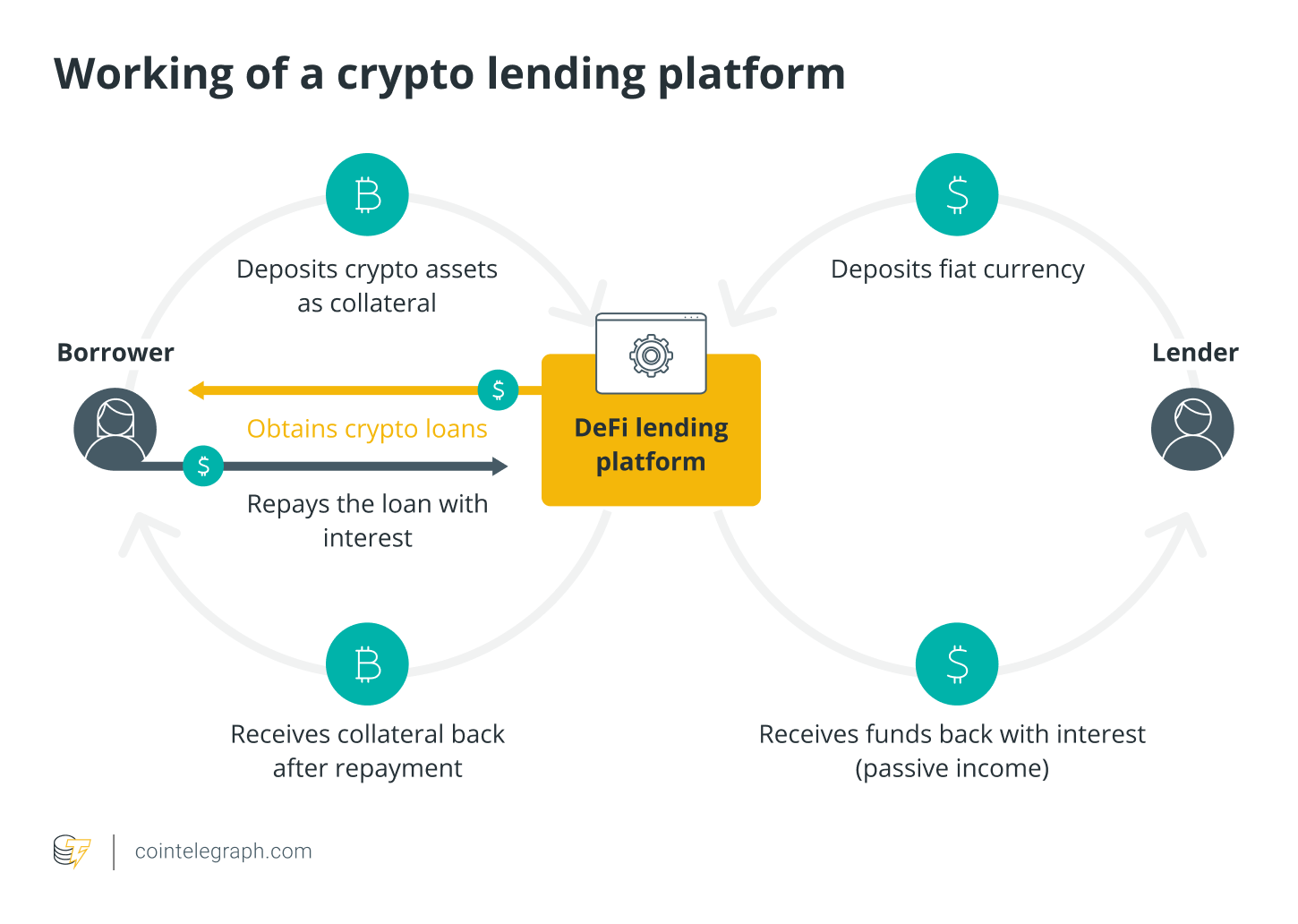

Functionality of a crypto lending platform.

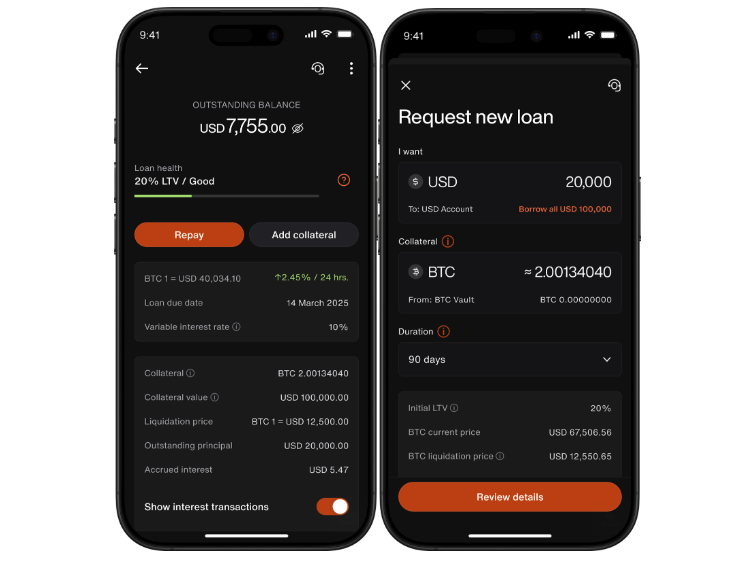

Eligible clients can select repayment terms of 30, 90, 180, or 365 days without incurring any penalties for early payment.

Eligibility Criteria

The new Bitcoin lending service is accessible to pre-approved clients based on several specific criteria.

Individuals will be assessed primarily on their Bitcoin holdings and how long they have held it since the service specifically targets long-term investors.

The offering is set to be available to global clients in regions such as Europe and Asia, with the exception of those residing in the United States.

Supported jurisdictions.

This bank is regulated by the Gibraltar Financial Services Commission under the Financial Services Act of 2019. In 2024, it successfully extended its banking license to the United Kingdom, allowing the bank’s app to operate fully within the country.

Although the lending service is available throughout the European Union, it remains unregulated by local frameworks such as the Markets in Crypto-Assets legislation.

A Comeback After Setbacks

The introduction of the Bitcoin loans follows a tumultuous period in the crypto lending market that began in 2022.

This crisis was triggered by the Terra collapse and a subsequent bear market, which led to the downfall of prominent lending firms like Celsius and BlockFi.

“The failures of Celsius, BlockFi, and similar centralized lenders significantly damaged trust in the crypto lending sector,” the bank’s CEO commented.

A depiction of the Bitcoin lending process.

“Borrowers today are much more cautious, favoring platforms with a verified history in Bitcoin custody and secure, transparent solutions — particularly those that avoid rehypothecation,” the CEO added.

“At the same time, interest in Bitcoin-backed loans is growing, especially among high-net-worth individuals and institutional investors looking for liquidity without liquidating their BTC holdings.”

In addition to eliminating rehypothecation and ensuring security through MPC, the bank provides risk management tools and proactive measures to prevent automatic liquidations.

“If there is a drop in Bitcoin’s price, clients receive immediate alerts, enabling them to either add to their collateral or make partial repayments to keep their loan status in good standing,” the CEO explained.

This bank is not the only entity venturing into lending products; in early March, a notable Bitcoin developer secured significant funding to launch several new institutional funds, including two focused on BTC lending.

Magazine: ETH might hit a low of $1.6K, SEC postpones multiple crypto ETFs, and more: Hodler’s Digest, March 9 – 15