In the European Union, 70% of cryptocurrency payments are directed towards retail, food, and beverage expenditures, based on findings from a recent survey of user spending habits.

This survey, which converted all transactions into US dollars, indicated that the typical payment size through the app was $8.36, while users made average deposits of roughly $85. Following retail and food and beverage transactions, 26% of payments were associated with tourism activities, including lodging, travel, and aviation. Additionally, 1.5% of transactions were for government services and digital payments, with another 1.5% allocated to various other purchases like healthcare and entertainment.

Related: Transak and Uranium.io partner to allow crypto purchases of tokenized uranium

The increase in crypto payment adoption can likely be attributed to the growing acceptance of digital assets within the EU, largely due to the enhanced credibility provided by governmental crypto regulations. Notably, 92% of transactions were conducted using the USDt (USDT) stablecoin, which has faced challenges under the MiCA regulation that fully came into effect on December 30, 2024.

Additionally, this report adds to data from another source showing that cryptocurrency adoption in Central, Northern, and Western Europe has surged by 44% year-over-year. For transactions valued under $1 million, the stablecoin market in that area has expanded at a rate 2.5 times quicker than in North America.

Related: Conflux Foundation announces $500M investment to support PayFi Web3 payments solution

Growing Use Cases: Micropayments and Stablecoins

Micropayments, often utilizing stablecoins, have emerged as a significant use case for cryptocurrency. Technological advancements like the Lightning Network, which facilitates rapid micropayments in Bitcoin (BTC), along with crypto debit cards that enable spending in crypto with “crypto-back,” have encouraged this trend. As highlighted by the survey, cryptocurrency is evolving from being a meme to a viable medium of exchange.

These advancements have led to a surge in global adoption. In June 2024, a major financial platform introduced the Lightning Network to 100 million customers across Latin America.

In June 2023, another company collaborated with a prominent Mexican group to enable millions of users to settle their internet bills using Bitcoin. Meanwhile, on March 13, 2025, a prominent provider secured a license to offer crypto payment solutions in the UAE.

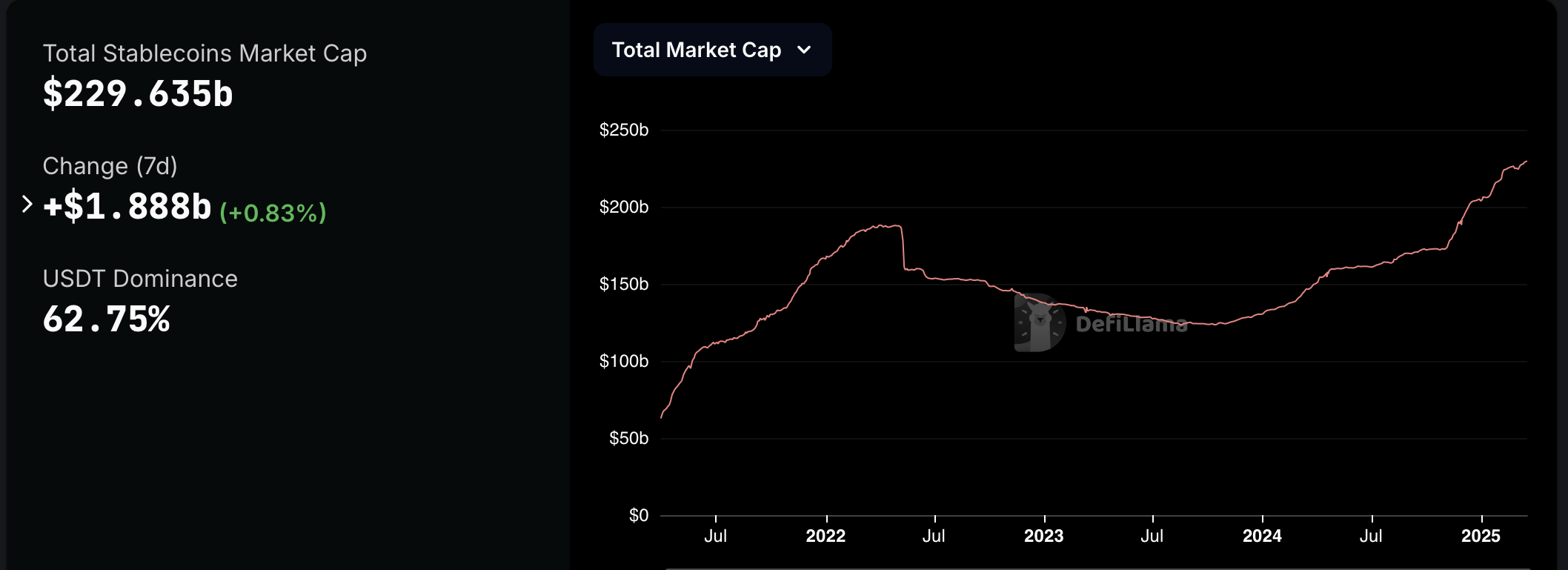

Stablecoins, like USDt and Circle’s USDC, continue to gain traction. According to financial data, their market capitalization has skyrocketed from $62.8 billion on April 1, 2021, to $229.6 billion by March 18, 2025, resulting in a remarkable increase of 266%.

Market cap of stablecoins from April 1, 2021, to March 18, 2025. Source: DefiLlama

These cryptocurrencies pegged to fiat currencies are often used in developing nations experiencing currency devaluation.

As a thought leader in the industry noted in early 2025, the realm of crypto payments may witness transformative changes starting in 2025. Observers should keep an eye on the emergence of central bank digital currencies, which could encourage individuals toward decentralized alternatives, as well as the partnerships forming between crypto payment providers and traditional financial institutions.

Magazine: The challenges of centralized stablecoins to Bitcoin payments