Recent analysis indicates that Bitcoin (BTC) exchanges are experiencing a significant “deleveraging event,” which is expected to influence future market performance.

On March 17, an onchain analytics platform published insights revealing a $10 billion capitulation in Bitcoin futures markets.

Key Event for BTC Price Recovery

Since reaching its all-time highs in mid-January, Bitcoin derivatives traders have adopted a considerably more cautious stance regarding BTC/USD.

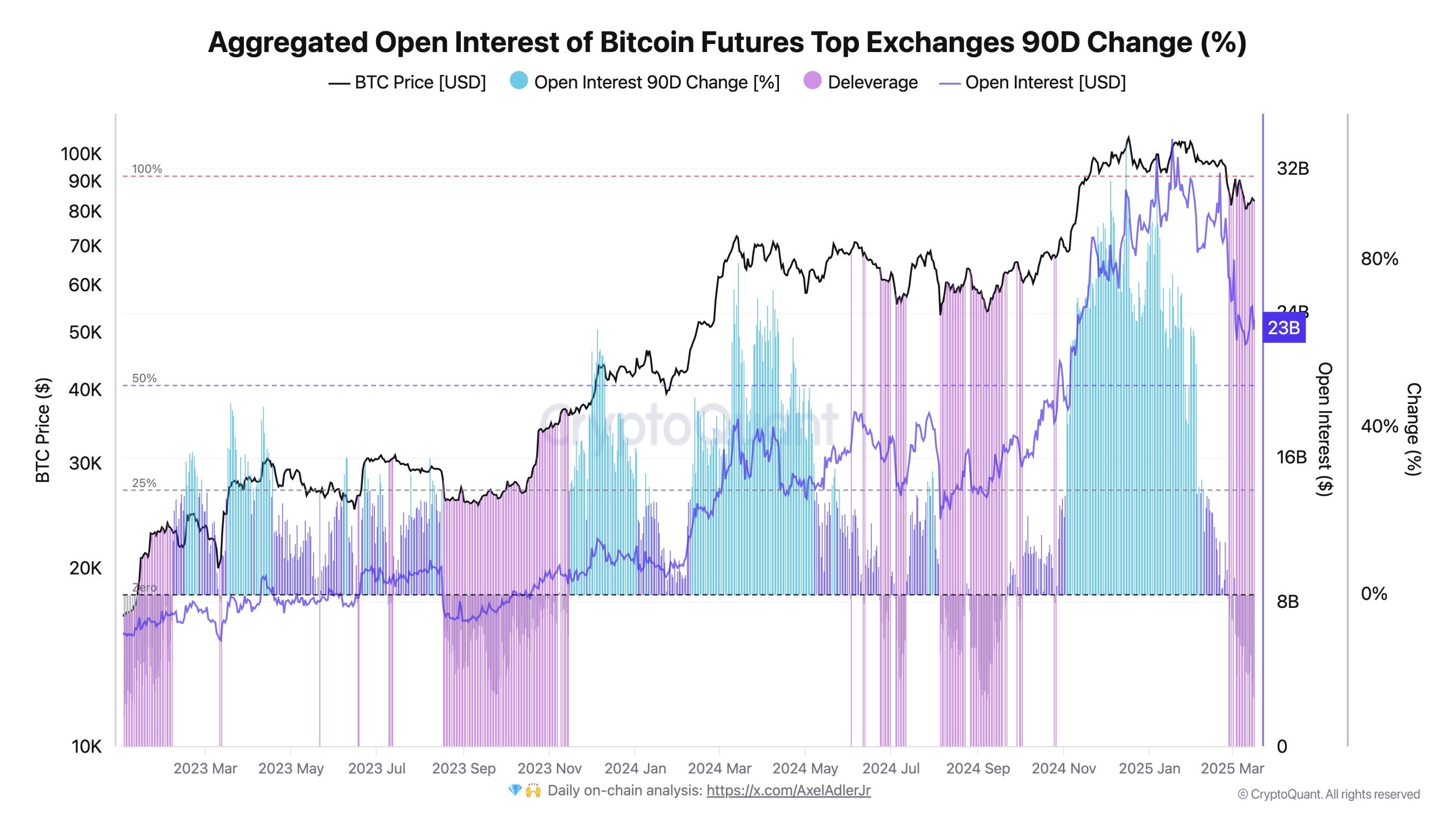

The analytics platform, utilizing data from various leading crypto exchanges, reported that the total open interest (OI) on futures contracts plummeted by $10 billion in a notable three-week period from February 20 through March 4.

According to a contributor, on January 17, Bitcoin’s open interest peaked at over $33 billion, marking an unprecedented level of leverage in the market.

The decline is viewed as a natural market correction, which is crucial for maintaining a bullish trend going forward.

Data on Bitcoin futures OI from leading exchanges.

An accompanying chart illustrates the 90-day rolling change in aggregate OI, underlining the market’s sharp reversal following the peak valuation.

The contributor concluded that the current 90-day change in Bitcoin futures open interest has significantly dropped and now stands at -14%.

“Historical patterns show that each previous deleveraging event has created favorable opportunities for traders in the short to medium term.”

Emerging Demand Issues in Crypto

Another analyst from the same platform noted that the derivatives markets have become increasingly active since November 2024.

Related: Peak ‘FUD’ signals potential $70K support — Key insights for Bitcoin this week

He highlighted that stablecoin reserves on derivatives exchanges have been rising, even eclipsing those in spot markets. However, this growth does not seem to translate into positive price movements.

“Despite a notable surge in stablecoin supply since November 2024, our analysis indicates this increase has not substantially benefited the market or investors,” the blog explains.

The analyst characterized the spot markets as facing a “demand crisis.”

“Until this distribution stabilizes, it may be wise to steer clear of high-leverage (high-risk) trading strategies,” he cautioned.

Screenshot of exchange stablecoin reserves.

This article is not intended as investment advice. Every trading decision involves risks, and readers are encouraged to conduct their own research before proceeding.