The recent decline in Bitcoin’s value since its peak in January is considered a standard cyclical retracement and is not unusual, according to crypto analysts and industry leaders.

“I don’t believe the bull market has concluded; rather, I think we’ve delayed reaching the cycle peak due to broader economic factors and global liquidity issues, which aren’t favorable for crypto,” stated the CEO of Collective Shift.

Bitcoin undergoing anticipated correction

“This is only the third or fourth instance of Bitcoin dropping over 25% in this cycle, compared to 12 in the previous cycle,” the CEO noted.

Bitcoin (BTC) has witnessed a 24% drop from its all-time high of $109,000 on January 20 amid uncertainties surrounding tariffs imposed by former US President Donald Trump and the future direction of US interest rates. However, this has been described as “a typical correction.”

“The market had overheated and needed to come down to establish a new base, and now we’re just waiting for the next narrative to develop,” he added.

Bitcoin has fallen 13.58% over the past month. Source: CoinMarketCap

The founder of Derive expressed a similar opinion, indicating that Bitcoin appears to be in a standard correction phase, with the peak of the cycle still ahead.

“Traditionally, Bitcoin has these types of corrections during extended rallies, and there’s no reason to think this instance is any different,” he remarked.

Following Trump’s election in November, Bitcoin experienced a nearly 36% surge within a month, reaching $100,000 for the first time in December. Presently, Bitcoin is trading at $82,824, according to current market data.

However, the Derive founder emphasized that Bitcoin’s trajectory over the next six months seems increasingly connected to traditional markets. In a similar vein, the CEO of Independent Reserve pointed out that the broader macroeconomic environment is impacting not just Bitcoin, but all asset classes.

“These conditions are affecting all types of assets and could lead to a rise in global inflation and a slowdown in international growth,” he stated.

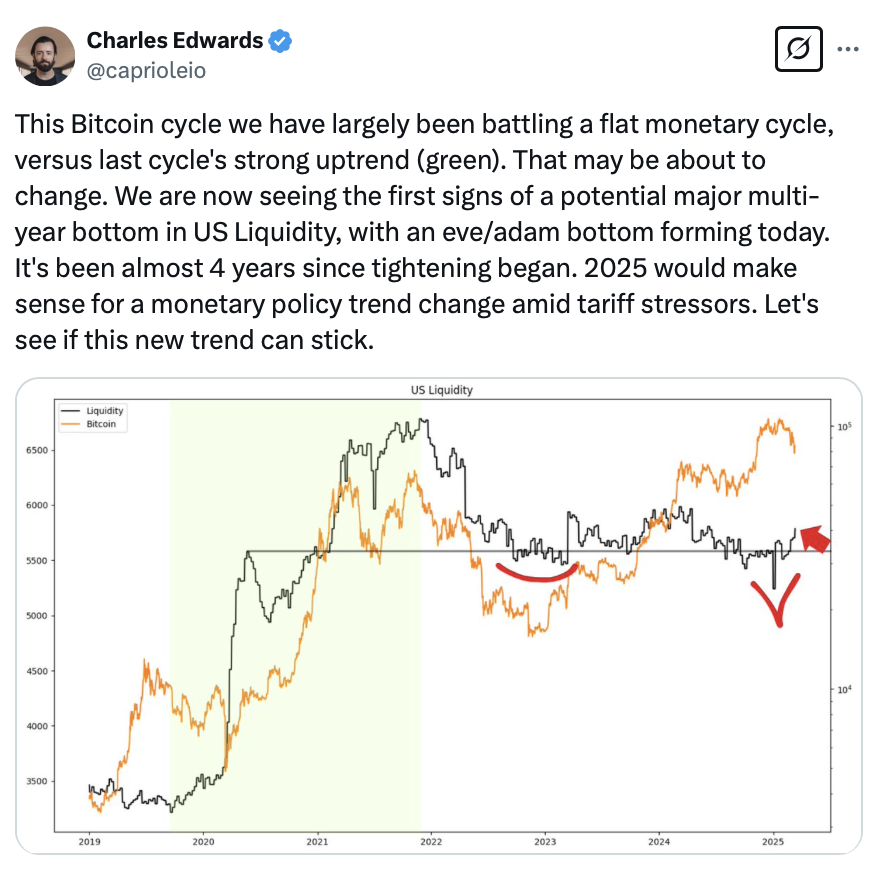

Source: Charles Edwards

The current price trend of Bitcoin aligns with historical patterns preceding significant rallies, despite its seemingly volatile nature at the moment.

Bitcoin’s trend may shift swiftly

The CEO of Collective Shift suggested that the upcoming narrative may focus on US interest rate cuts, a reduction in quantitative tightening, and a rise in global liquidity.

However, the founder of Capriole Investments expressed uncertainty regarding whether the Bitcoin bull market has ended.

The likelihood, he believes, is “50:50.”

“From an on-chain perspective, yes, but this could change rapidly if the Federal Reserve decides to ease in the latter half of the year, halts balance sheet reductions, and liquidity in dollars increases as a result, which I think has a reasonable chance of occurring,” he explained.

These thoughts echo recent sentiments expressed by the CEO of CryptoQuant, who claimed that the “Bitcoin bull cycle is over,” predicting “6-12 months of bearish or stagnant price movements.”

Disclaimer: This article does not constitute investment advice or recommendations. Every investment and trading decision carries risk, and it’s crucial for readers to conduct their own research.