On March 11, Bitcoin’s corrective phase reached a four-month low of $76,600. Even amid this drop, long-term holders have maintained significant amounts of BTC, indicating a “distinct market dynamic moving forward,” recent analysis suggests.

“The activity of Long-Term Holders remains predominantly low, accompanied by a significant reduction in their selling pressure,” an analyst noted in a March 18 market review.

Signs of Optimism Among Long-term Holders

Bitcoin’s rebound coincides with a decrease in selling activity among Long-Term Holders (LTHs)—those who have held Bitcoin for over 155 days.

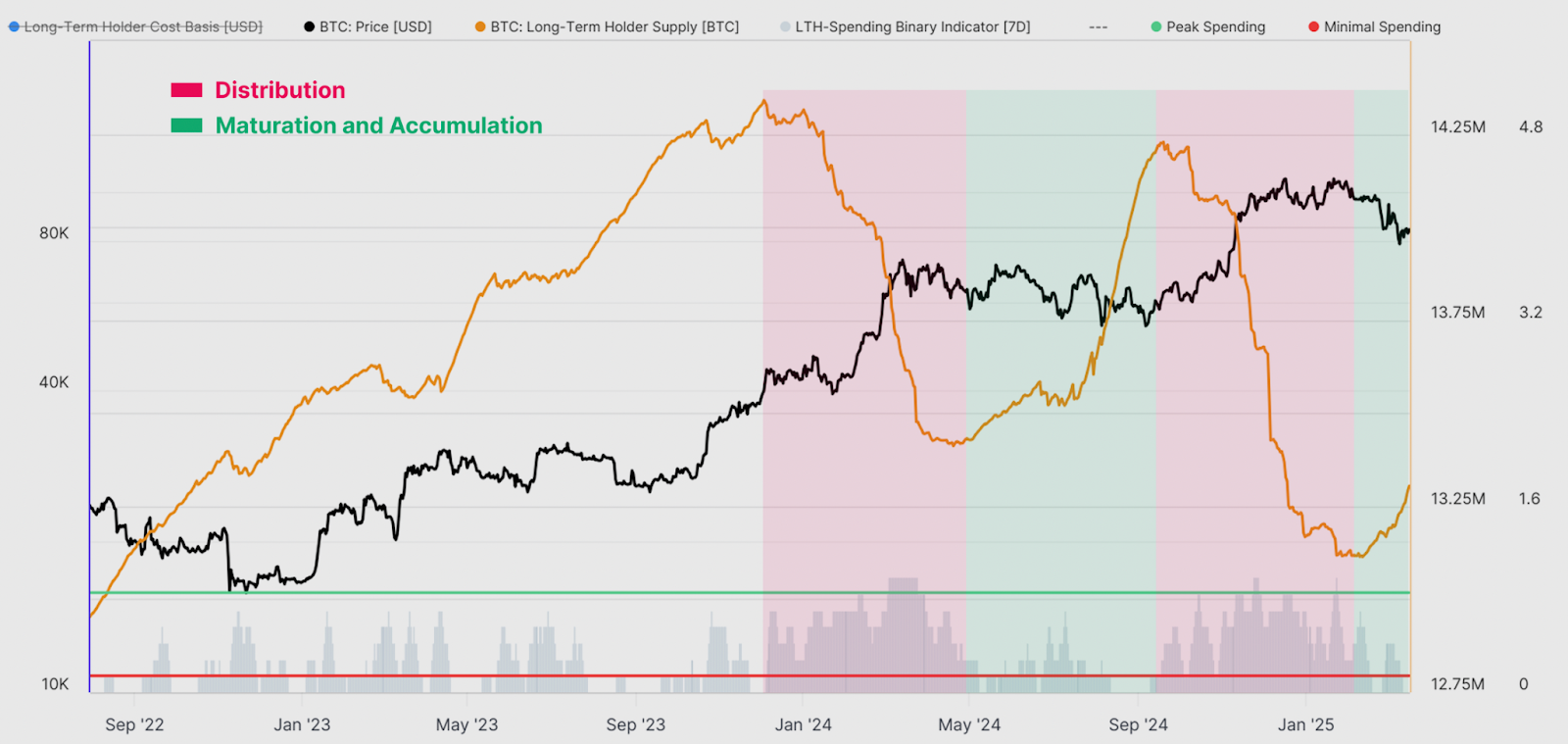

The Binary Spending Indicator, which gauges when LTHs are liquidating a significant part of their holdings over time, exhibits a slowdown (refer to the chart below). Additionally, LTH supply is starting to bounce back after months of decline.

“This suggests that this group is more inclined to hold than to spend their coins,” the analysis pointed out, adding:

“This might represent a change in sentiment, indicating Long-Term Holder behavior is shifting away from distribution.”

Bitcoin: LTH spending binary indicator.

Bull market peaks are often characterized by intense selling pressure and profit-taking among LTHs, typically signifying a complete turn towards pessimism.

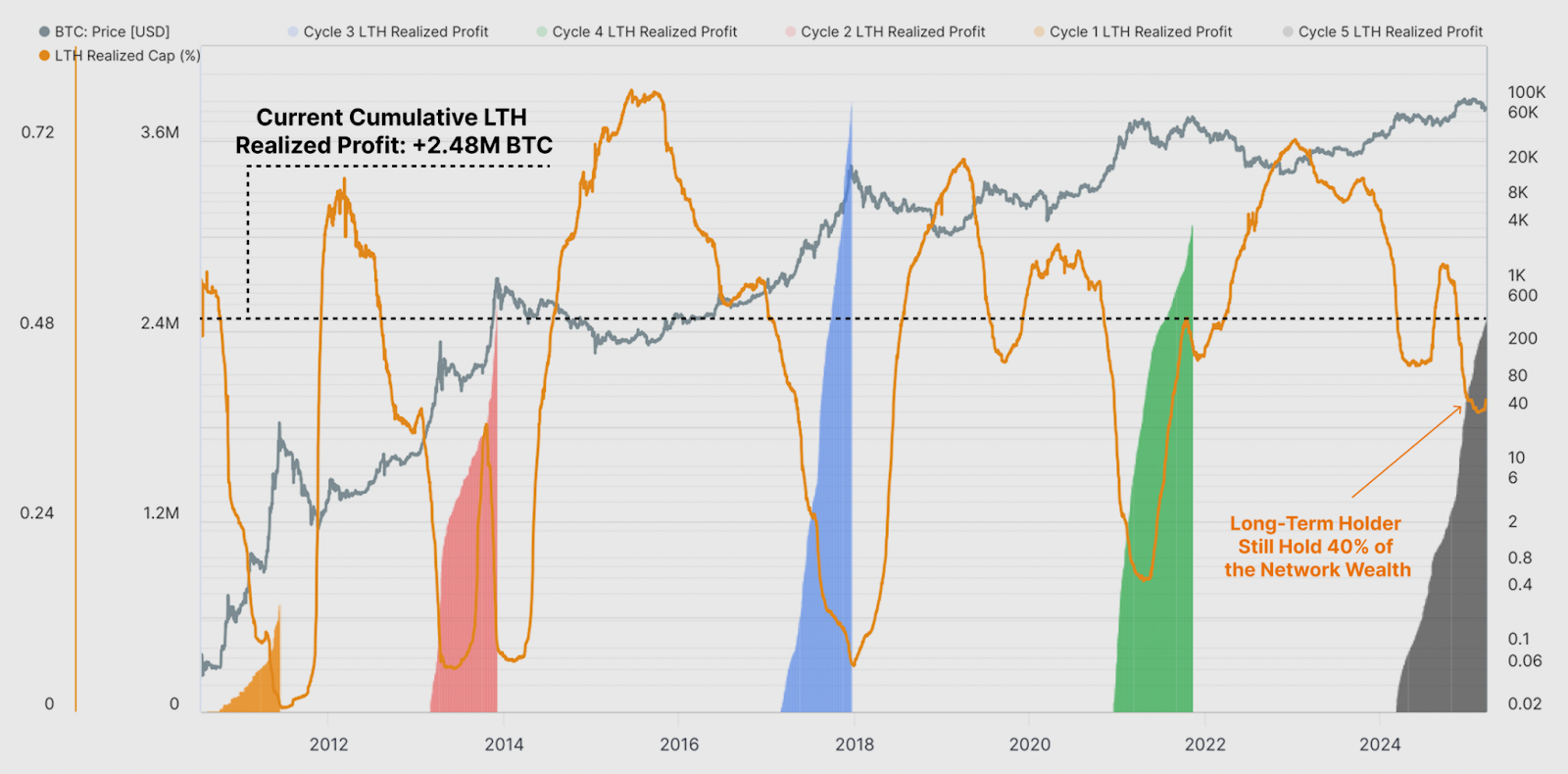

Yet, even with Bitcoin’s recent downturn, this segment of investors continues to retain a significant portion of their profits, particularly noteworthy for this later phase of the market cycle. This could imply that long-term holders are still anticipating further price increases for BTC in the coming months.

“This intriguing observation may signal a more unique market dynamic ahead.”

Bitcoin: Cumulative LTH realized profit.

New Bitcoin Whales Reshape the Market

Emerging Bitcoin whales, defined as addresses holding at least 1,000 BTC with an average acquisition age of less than six months, are actively accumulating, according to recent data.

This indicates strong confidence in Bitcoin’s long-term potential among these new large investors.

These wallets have collectively secured over 1 million BTC since November 2024, “marking them as some of the most influential players in the market,” an independent analyst commented in a recent report.

The chart illustrates that their accumulation pace has intensified in recent weeks, having acquired over 200,000 BTC this month alone.

“This continued inflow signifies a shift in market conditions, suggesting rising participation from institutions or high-net-worth individuals.”

Bitcoin supply held by new whales.

Meanwhile, several crypto executives shared that Bitcoin’s recent price drop is simply a “normal correction,” with the market currently awaiting a fresh narrative and an impending cycle peak.

However, not everyone shares this view. For instance, the founder and CEO of CryptoQuant remarked that the Bitcoin bull cycle has come to an end, forecasting:

“Anticipate 6 to 12 months of bearish or sideways price movement.”

This article is not intended as investment advice. All investments and trading strategies carry risks, and readers should conduct their own research before making any decisions.