- Bitcoin is trading above $81,000 as on-chain metrics and futures market data indicate a reduction in liquidity.

- Short-term holders are facing $7 billion in ongoing losses, representing the longest period of sustained losses in this cycle.

- Long-term holders are maintaining profitable positions despite price drops, suggesting the market hasn’t transitioned into a bearish phase.

On Wednesday, Bitcoin (BTC) was trading above $81,000, with insights from a recent report highlighting diminishing on-chain liquidity and futures open interest. The findings suggest that the present market dip might not signal a shift towards bearish conditions, as long-term holders (LTHs) have not yet liquidated a significant portion of their profits.

Declining Bitcoin futures and on-chain liquidity amid long-term holders’ strength

Bitcoin remains within the $80,000 to $83,000 range, a 25% decrease from its record peak of $109,114.

The current delay in Bitcoin’s recovery can be attributed to a deficiency in capital inflows to bolster prices. Additionally, there has been a substantial contraction in Bitcoin’s liquidity, resulting in heightened price volatility.

Recent data indicated that Bitcoin’s Hot Supply volume — the quantity of BTC that is less than a week old — has more than halved, reflecting a waning interest in trading among investors. Similarly, there has been a downturn in futures trading activity, with open interest dropping by 35% in recent months.

Open interest denotes the total number of open contracts within the derivatives market.

The report also pointed out a notable decline in Bitcoin inflows to exchanges, which act as key centers for trading activity. During Bitcoin’s peak market performance, inflows reached over 58.6K BTC daily, but this number has since decreased to around 26.9K BTC daily, marking a decline of over 54%.

This downturn highlights increased pressure on short-term holders, contributing significantly to the recent market contraction.

“An examination of the rolling 30-day total of Short-Term Holder losses shows that a substantial segment of new investors has capitulated under severe drawdown pressure,” the report noted.

BTC short-term holder rolling 30-day realized loss.

The short-term holder segment has incurred $7 billion in prolonged losses during this cycle, marking the longest period of loss-taking seen in this timeframe.

However, compared to sell-offs in earlier cycles, these short-term holder losses have not significantly influenced the broader market.

“The magnitude of unrealized losses is also considerably less intense than those faced during the May 2021 drop and the 2022 bear market,” the report added.

Conversely, long-term holders continue to exhibit indications of bullish sentiment. Despite recent market corrections, this group has demonstrated a strong inclination to retain their profits.

The report suggested that this behavior may reflect a slight change in sentiment, indicating that the market has yet to enter a bearish phase.

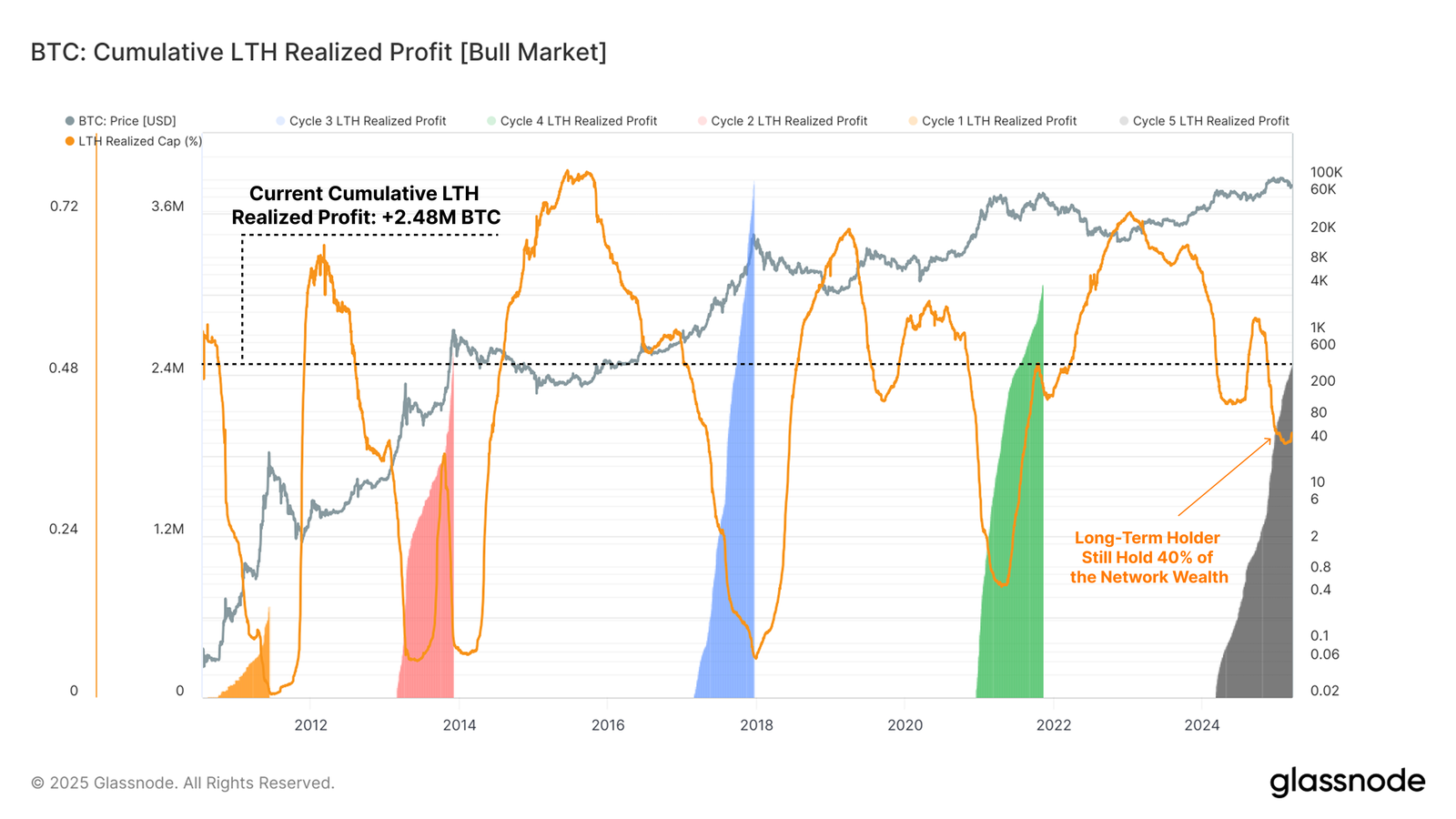

BTC cumulative LTH realized profit (bull market).

Bull markets are typically characterized by pronounced profit-taking among long-term holders, signaling a definitive shift towards bearish behavior. Nevertheless, despite Bitcoin’s fluctuations in recent weeks, long-term holders have continued to retain a significant share of their profits.

This suggests that these holders may still be anticipating another price rally later in the year.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the most prominent cryptocurrency, designed to act as digital money. It operates without the control of a single entity, which means transactions do not require third-party involvement.

Altcoins refer to any cryptocurrencies other than Bitcoin, although some consider Ethereum a separate category. Litecoin, as a fork of Bitcoin, is often regarded as the first altcoin and an “enhanced” version of Bitcoin.

Stablecoins are cryptocurrencies intended to maintain a stable value, typically backed by a reserve of the underlying asset. Their value is often pegged to a commodity or financial instrument, such as the US Dollar (USD), with supply managed by algorithms or demand. The primary aim of stablecoins is to offer a secure gateway for investors looking to trade and invest in cryptocurrencies, while also allowing for value storage given the general volatility of cryptocurrencies.

Bitcoin dominance represents the ratio of Bitcoin’s market capitalization relative to the combined market capitalization of all cryptocurrencies. This metric provides insight into Bitcoin’s appeal among investors. A high BTC dominance is often seen leading up to and during bull markets, as investors tend to allocate funds to stable, high-cap cryptocurrencies like Bitcoin. Conversely, a decrease in BTC dominance usually indicates that investors are diversifying into altcoins in search of greater returns, often prompting significant rallies in the altcoin market.