Bitcoin (BTC) surpassed $84,000 as markets prepared for the March 19 Wall Street opening, with attention on the US Federal Reserve’s interest-rate announcement.

BTC/USD 1-hour chart. Image from TradingView

Bitcoin and Risk Assets Lack Support Ahead of FOMC Meeting

According to market data, Bitcoin reached local highs of $84,358 on Bitstamp.

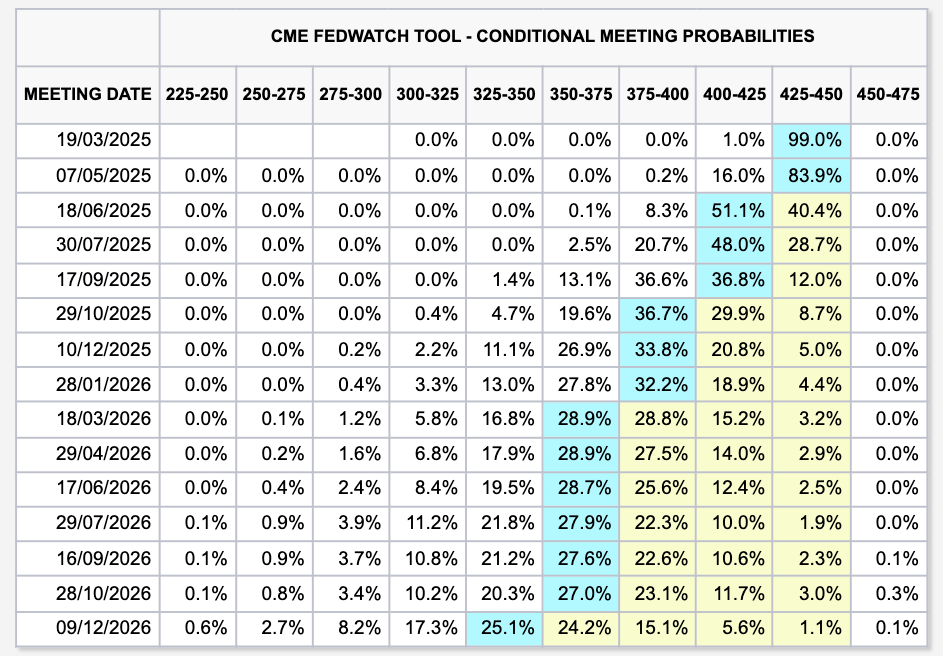

Risk assets were cautious ahead of the Federal Open Market Committee (FOMC) meeting, with the Fed widely anticipated to maintain current rates at least until June, based on CME Group’s FedWatch Tool.

Fed target rate probabilities (screenshot). Image from CME Group

Traders were particularly focused on how Fed Chair Jerome Powell would communicate, given his already hawkish stance. Powell also faces challenges from US trade tariffs as inflation rates are just starting to decrease.

“Tonight’s FOMC meeting is very likely to keep rates steady, but we will monitor for any dovish signals, especially regarding growth and inflation forecasts,” noted a trading firm in their latest update to subscribers.

“Since it will take a while for tariff effects to impact the economy, we expect the Fed to adopt a ‘wait-and-see’ approach. The April 2 tariff decision, while anticipated, stays a significant uncertainty.”

Bitcoin managed to hold above $80,000 during the week, but its stability appeared precarious amidst a downturn in US stocks.

At the time of writing, the S&P 500 and Nasdaq Composite Index had declined by 4% and 8.7% year-to-date, respectively, juxtaposed against Bitcoin’s 10% gain.

“Bitcoin has found some support at the $80k level, but this seems fragile in light of the broader market weaknesses,” the trading firm added.

“While we won’t pinpoint the exact moment when the market pivots, we find it challenging to see any significant positive momentum to counter this downturn.”

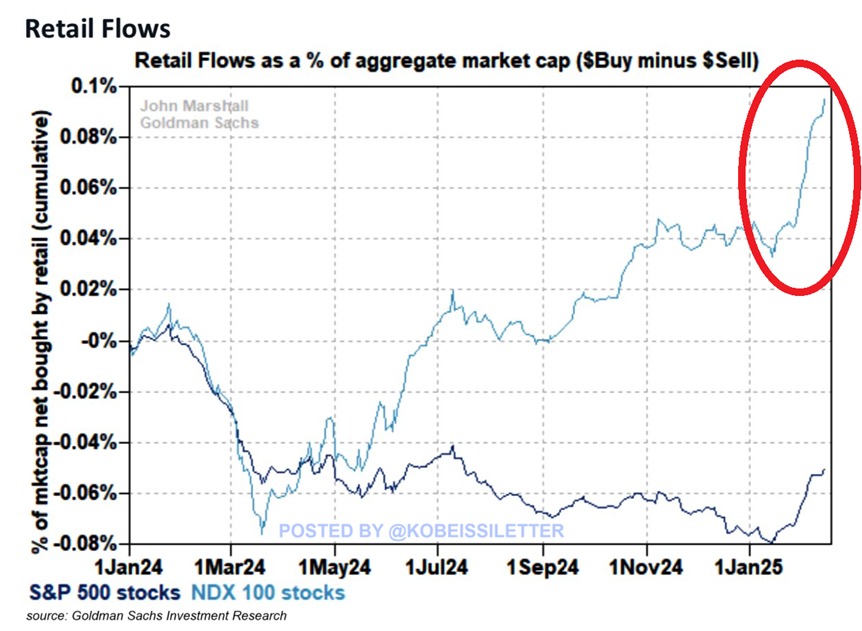

A trading resource suggested a possible positive note in the rising equity allocations by US retail investors.

“Retail net inflows into Nasdaq 100 index stocks, as a percentage of market capitalization, have hit 0.1%, the highest level in over a year. Retail flows have DOUBLED in the past few weeks,” they reported in a social media post.

“Furthermore, JPMorgan’s retail investor sentiment score has reached a record high of 4 points, surpassing the peak during the meme stock craze of 2021. Tesla and Nvidia were among the most favored picks by retail investors, showing they are fully engaged.”

US stocks retail flows data. Image from a trading resource

Negative FOMC Outcome Could Trigger $76,000 BTC Drop

Related: Bitcoin futures ‘deleveraging’ erases $10B in open interest over two weeks

Such gaps have historically served as short-term price attractors.

“Bitcoin continues to effectively retest the CME Gap as support (orange box, $78k-$80.7k),” the trader explained with accompanying visuals.

“Moreover, BTC has been achieving this at a higher low (black).”

CME Bitcoin futures 1-day chart. Image from a trading source

Meanwhile, a co-founder of another trading resource indicated that a dovish stance from Powell could significantly influence price trends.

“A softer tone that lessens recession fears could propel Bitcoin prices above the 200-Day and 21-Day moving averages, potentially avoiding what looked like an inevitable death cross between these key averages,” he stated in a social media post.

He highlighted two relevant moving averages, which are noted at $84,995 and $84,350 for the 200-day and 21-day, respectively.

BTC/USD 1-day chart with 21 and 200 MA. Image from a trading source

On the flip side, adverse news could lead to a revisit of the multi-month lows around $76,000, he cautioned.

This article does not constitute investment advice or recommendations. Every investment and trading decision carries risk, and readers should conduct their own research prior to making any investments.