The price of Bitcoin (BTC) shifted into a bullish trend on March 19 as market participants grew increasingly eager for the release of the Federal Open Market Committee (FOMC) minutes and the press conference led by the Federal Reserve Chair.

BTC/USDT 1-day chart. Image Source: TradingView

Traders typically scrutinize the FOMC minutes and Powell’s remarks to gain direct insights into the Fed’s perspective on the US economy, as well as their strategies regarding monetary policy and interest rates.

During the press briefing, Powell affirmed that the Fed plans to maintain interest rates in their target range of 4.25% to 4.5%, where they have remained since December 2024.

While the Fed lowered its economic growth forecast and highlighted that controlling inflation is a persistent challenge, their statements generally correlated with the expectations of market participants.

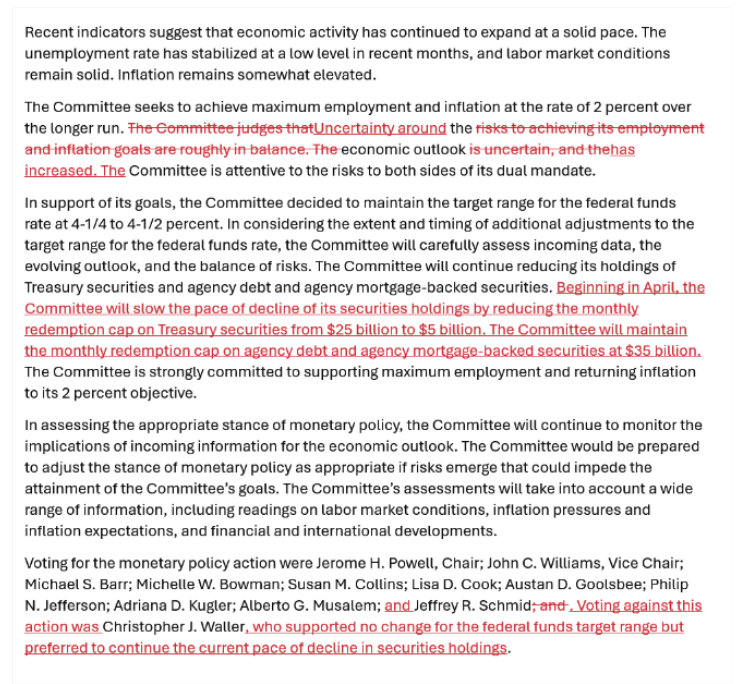

Both crypto and equity traders had also anticipated a reduction in the Fed’s quantitative tightening (QT) measures, and the FOMC minutes confirmed that the central bank will lower the “monthly redemption cap on Treasury securities from $25 billion to $5 billion.”

Updates to the FOMC statement (highlighted in red). Image Source: FederalReserve.gov

Related: The volatility of Bitcoin’s price tends to increase around FOMC meetings — Will this instance differ?

In the wake of the Fed’s comments, Bitcoin prices continued to rise, reaching an intraday peak of $85,950 as of this writing.

The DOW experienced a gain of 400 points, while the S&P 500 index climbed by 77. Powell and the Fed’s assurance of two more rate cuts in 2025 aligns with the expectations of crypto traders and could further support Bitcoin’s current recovery.

This article does not provide investment advice or recommendations. Investing and trading carry risks, and readers should perform their own research before making decisions.