The price of Cardano (ADA) has seen a consistent increase of 13.5% in March, recovering from a significant 32% decline in February. Although the altcoin is still down 15% for the first quarter, technical indicators suggest that the recent positive price momentum may continue.

Cardano 1-day chart. Source: TradingView

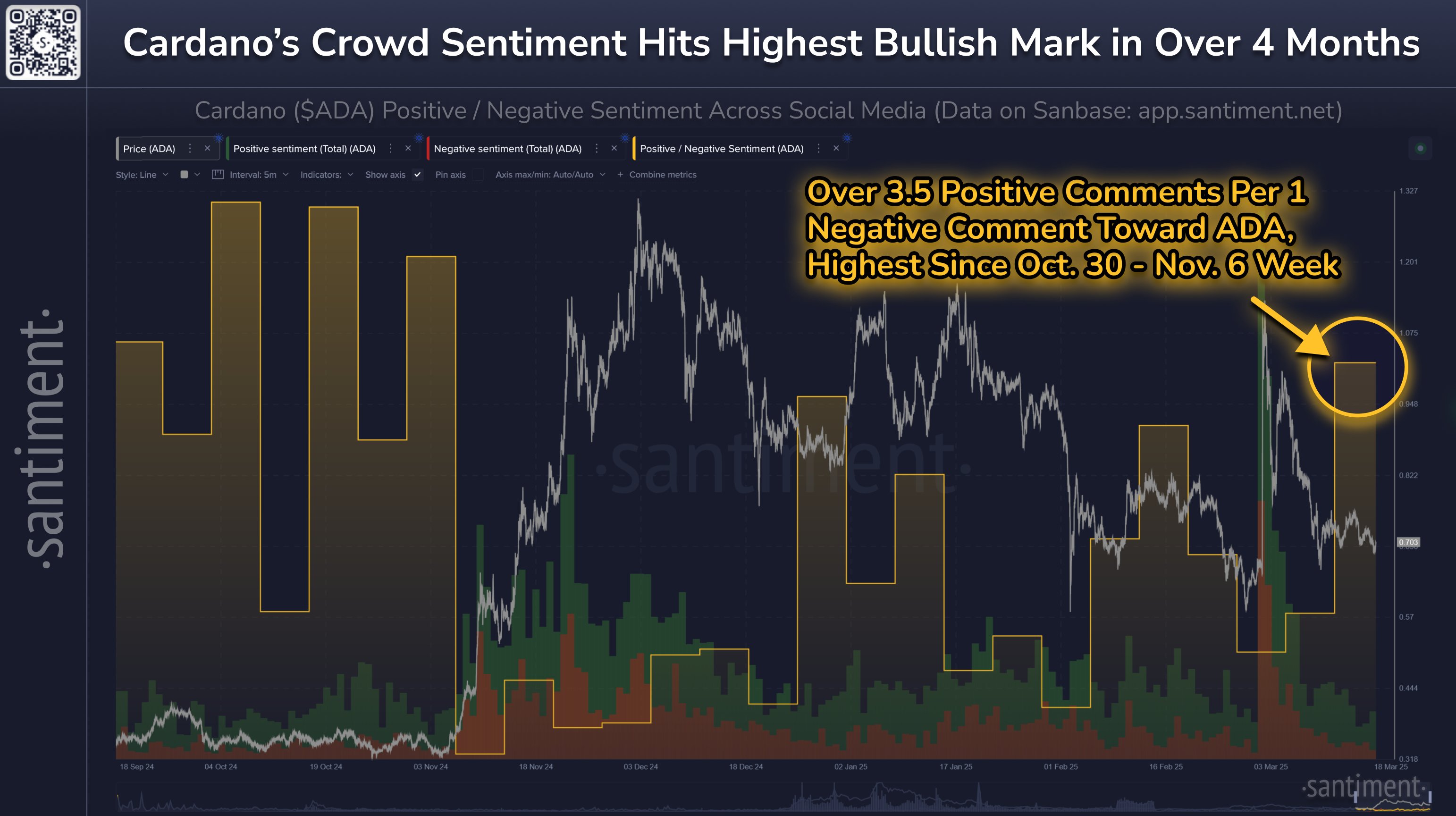

Over the past ten days, ADA has been trading within a range of $0.70 to $0.78, yet social sentiment surrounding the altcoin has reached a year-to-date high.

Surge in Cardano’s “bullish” sentiment to a four-month peak

An on-chain intelligence platform indicates that Cardano’s social sentiment has shown its most favorable reading in the last four months.

Investors in ADA were encouraged by recent comments from the US Securities and Exchange Commission (SEC), which described Cardano’s use case as “smart contracts for government services.” Following this statement, ADA saw its highest volume of positive comments since the first week of November 2024.

Cardano’s crowd sentiment score. Source: X.com

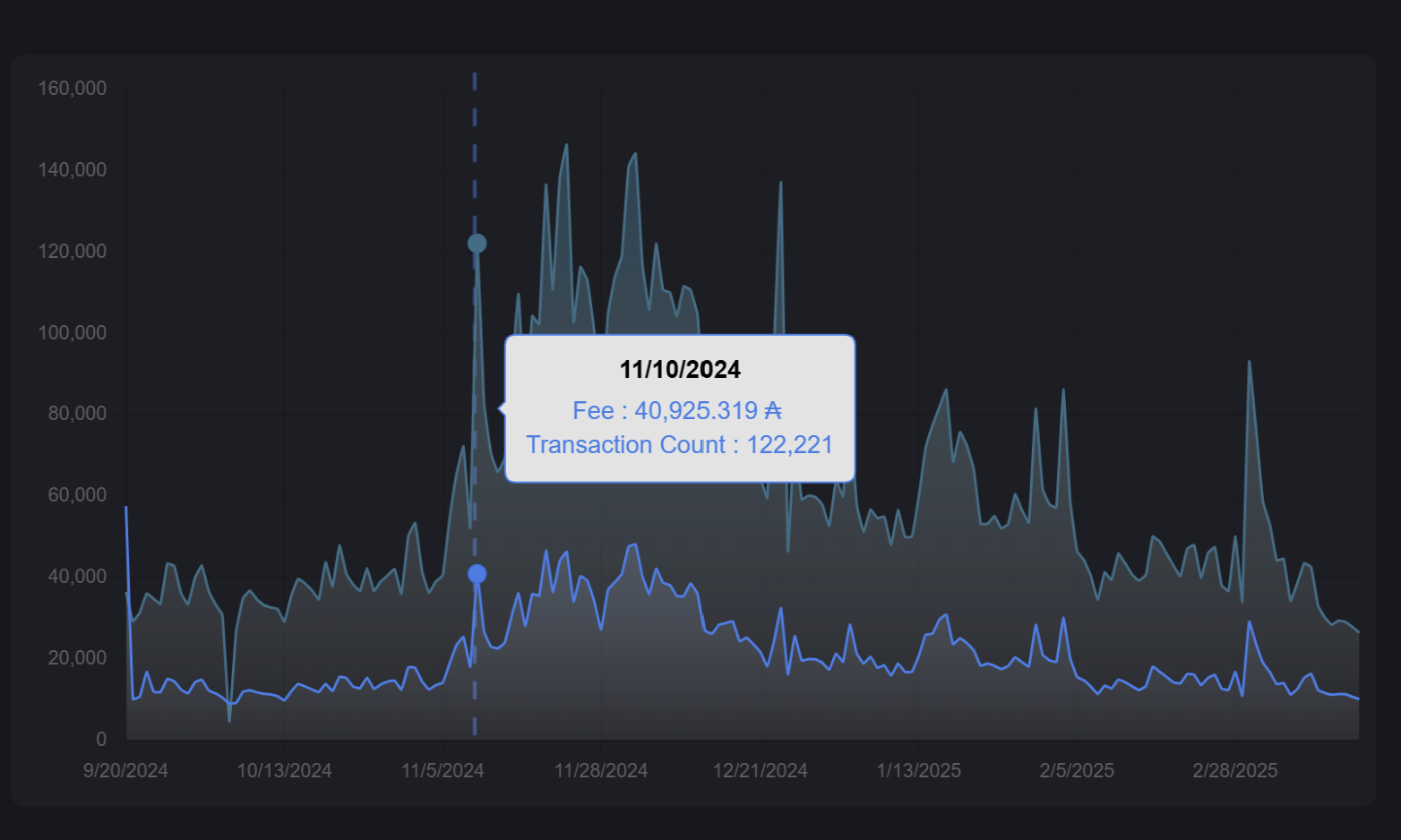

A rise in social sentiment often correlates with increased trading activity and, at times, climbing prices. In Q4 of 2024, a boost in positive social sentiment coincided with increased active transactions for ADA. However, the current situation is somewhat different.

Data from a blockchain analytics platform reveals a significant discrepancy in active transaction counts from early November 2024 compared to now. During the fourth quarter, the average number of daily transactions stayed above 100,000 for most of November and December, but has since dropped around 70%, with just 26,437 transactions recorded on March 18.

Daily transaction count and fee chart. Source: cardanoscan.io

Despite the lack of robust on-chain activity, the CEO of 0G Labs suggested that Cardano’s strength lies in its community engagement. Speaking about ADA and XRP’s inclusion in a US Digital Asset Stockpile, he remarked,

“These tokens have been around for a long time, they’re liquid, and they are not likely to deliver any sudden surprises.”

Related: Cardano’s ADA secures position in the US Digital Asset Stockpile — Will it create value?

Will ADA rally by 20% before March ends?

Regardless of the lackluster on-chain metrics, ADA has historically reacted favorably to positive developments.

The altcoin has remained above the 0.50 Fibonacci retracement line, even as it has experienced a decline since reaching its peak of $1.32 in 2024. This suggests that ADA is still on a technical uptrend on higher time frames.

ADA/USDT 1-day chart. Source: TradingView

Cardano continues to find support from the upward trendline while trading within its range. The immediate resistance is at the upper end of this channel, around $0.78, coinciding with the 200-day exponential moving average (200-DEMA). A daily close above the 200-DEMA may signal a bullish shift that could push the price above $0.78.

The next target above $0.78 is between $0.84 and $0.88, where a daily fair value gap is present. A retest of the $0.88 mark would yield a 20% gain from the current price.

However, historically, Cardano has demonstrated extended periods of sideways movement, which may limit short-term profits. A breakthrough above $0.78 would serve as further confirmation for a rally, but absent that, the altcoin might continue to trade within the $0.70 to $0.78 range.

Related: Analysts predict Bitcoin is experiencing a ‘normal correction’; cycle peak still ahead

This article does not constitute investment advice or recommendations. All investments and trading carry risks, and readers should conduct their own research prior to making decisions.