By Francisco Rodrigues (All times ET unless specified)

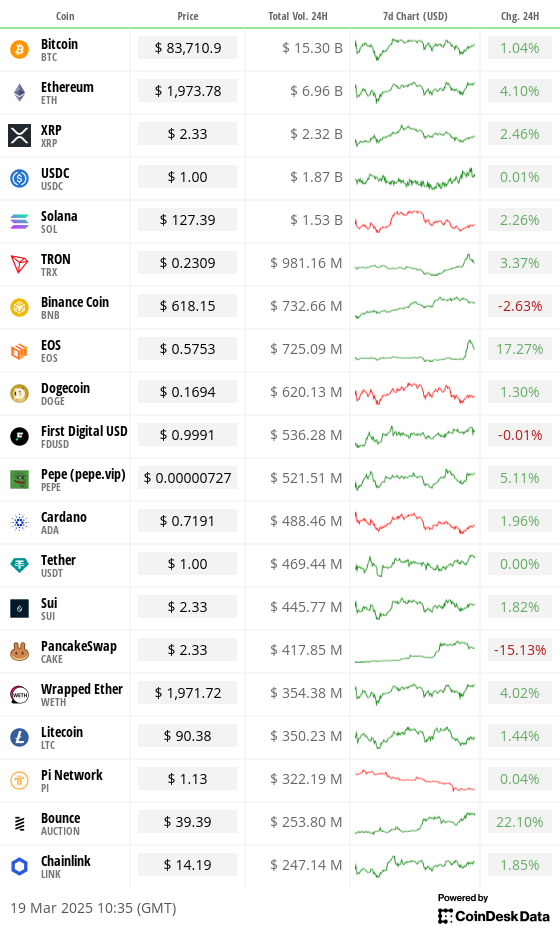

Cryptocurrency values are experiencing a minor rebound following Tuesday’s downturn, with bitcoin (BTC) rising 0.5% and the wider CoinDesk 20 Index (CD20) increasing by 0.8% over the past day.

This recent decline occurred ahead of the Federal Reserve’s policy announcement set for later today. Interest rates are expected to stay steady at 4.25%-4.5%, leading investors to concentrate on the macroeconomic outlook, particularly regarding a possible cessation of quantitative tightening (QT).

Since the middle of 2022, the Fed has been gradually reducing its balance sheet, which had inflated to $9 trillion to bolster the economy during the pandemic. An earlier-than-anticipated conclusion to QT, which has cut the Fed’s balance sheet down to $6.7 trillion, might positively affect risk assets like bitcoin.

A halt to QT would stop the Fed from contracting liquidity in the market, potentially weakening the dollar and enhancing the appeal of crypto assets. Traders on the prediction market Polymarket are almost certain that an end to QT will be declared before May.

Additional support for risk assets came from the Bank of Japan (BOJ), which maintained its benchmark interest rate despite rising inflation in the nation. This choice keeps Japanese bond yields stable, making these assets less attractive and drawing less capital to traditional markets. Nevertheless, bitcoin did not react to this news.

Bitcoin’s status as a potential store of value is gaining more acknowledgment. The amount of public firms buying bitcoin has more than doubled to 80 from 33 in just two years, based on data from River. The largest corporate BTC holder, Strategy, even revealed intentions to issue $500 million in preferred stock to acquire more bitcoin.

However, increasing threats of tariffs have rekindled inflationary concerns as economic growth stagnates. This could lead to stagflation, a scenario that would likely not sit well with market participants. Remain vigilant!

What to Monitor

Crypto:

March 20: Pascal hard fork network upgrade launches on the BNB Smart Chain (BSC) mainnet.

March 21, 1:00 p.m.: The SEC’s Crypto Task Force will hold a roundtable, open to the public, to discuss the definition of a security.

March 24 (before market opening): Bitcoin miner CleanSpark (CLSK) is set to join the S&P SmallCap 600 index.

March 24, 11:00 a.m.: Bugis network upgrade goes live on the Enjin Matrixchain mainnet.

March 25: The Mimir upgrade is set to go live on Chromia (CHR) mainnet.

Macro

March 19, 2:00 p.m.: The Federal Reserve will announce its interest-rate decision. The FOMC press conference is expected to be live-streamed 30 minutes later.

Fed Funds Interest Rate Est. 4.5% vs. Prev. 4.5%

March 19, 3:00 p.m.: Argentina’s National Institute of Statistics and Census will publish GDP data.

Full Year GDP Growth (2024) Prev. -1.6%

GDP Growth Rate QoQ (Q4) Prev. 3.9%

GDP Growth Rate YoY(Q4) Est. 1.7% vs. Prev. -2.1%

March 19, 5:30 p.m.: The Central Bank of Brazil will announce its interest-rate decision.

Selic Rate Est. 14.25% vs. Prev. 13.25%

March 20, 3:00 a.m.: The U.K.’s Office for National Statistics will release January employment data.

Unemployment Rate Est. 4.4% vs. Prev. 4.4%

March 20, 8:00 a.m.: The Bank of England will announce its interest-rate decision.

Bank Rate Est. 4.5% vs. Prev. 4.5%

March 20, 8:30 a.m.: The U.S. Department of Labor will issue employment data for the week ending March 15.

Initial Jobless Claims Est. 224K vs. Prev. 220K

Continuing Jobless Claims Est. 1890K vs. Prev. 1870K

March 20, 3:00 p.m.: Argentina’s National Institute of Statistics and Census will release Q4 employment data.

Unemployment Rate Prev. 6.9%

March 20, 7:30 p.m.: Japan’s Ministry of Internal Affairs & Communications will release February consumer price index (CPI) data.

Core Inflation Rate YoY Est. 2.9% vs. Prev. 3.2%

Inflation Rate MoM Prev. 0.5%

Inflation Rate YoY Prev. 4%

Earnings (Estimates based on FactSet data)

March 27: KULR Technology Group (KULR), post-market, $-0.02

March 28: Galaxy Digital Holdings (GLXY), pre-market, C$0.38

Token Events

Governance votes & proposals

Arbitrum DAO is voting on registering the “Sky Custom Gateway contracts” in the “Router contracts” to allow users to bridge USDS and sUSDS via the official Arbitrum Bridge UI.

Frax DAO is voting on introducing the WisdomTree Government Money Market Digital Fund (WTGXX) as a reserve for Frax USD on-chain.

March 21, 11:30 a.m.: Flare will host an X Spaces session about Flare 2.0.

Unlocks

March 21: Immutable (IMX) will unlock 1.39% of its circulating supply, valued at $14.16 million.

March 23: Metars Genesis (MRS) will unlock 11.87% of its circulating supply, worth $146.8 million.

March 31: Optimism (OP) will unlock 1.93% of its circulating supply, valued at $28.22 million.

April 1: Sui (SUI) will unlock 2.03% of its circulating supply, worth $150.22 million.

April 3: Wormhole (W) will unlock 47.7% of its circulating supply, valued at $118.05 million.

April 7: Kaspa (KAS) will unlock 0.59% of its circulating supply, valued at $12.3 million.

Token Listings

March 19: Hamster Kombat (HMSTR) and DuckChain (DUCK) are set to be listed on Kraken.

March 31: Binance will delist USDT, FDUSD, TUSD, USDP, DAI, AEUR, UST, USTC, and PAXG.

Conferences

Consensus is scheduled for Toronto on May 14-16. Use code DAYBOOK for 15% off passes.

Day 2 of 3: Digital Asset Summit 2025 (New York)

Day 2 of 3: Fintech Americas Miami 2025

Day 1 of 2: Next Block Expo (Warsaw)

March 24-26: Merge Buenos Aires

March 25-26: PAY360 2025 (London)

March 25-27: Mining Disrupt (Fort Lauderdale, Fla.)

March 26: Crypto Assets Conference (Frankfurt)

March 26: DC Blockchain Summit 2025 (Washington)

March 26-28: Real World Crypto Symposium 2025 (Sofia, Bulgaria)

March 27: Building Blocks (Tel Aviv)

March 27: Digital Euro Conference 2025 (Frankfurt)

March 27: WIKI Finance EXPO Hong Kong 2025

March 27-28: Money Motion 2025 (Zagreb, Croatia)

March 28: Solana APEX (Cape Town)

April 2-3: Southeast Asia Blockchain Week 2025 Main Conference (Bangkok)

April 3-6: BitBlockBoom (Dallas)

April 6-9: Hong Kong Web3 Festival

April 8-10: Paris Blockchain Week

April 15-16: BUIDL Asia 2025 (Seoul)

Token Update

By Shaurya Malwa

In a notable development, over 590 new tokens were launched on the Tron blockchain-based SunPump today, marking the highest issuance in four months and prompting Tron founder Justin Sun to declare “tron meme szn” on X.

Sun later added that trading fees will be “subsidized,” ensuring that every memecoin would be “reintroduced” on Tron.

SunPump enables instant trading without the need for initial liquidity seeding, driving excitement reminiscent of past frenzies. It has generated $5.74 million in fees over the past 24 hours, reaching figures not seen since August.

Derivatives Positioning

Open interest (OI) for bitcoin futures on centralized exchanges has surged above $55 billion, reflecting a 32% increase since February 23, while OI for SOL and ETH futures has remained relatively stable. The market clearly favors the leading cryptocurrency.

However, positioning in bitcoin CME futures remains light, close to February’s lows.

NEAR, TON, and TRX are leading the increase in perpetual futures open interest over the past day. NEAR stands out due to a negative cumulative volume delta, indicating net selling.

Deribit-listed bitcoin and Ethereum options continue to show a preference for short and near-dated protective puts.

Market Updates:

BTC has risen 1.84% from 4 p.m. ET Tuesday, currently at $83,576.60 (24hrs: +0.88%)

ETH is up 2.04% at $1,945.99 (24hrs: +2.6%)

CoinDesk 20 is additionally up 2.2% at 2,624.87 (24hrs: +1.6%)

The Ether CESR Composite Staking Rate remains steady at 2.96%

BTC funding rate is at 0.0071% (7.74% annualized) on Binance

DXY is down 0.32% at 103.57

Gold remains unchanged at $3,030.30/oz

Silver is down 1.24% at $33.70/oz

Nikkei 225 closed -0.25% at 37,751.88

Hang Seng closed +0.12% at 24,771.14

FTSE is down 0.15% at 8,691.31

Euro Stoxx 50 is up 0.15% at 5,493.38

DJIA closed on Tuesday +0.62% at 41,581.31

S&P 500 closed -1.07% at 5,614.66

Nasdaq closed -1.71% at 17,504.12

S&P/TSX Composite Index closed -0.32% at 24,706.07

S&P 40 Latin America remained unchanged at 2,476.87

The U.S. 10-year Treasury rate is steady at 4.29%

E-mini S&P 500 futures are up 0.23% at 5,682.25

E-mini Nasdaq-100 futures are up 0.32% at 19,764.25

E-mini Dow Jones Industrial Average Index futures are up 0.16% at 42,004.00

Bitcoin Metrics:

BTC Dominance: 61.62 (0.27%)

Ethereum to bitcoin ratio: 0.02329 (-0.30%)

Hashrate (seven-day moving average): 773 EH/s

Hashprice (spot): $47.30

Total Fees: 5.13 BTC / $428,677

CME Futures Open Interest: 154,060 BTC

BTC priced in gold: 27.2 oz

BTC vs gold market cap: 7.71%

Technical Overview

BTC’s recent rise toward the 200-day simple moving average (SMA) coincides with a downward trend in daily trading volumes.

This discrepancy casts doubt on the durability of the upswing.

Moreover, the 50-day SMA has crossed below the 100-day SMA, a bearish indicator suggesting that the easiest path may be downward.

Crypto Stocks

Strategy (MSTR): closed on Tuesday at $283.19 (-3.77%), up 1.95% at $288.47 in pre-market trading

Coinbase Global (COIN): closed at $181.14 (-4.14%), up 1.36% at $183.60

Galaxy Digital Holdings (GLXY): closed at C$17.09 (-1.5%)

MARA Holdings (MARA): closed at $12.07 (-6.94%), up 1.74% at $12.28

Riot Platforms (RIOT): closed at $7.40 (-4.64%), up 1.22% at $7.49

Core Scientific (CORZ): closed at $8.02 (-8.45%)

CleanSpark (CLSK): closed at $7.59 (-6.53%), up 1.98% at $7.74

CoinShares Valkyrie Bitcoin Miners ETF (WGMI): closed at $14.25 (-7.29%)

Semler Scientific (SMLR): closed at $35.49 (-1.5%), up 9.33% at $38.80

Exodus Movement (EXOD): closed at $30.26 (-6.46%)

ETF Flows

Spot BTC ETFs:

Daily net flow: $209.1 million

Cumulative net flows: $35.87 billion

Total BTC holdings approximately 1,116 million.

Spot ETH ETFs

Daily net flow: -$52.8 million

Cumulative net flows: $2.47 billion

Total ETH holdings approximately 3.472 million.

Overnight Movements

Chart of the Day

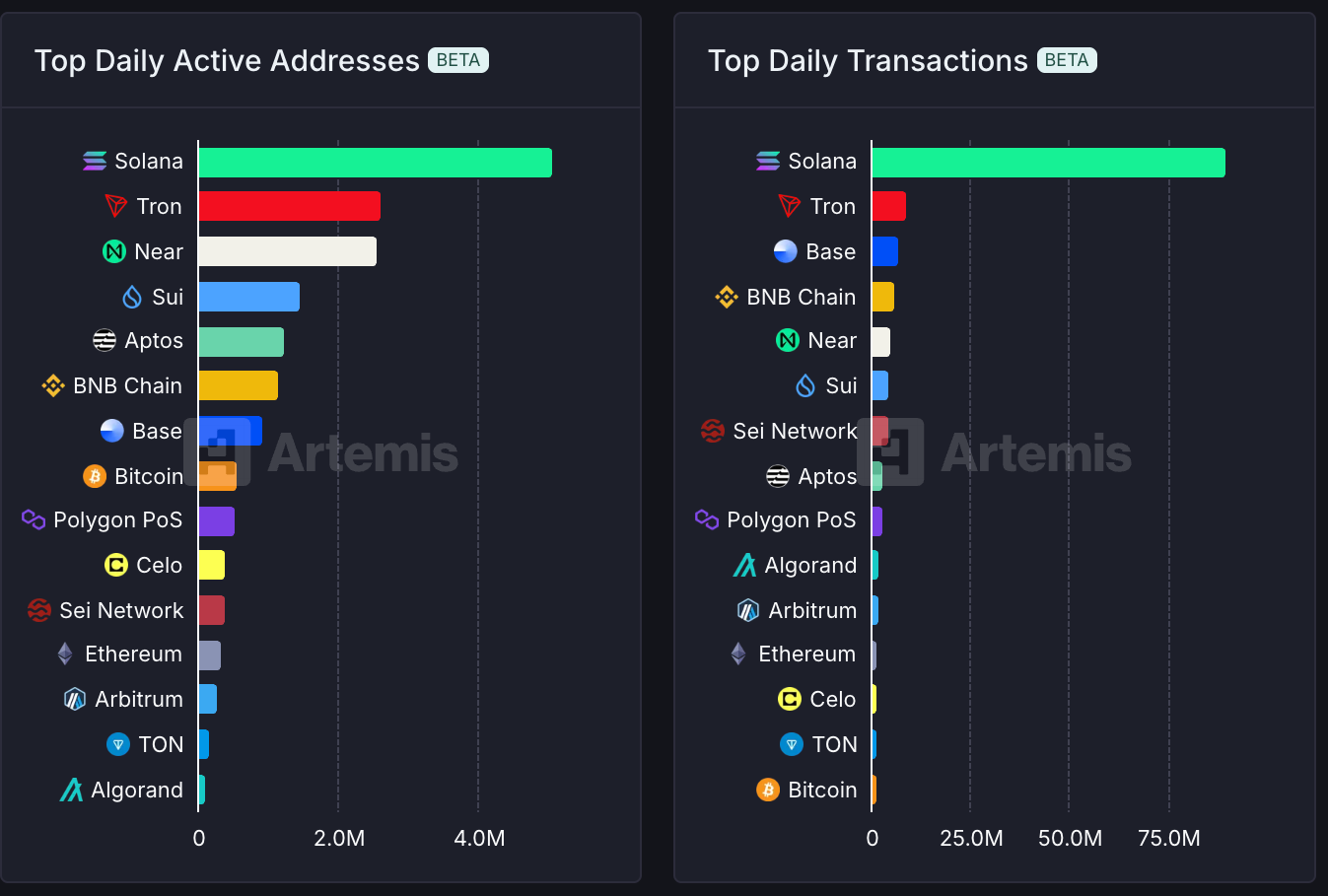

Programmable blockchain Solana leads other platforms with the highest number of daily active addresses and transactions, despite a recent lull in memecoin trading.

This data strengthens the argument for the bullish potential of the blockchain’s SOL token relative to the native coins of other smart-contract platforms.

While You Were Sleeping

Investors Allocate $22B Into Short-Term U.S. Debt Amid Market ‘Storm’: Investors, concerned about Donald Trump’s economic policies, have shifted to safe assets, with short-term Treasury funds registering $21.7 billion in net inflows from early January to March 14.

BOJ Maintains Interest Rates, Cautions on Trump Tariff Dangers: The central bank opted to keep its benchmark rate at 0.5%, as anticipated. Governor Kazuo Ueda suggested that future rate decisions may reflect the implications of U.S. tariffs.

Drone Attack Ignites Russian Oil Depot Close to Damaged CPC Link: Despite discussions between Donald Trump and Vladimir Putin regarding a ceasefire on energy infrastructure attacks, a key Russian oil depot was hit by a Ukrainian drone early Wednesday.

Raydium’s RAY Jumps 13% as DEX Introduces Own Token Issuance Platform: The decentralized exchange powered by Solana, Raydium, is allegedly planning to unveil a platform named LaunchLab to foster revenue growth and broaden its user base.

Untangled Finance Integrates Moody’s Credit Scores On-Chain: This proof of concept, utilizing Polygon’s Amoy testnet, employs zero-knowledge proof technology to secure publication, updates, and withdrawals of credit ratings on-chain, safeguarding proprietary information.

North Dakota Senate Passes Bill for Crypto ATM Licensing: House Bill 1447 mandates crypto ATM operators to provide fraud warnings, acquire money transmitter licenses, deploy blockchain analytics for fraud detection, file quarterly reports, and appoint a compliance officer.

In the Ether