- Cryptocurrency market cap jumps by 4%, adding over $50 billion and reaching $2.8 trillion on Wednesday.

- Bitcoin’s price peaked at $84,900 as the market rallied in anticipation of the US Federal Reserve’s decision to pause interest rates.

- The SEC concludes its protracted lawsuit against Ripple, lifting XRP’s price above $2.59 for the first time in two weeks.

Bitcoin Market Insights:

- On Wednesday, Bitcoin’s price increased by 4%, hovering near the 24-hour high of $84,800 at the time.

Bitcoin Liquidation Map, March 19 | Coinglass

The BTC price is having difficulty surpassing the $85,000 mark as short traders make final efforts to prevent cascading liquidations on $697 million in leveraged short positions concentrated around this threshold.

- Bitcoin ETFs experienced $209 million in inflows on Tuesday.

Bitcoin ETF Flows, March 19, 2025

Since their inception, Bitcoin ETF demand has been a useful indicator for gauging short-term sentiment among institutional Bitcoin investors in the United States.

With $515 million in Bitcoin ETF purchases over three consecutive days of inflows, a US Fed rate pause in line with market expectations could enhance BTC inflows from corporate investors in the upcoming sessions.

Altcoin Market Insights: XRP Fuels Altcoin Rally as SEC Lawsuits Conclude

The altcoin market is witnessing a spike in trading activity on Wednesday, despite Bitcoin remaining anchored below $85,000, constrained by cautious short sellers.

The anticipated decision from the US Federal Reserve to keep interest rates steady could provide some modest uplift to the market.

However, the primary driver for the altcoin surge was Ripple CEO Brad Garlinghouse’s announcement in a brief video confirming the SEC’s withdrawal of its lengthy lawsuit against the company.

This announcement generated a surge of bullish sentiment across the altcoin sector, particularly benefiting projects sensitive to regulatory changes and those involved in ETF applications.

Chart of the Day: BNB Trailblazed as Solana and Cardano Join XRP Ascendancy

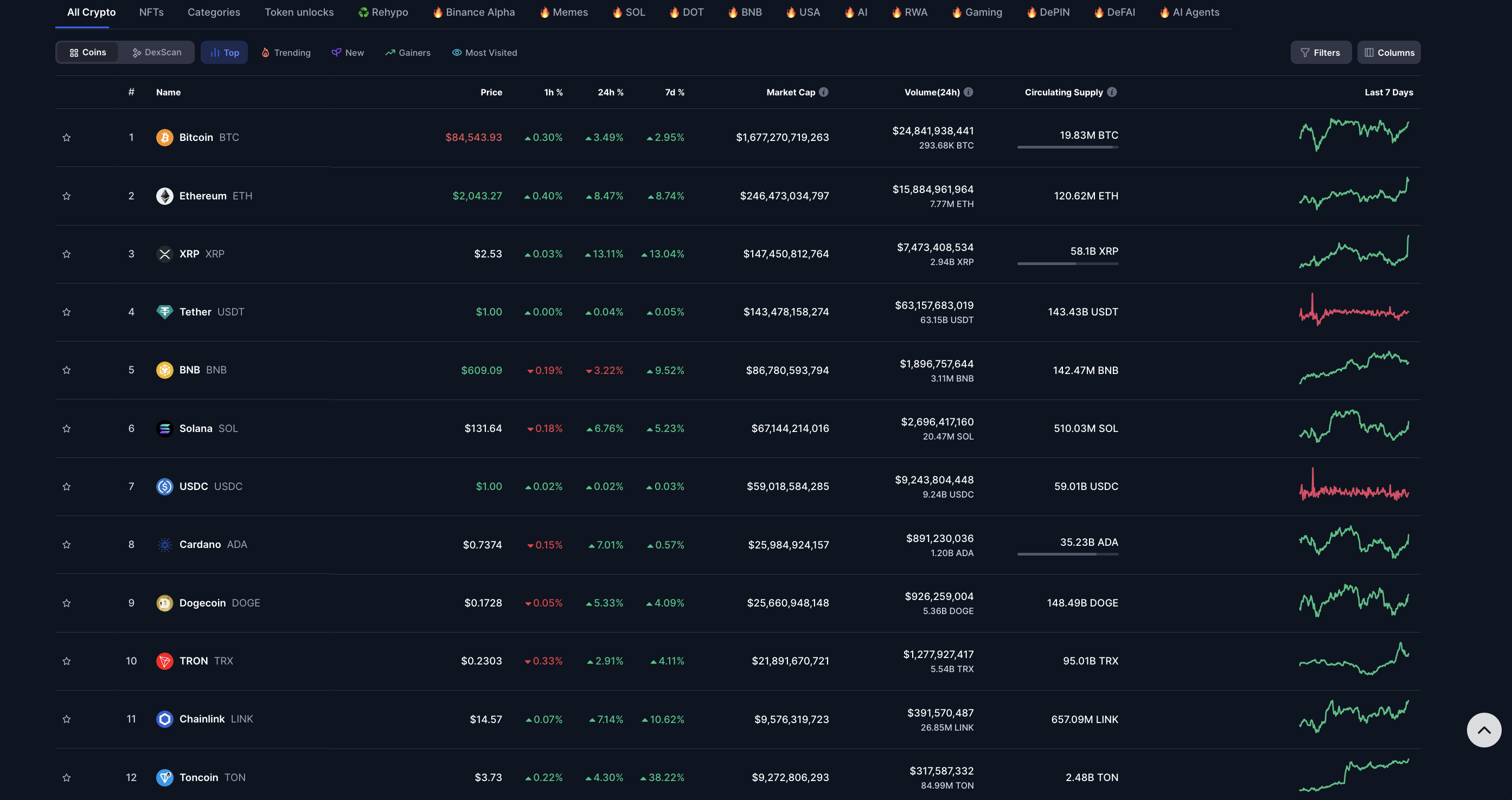

XRP was among the top performers, jumping 13.11% to $2.53, fueled by renewed investor confidence following the resolution of the lawsuit. Toncoin (TON) continued its impressive upswing, soaring 38.22% to $3.73, driven by news that Telegram founder Pavel Durov has returned to Dubai after a recent arrest in France.

Ethereum gained 9%, reclaiming the $2,000 resistance level. Similarly, Cardano (ADA) and Solana (SOL) increased by 5.70% and 6.76%, respectively, as the Ripple lawsuit’s outcome bolstered investor confidence related to the government’s supportive stance towards the cryptocurrency market.

Crypto market performance, March 19, BNB lagging as Solana, Cardano join XRP rally | Coinmarketcap

Chainlink (LINK) surged 7.14% to $14.57, benefiting from renewed activity in the DeFi sector.

In contrast, BNB was the only top-10 cryptocurrency to see a decline, falling 3.22% to $609.09.

A drop in an exchange token like BNB during a broader market upswing typically suggests that the rally is driven by fresh spot purchases, rather than traders merely rotating their positions at high volumes, which generally involves staking exchange tokens for fee reductions.

Crypto News Updates:

-

Filmmaker Charged with Fraud for Misusing $11M from Netflix

US federal prosecutors have charged a filmmaker with fraud and money laundering, alleging he misappropriated $11 million from Netflix that was intended for a sci-fi series production.

Prosecutors assert that instead of using the funds for the project, the filmmaker redirected the money into speculative stock and cryptocurrency trades.

Court documents reveal that he engaged in risky stock investments and crypto trading, using some of his profits to purchase luxury vehicles and high-end items.

The filmmaker, recognized for directing 47 Ronin, now faces several charges of fraud and money laundering, with each count carrying a possible sentence of up to 20 years in prison.

-

North Carolina Proposes $950M Bitcoin Investment via New Legislation

Lawmakers in North Carolina have introduced SB327, a bill that could allow the state to invest up to $950 million from its general fund into Bitcoin (BTC) as part of a long-term financial strategy. The legislation would empower the State Treasurer to allocate up to 10% of public funds to create a Bitcoin Reserve designed for financial innovation.

The bill stipulates that multi-signature cold storage is required for added security and mandates monthly audits of the holdings.

The state may also investigate options such as staking, lending, and Bitcoin mining to increase its reserves.

As outlined in the bill, any liquidation of the fund would necessitate two-thirds approval from both legislative chambers, with permissible uses including responses to financial crises, infrastructure development, and Bitcoin-related research.

-

Crypto.com Faces Criticism Over 70B CRO Re-Issuance Vote

Crypto.com is facing backlash after a contentious governance vote reversed a prior decision to burn 70 billion CRO tokens initially announced in 2021.

Critics argue that the vote, which enabled the re-issuance of these tokens, was manipulated, with some suggesting that Crypto.com controls up to 80% of the voting power on its Cronos blockchain.

CEO Kris Marszalek addressed the exchange’s financial and regulatory position on Wednesday but did not specifically respond to the criticism.

Community members have accused the company of prioritizing profit over decentralization, questioning why it opted to reissue CRO instead of buying back tokens from the market to support investors.

-

Fintech and Crypto Companies Seek Bank Charters Amid Regulatory Changes

According to reports, global fintech and crypto firms are increasingly pursuing state or federal bank charters to expand their operations, reduce borrowing costs, and gain legitimacy.

Industry insiders report a spike in applications, driven by the expectation that the regulatory environment will be more favorable under the current administration.

Legal experts indicate that while applicants are remaining cautious, preparations for charter applications have intensified.

Becoming a banking entity introduces stricter regulatory oversight but also offers advantages like lower capital requirements and access to deposit funding.

Analysts believe that new banking entrants could increase competition or offer niche services that complement the cryptocurrency landscape.