According to former Congressman Wiley Nickel, effective and lasting crypto regulations must be established through an act of Congress. In a recent exclusive video interview, he stressed the importance of bipartisan efforts in creating comprehensive regulations for the crypto space. Nickel expressed:

“It’s crucial for anyone invested in this issue to recognize that if you’re aiming for enduring change in Washington, you need to push legislation through Congress. If you rely solely on executive orders, the situation will just swing back and forth.”

“You certainly don’t want to repeat the confusion we witnessed a few months ago with the SEC’s actions under Gary Gensler — getting legislation through Congress is essential,” Nickel emphasized.

Examples of executive orders, such as the one issued by President Trump establishing a Working Group on Digital Assets and banning the development of a central bank digital currency (CBDC), highlight the temporary nature of such actions that can be easily reversed.

Former Congressman Wiley Nickel is seen seated second from the left at a recent Digital Asset Summit.

Legislative Moves Gaining Momentum in Both Congressional Chambers

On March 6, Rep. Tom Emmer, the majority whip of the House of Representatives, put forth renewed legislation aimed at banning a CBDC in the United States.

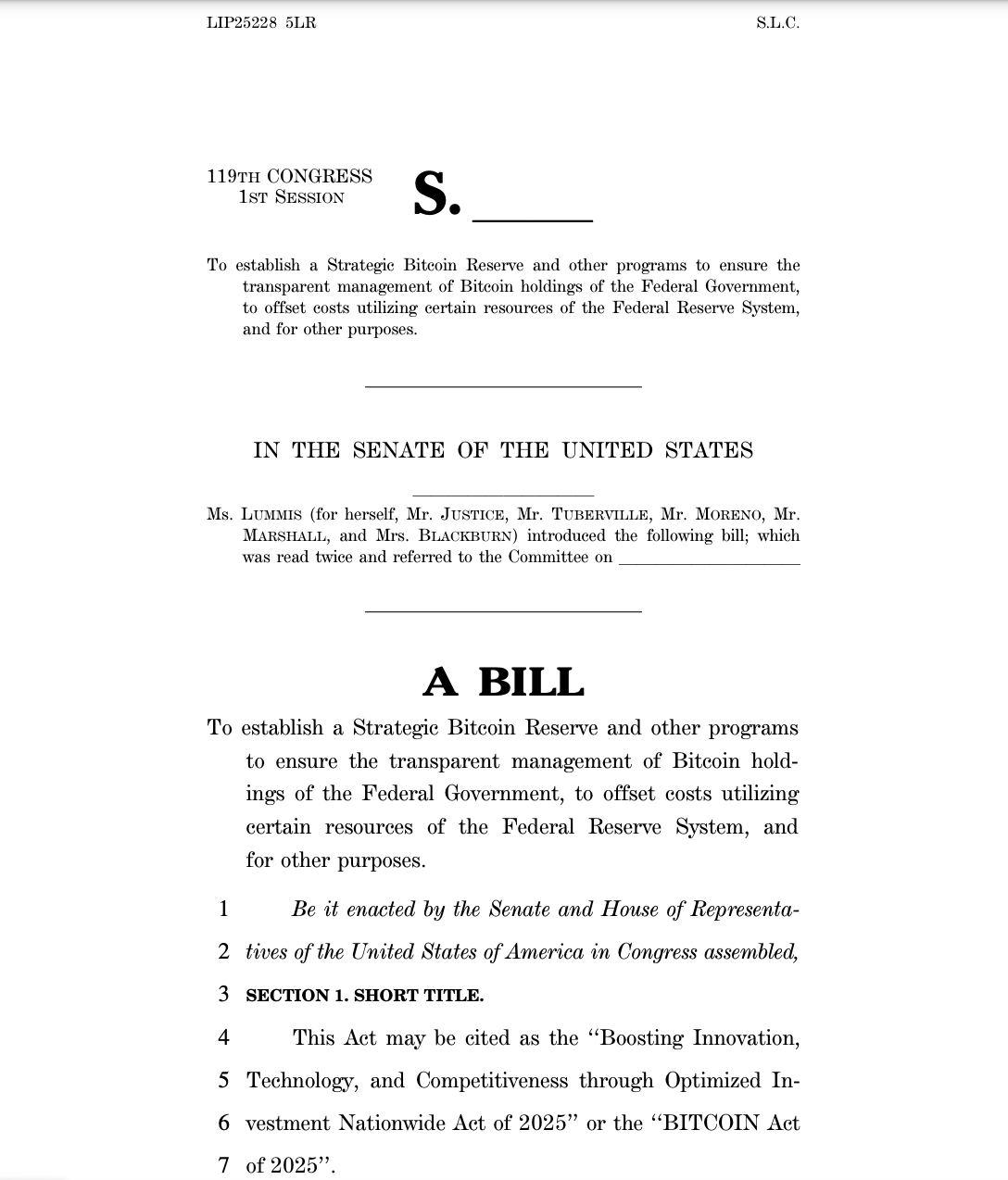

Senator Cynthia Lummis from Wyoming also reintroduced the Bitcoin Act in March, which allows for the US to acquire over 1 million Bitcoin (BTC) and builds upon a previous version of the bill.

Senator Lummis’ Bitcoin Act of 2025.

Additionally, Rep. Byron Donalds has indicated plans to draft legislation that would enshrine the Bitcoin strategic reserve into law, thereby protecting it from potential repeal by future administrations.

On March 12, the House of Representatives voted 292-131 to repeal the IRS broker rule, which required decentralized finance platforms to report their data to the IRS.

At this year’s Digital Asset Summit, Democratic Rep. Ro Khanna shared his optimism that Congress could pass comprehensive crypto regulations in 2025, which would include both a stablecoin bill and a market structure bill.