The memecoin launch platform based on the BNB Chain, Four.Meme, has resumed its operations after recovering from a sandwich attack that resulted in a loss of approximately $120,000.

In a post on March 18, the team announced that the launch function was reactivated following a comprehensive security review and resolution of a security vulnerability. Previously, they had paused the function to investigate the incident, describing it as “under attack.”

“After a detailed security assessment, the launch function has been restored. Our team has remedied the issue and enhanced the security of the system. Compensation for the users affected is already in progress,” stated the Four.Meme team.

Image credit: Four.Meme

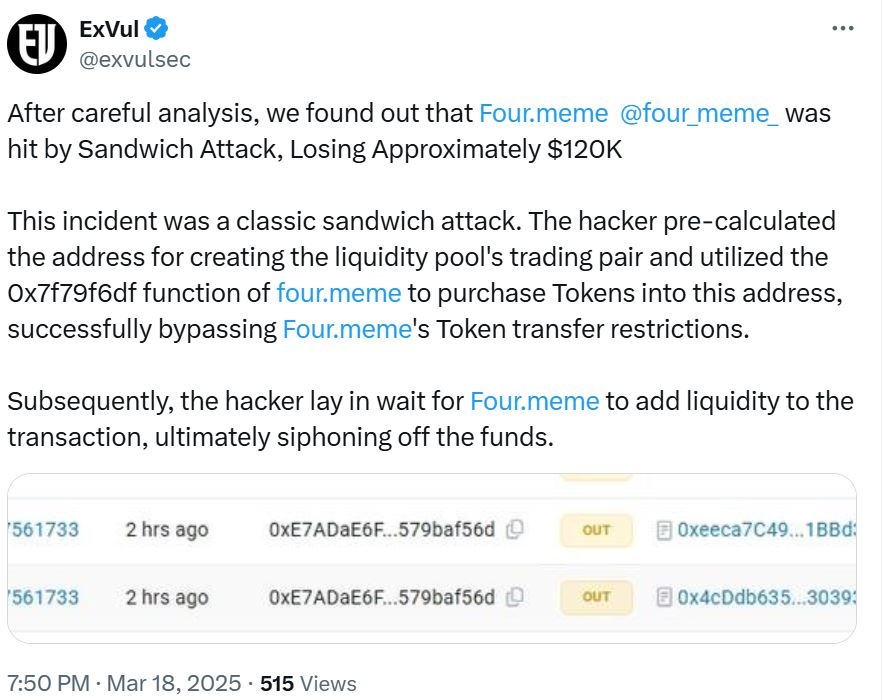

Web3 security experts reported in a March 18 post that the exploit appeared to utilize a market manipulation strategy known as a sandwich attack, yielding the attacker around $120,000.

The report indicated that the attacker had “pre-calculated the address for creating the liquidity pool’s trading pair” and exploited one of the platform’s functions to acquire tokens, which allowed them to circumvent Four.Meme’s token transfer restrictions.

“The hacker then waited for Four.Meme to add liquidity to the transaction, ultimately draining the funds,” they elaborated.

Image credit: ExVul

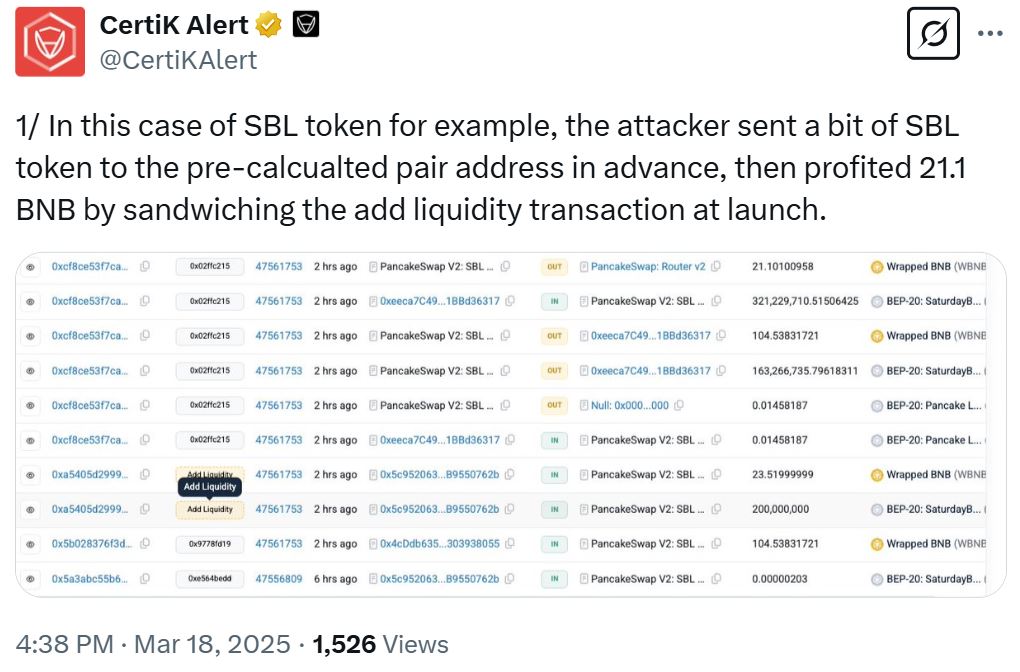

A blockchain security firm came to a similar conclusion, stating that the attacker moved an unequal amount of un-launched tokens to pair addresses before establishing the pair and then manipulated the price at launch to sell them for profit.

Image credit: CertiK

The attacker ended up with at least 192 BNB, approximately $120,000, which was transferred to the decentralized exchange FixedFloat, according to reports.

Related: Pump.fun memecoins are declining at unprecedented rates, with less than 1% surviving

This marks the second time that Four.Meme has faced an attack in just two months; a previous exploit on February 11 led to a loss of around $183,000 in digital assets.

In the wider crypto ecosystem, February recorded $1.53 billion in losses due to scams, exploits, and hacks, with the Bybit hack contributing the majority at $1.4 billion.

According to blockchain analytics, the past year has seen $51 billion in illicit transaction volume, a trend fueled by the professionalization of crypto crime, which now often involves AI-driven scams, stablecoin laundering, and organized cybercrime.

Analysis: Memecoins are likely to face extinction, while DeFi could experience a resurgence — Industry Expert