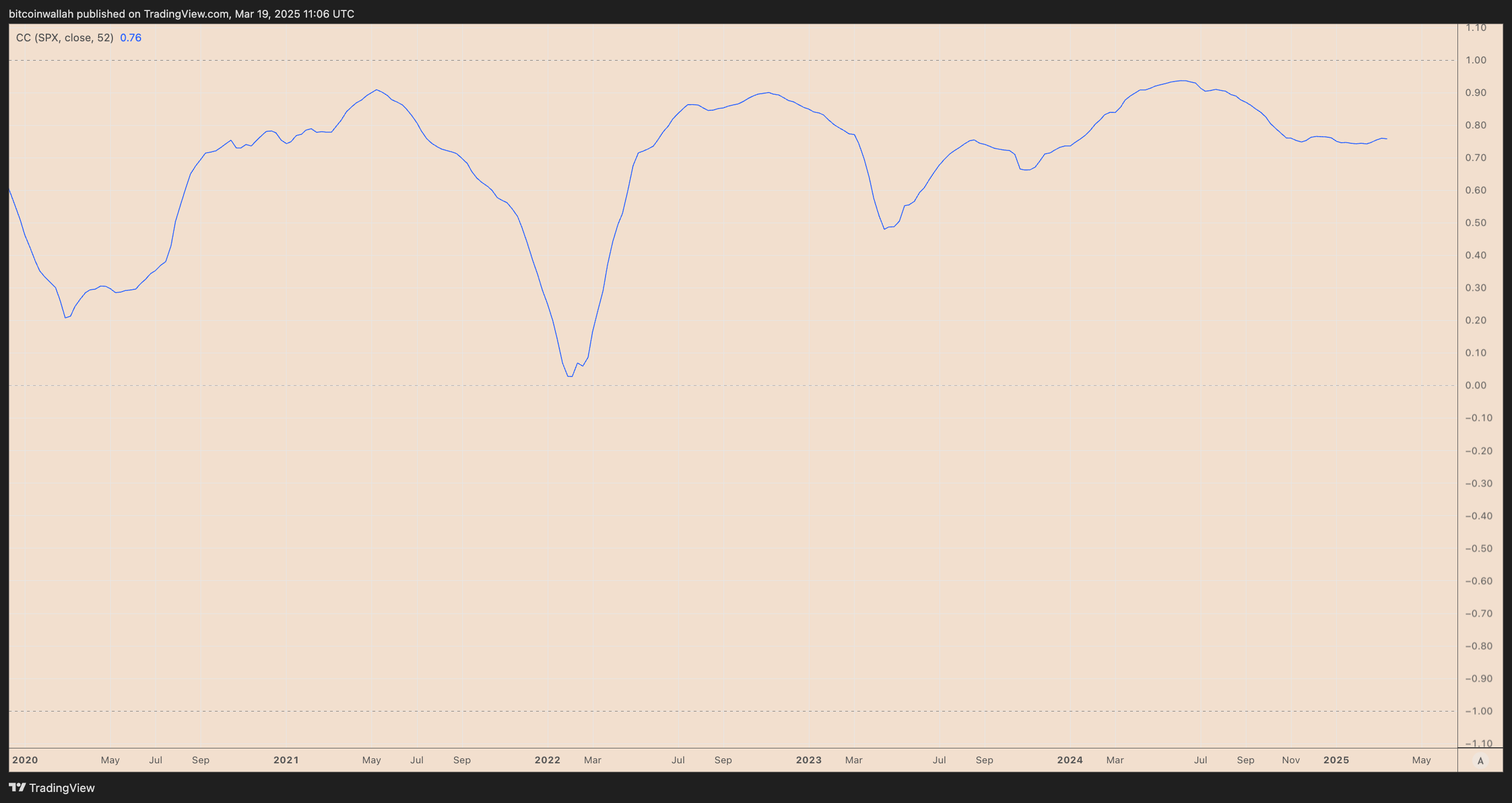

The price movements of Bitcoin (BTC) have increasingly mirrored those of the US stock market in recent times, especially the tech-heavy Nasdaq and the S&P 500 index.

Now, with portfolio managers initiating an unprecedented departure from US stocks, a pertinent question arises: could Bitcoin be next in line to suffer?

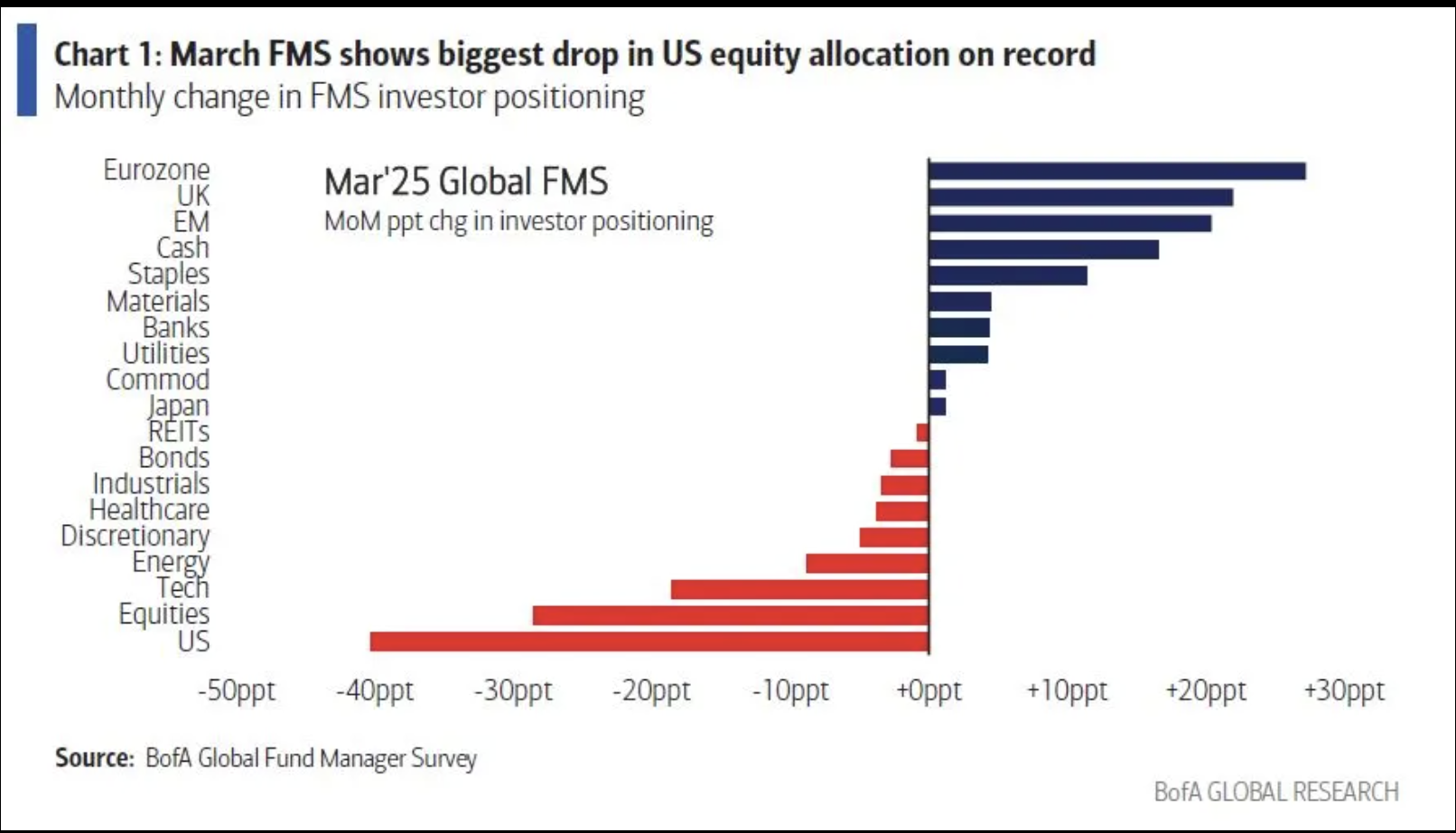

Portfolio managers exit US stocks at an unprecedented rate

Investors have notably reduced their exposure to US equities, recording a staggering 40-percentage-point drop between February and March, as reported by the latest findings from Bank of America.

This marks the most substantial monthly decline since the institution started tracking such data in 1994. Dubbed a “bull crash,” this shift highlights diminishing confidence in the US economy’s ability to outperform, coupled with escalating concerns about a global downturn.

With a net 69% of the surveyed portfolio managers indicating they believe the peak of “US exceptionalism” has passed, this data hints at a significant shift that could impact risk assets like Bitcoin, especially given their ongoing 52-week positive correlation over the years.

Chart showing the 52-week correlation coefficient between Bitcoin and the S&P 500 index. Source: TradingView

Further downside risks for Bitcoin and the broader cryptocurrency market are emerging as investors increase their cash positions.

According to March’s survey, cash levels, a typical sign of a flight to safety, rose to 4.1% from February’s 3.5%, which was the lowest since 2010.

Results from the March Global Fund Manager survey. Source: BofA Research

Compounding the anxiety, 55% of managers identified “Trade war triggers global recession” as the primary tail risk, an increase from 39% in February, while 19% expressed concern that inflation might lead to Federal Reserve interest rate hikes — both scenarios likely to dampen enthusiasm for speculative assets like Bitcoin.

On the other hand, “Long crypto” remains one of the most popular trades at 9%, coinciding with the establishment of a Strategic Bitcoin Reserve in the country.

Additionally, 68% of managers now foresee interest rate cuts by the Federal Reserve in 2025, an increase from 51% last month.

Related: ‘We are worried about a recession,’ but there’s a silver lining — Cathie Wood

Historically, lower interest rates have correlated with gains in Bitcoin and the broader cryptocurrency market, which bettors on Polymarket believe is a certainty to occur before May.

Bitcoin’s price precariously positioned

Since reaching an all-time high of nearly $110,000, Bitcoin’s price has experienced a decline of over 25%. This dip is often viewed as a correction within a bull market, suggesting a potential recovery for the cryptocurrency in the near future.

“Historically, Bitcoin undergoes such corrections during prolonged rallies, and there’s no reason to assert that this time is any different,” noted Nick Forster, founder of Derive, while emphasizing that the cryptocurrency’s trajectory in the next six months will largely depend on the performance of traditional markets (stocks).

As of March 19, Bitcoin was clinging above its 50-week exponential moving average (50-week EMA; represented by the red wave) at $77,250.

Weekly price chart for BTC/USD. Source: TradingView

Historically, Bitcoin tends to revert to the 50-week EMA following strong rallies. A decisive break below this support has previously indicated bear markets, as seen in the correction cycles of 2018 and 2022.

Source: Milkybull Crypto

A significant breakdown beneath the wave support could result in bearish traders targeting the 200-week EMA (the blue wave) below $50,000, reflecting the negative sentiment expressed in the survey findings.

Conversely, maintaining above the 50-week EMA has historically spurred prices to reach new seasonal highs, similar to trends observed in 2024. Should Bitcoin bounce back from this support, the possibility of testing the $100,000 psychological resistance level appears considerable.

This article does not constitute investment advice or recommendations. Every investment and trading decision carries risk, and readers should conduct their own research before making a choice.