Key Insights

- Embracing cryptocurrency payments can lead to lower transaction fees, the removal of chargebacks, and smoother international transactions.

- Companies, ranging from online retailers to real estate firms, are adopting cryptocurrency payments to draw in new clientele.

- Challenges like price fluctuations and adherence to regulations can be effectively handled with reliable payment services.

- Establishing cryptocurrency payment options has become increasingly straightforward, requiring no initial investment and offering easy integration solutions for smaller businesses.

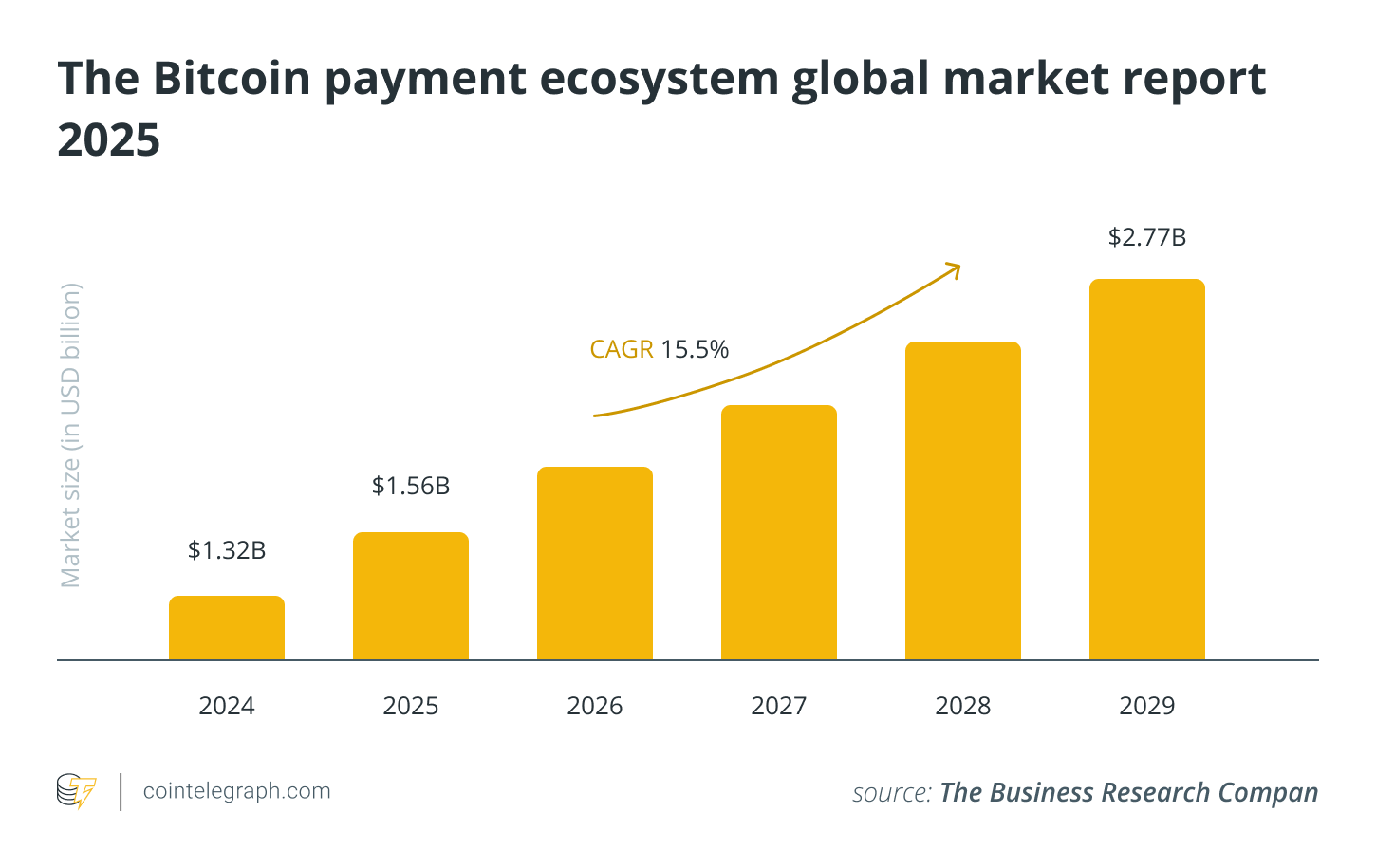

- The swift rise in cryptocurrency usage has prompted an array of businesses to adopt digital currencies like Bitcoin as a bona fide payment alternative.

This isn’t merely a rehash of old trends. For years, luxury companies and telecom giants have accepted Bitcoin, but now, crypto payments have extended their reach into e-commerce, hospitality, travel, and even your local café.

What began as a niche phenomenon in the early 2010s has gained significant momentum. By 2025, over 659 million people globally — about 1 in 13 — are projected to use cryptocurrency. In fact, around 15,000 businesses worldwide are currently accepting Bitcoin, including approximately 2,300 in the U.S.

While there are factors to consider, many perceive the acceptance of Bitcoin and other cryptocurrencies as advantageous, especially for small businesses. Often, the benefits outweigh any potential drawbacks, offering minimal risks alongside substantial rewards.

The following sections will delve into the various stakeholders, motivations, and operational methods.

What companies are currently utilizing cryptocurrencies?

As previously mentioned, it’s not just specialized crypto sectors that are engaging with Bitcoin payments. Here are some industries you may not have thought of, along with relevant examples.

E-commerce

- Shopify allows merchants to take cryptocurrency payments via several gateways, such as BitPay and Coinbase Commerce.

- Newegg facilitates Bitcoin and other crypto transactions for electronics, integrating these options into their checkout process.

- Rakuten Japan permits users to trade Rakuten Points for Bitcoin, Ether, and Bitcoin Cash, thereby incorporating cryptocurrency into its rewards system.

Food and Beverage

- Selected Subway outlets accept Bitcoin, with franchises in Europe and North America utilizing crypto payments.

- In Brazil and Venezuela, Burger King franchises accept Bitcoin along with a few altcoins for meal purchases.

- Starbucks allows Bitcoin payments through the Bakkt app, enabling customers to top up their Starbucks cards with cryptocurrency.

Retail

- Home Depot accepts Bitcoin payments through Flexa, enabling customers to use cryptocurrency for home improvement buys.

- Whole Foods allows cryptocurrency transactions via the Spedn app, which supports Bitcoin and various digital currencies at checkout.

- Nordstrom has incorporated cryptocurrency payments into both its online and in-store shopping experiences, enabling purchases via Bitcoin and Ethereum.

Real Estate

- A $22.5-million penthouse in Miami’s Arte Surfside complex was completely purchased with Bitcoin, marking one of the largest cryptocurrency real estate transactions.

- Magnum Real Estate Group sold a retail condo in Manhattan for $15.3 million in Bitcoin, representing one of the first significant commercial real estate operations involving crypto.

- Kuper Sotheby’s International Realty in Texas completed a home sale utilizing Bitcoin, bringing cryptocurrency transactions into the residential property market.

Hospitality and Travel

- Mirai Flights accepts cryptocurrency payments for private jet charters, targeting high-net-worth clients.

- Travala allows payments with Bitcoin, Ether, and other cryptocurrencies for hotel and flight reservations, collaborating with major travel service providers.

- Expedia supports crypto payments for hotel bookings through Travala, providing Bitcoin payment options for specific accommodations.

Advertising

- Claimr, a Web3 marketing platform, processes around 8 million euros annually, with a majority of transactions conducted in cryptocurrency.

- Accessible.org began accepting Bitcoin and other cryptocurrencies in 2025, allowing clients to pay for digital accessibility services using crypto.

- Black Iris Social Club in Richmond accepts Bitcoin for event bookings and memberships, incorporating cryptocurrency into its operations.

Fun Fact: The first real-world Bitcoin transaction took place on May 22, 2010, when programmer Laszlo Hanyecz bought two pizzas for 10,000 BTC. Today, those 10,000 BTC would be worth hundreds of millions of dollars, making it an iconic pizza purchase in history. This day is now celebrated annually as Bitcoin Pizza Day within the crypto community.

Why are businesses adopting crypto payments?

While major brands are on board, what factors are driving this trend, and can smaller businesses benefit as well?

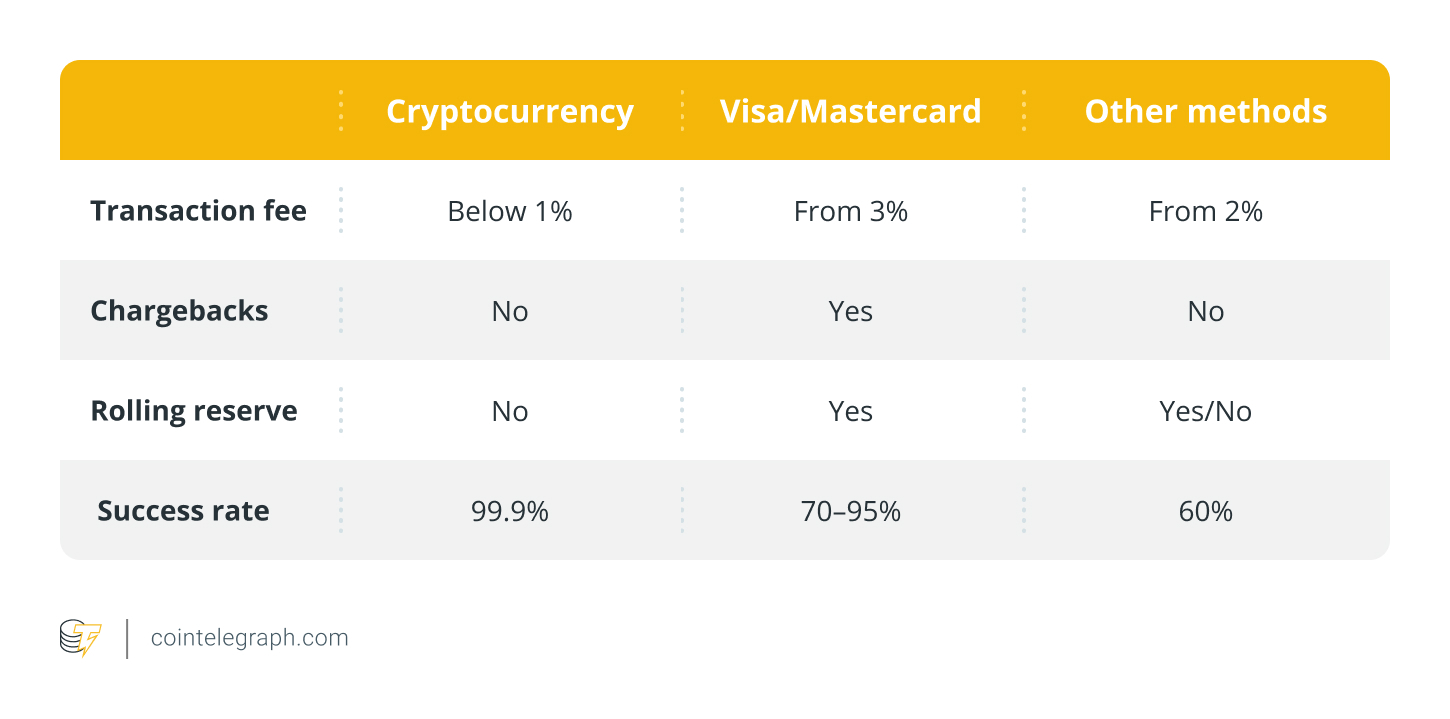

One of the most notable advantages is the reduction in transaction fees. Traditional payment processors and credit card companies typically impose charges between 2% and 4% per transaction, while crypto payment gateways often bring this down to below 1%. For businesses handling a high volume of transactions, these savings can be significant.

Additionally, cryptocurrency payments provide access to a global market free from the constraints of currency fluctuations and international banking fees. These transactions facilitate seamless cross-border commerce, enabling businesses to cater to international clients without hassle — particularly beneficial in sectors like travel, luxury goods, and digital services where global trade is prevalent.

Furthermore, security and fraud prevention are crucial factors. Cryptocurrency transactions are irreversible, hence eliminating chargebacks — an issue that costs merchants billions annually in fraudulent disputes. This quality makes crypto payments particularly attractive to businesses in industries where chargebacks are commonplace, like e-commerce and online services.

Interesting Insight: In 2025, chargeback fraud, specifically friendly fraud, has emerged as a significant problem for merchants. A recent survey revealed that 55% of Generation Z and 49% of high-income Millennials admitted to participating in digital shoplifting — a tactic where consumers falsely report issues with online orders to secure refunds or evade payments.

Moreover, businesses recognize that offering cryptocurrency aligns with the growing preferences of the crypto user demographic. By adopting crypto payments, companies position themselves as innovative and progressive, appealing to a tech-savvy customer base that favors digital transactions over traditional banking methods.

Finally, some businesses are intrigued by the prospect of holding crypto as an asset. While many opt for payment processors that convert cryptocurrency to fiat instantly to avoid volatility, others see it as a means to engage with a burgeoning asset class. Major companies like Tesla and MicroStrategy hold Bitcoin, inspiring smaller enterprises to consider doing the same, as they acknowledge the potential long-term value.

Small businesses, in particular, stand to gain greatly from these advancements, as appealing to the cryptocurrency market creates opportunities to reach a more extensive customer base than relying solely on fiat transactions. This approach could very well determine success or failure in a competitive startup landscape.

Interesting Fact: A Deloitte survey found that 85% of merchants view crypto payments as a method to attract new customers.

Pitfalls of accepting cryptocurrency payments

Though the acceptance of cryptocurrency payments is frequently regarded as beneficial, companies must remain aware of the potential risks of operating independently, without adequate accounting systems and cryptocurrency processing partners.

Price volatility

Cryptocurrencies like Bitcoin are notorious for their substantial price swings. For instance, in early 2025, Bitcoin’s value plummeted from $109,071 to about $80,000 — a drop of nearly 25% within a brief period. Such volatility can influence the value of received payments if they aren’t swiftly converted into more stable currencies.

Regulatory and tax compliance

The regulatory landscape surrounding cryptocurrencies differs from one jurisdiction to another and is continuously evolving. For example, in the U.S., the IRS classifies cryptocurrencies as property rather than currency, introducing complexities in tax reporting and compliance. Businesses need to stay abreast of pertinent regulations to ensure they meet tax obligations and avoid potential legal issues.

Security concerns

Accepting cryptocurrencies necessitates the use of digital wallets and exchanges, which can be vulnerable to cyber threats. Without strong security measures, companies risk unauthorized access and digital asset theft. Implementing rigorous cybersecurity protocols is vital.

Technical hurdles

Integrating cryptocurrency payment systems often requires technical expertise that may be lacking among some small business owners. Setting up digital wallets and navigating cryptocurrency exchanges can be daunting, potentially resulting in operational inefficiencies or errors. Investing in employee training or consulting with specialists may be essential to overcome these obstacles.

Market acceptance and perception

Despite increasing adoption, cryptocurrencies are still not universally accepted or understood. Some customers may be reluctant to use digital currencies due to security concerns or unfamiliarity, potentially limiting the perceived advantages of providing crypto payment options. Businesses should evaluate their target audience to determine if accepting cryptocurrencies aligns with their customers’ preferences.

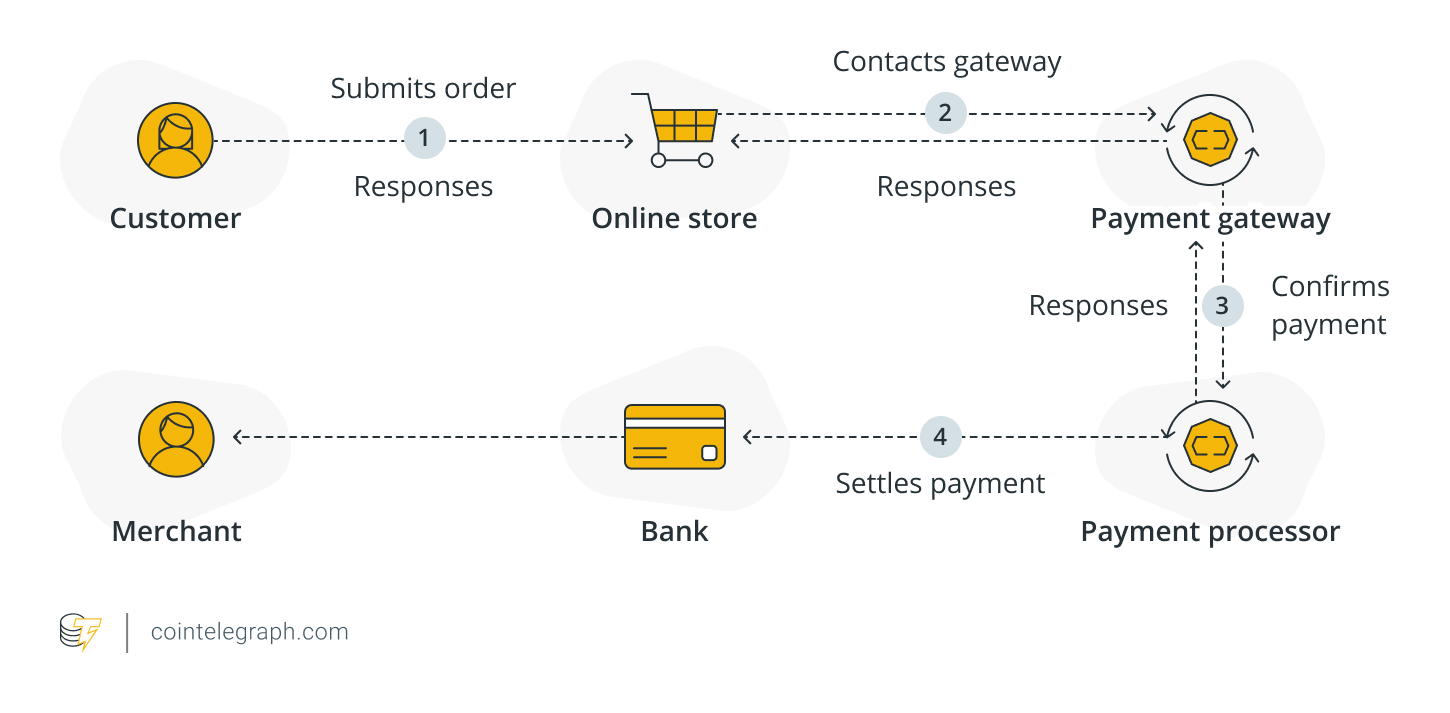

Utilizing a crypto payment provider

As a small business, it’s unlikely you’ll journey down this path independently — especially when leading cryptocurrency payment processors provide zero upfront integration costs:

- These processors offer immediate conversion services that instantly turn volatile cryptocurrencies into stable fiat currencies upon receipt, protecting businesses from price fluctuations.

- They assist with navigating the complex regulatory environment by providing tools for precise tax reporting and ensuring compliance with changing laws.

- To address security issues, reputable processors employ robust cybersecurity measures to protect digital assets from potential threats.

- In addition, they offer user-friendly platforms that simplify the technical elements of cryptocurrency transactions, making it accessible even for those with minimal technical background.

The next section will examine a variety of cryptocurrency processing providers that small businesses might consider.

Selecting a crypto payment gateway in 2025

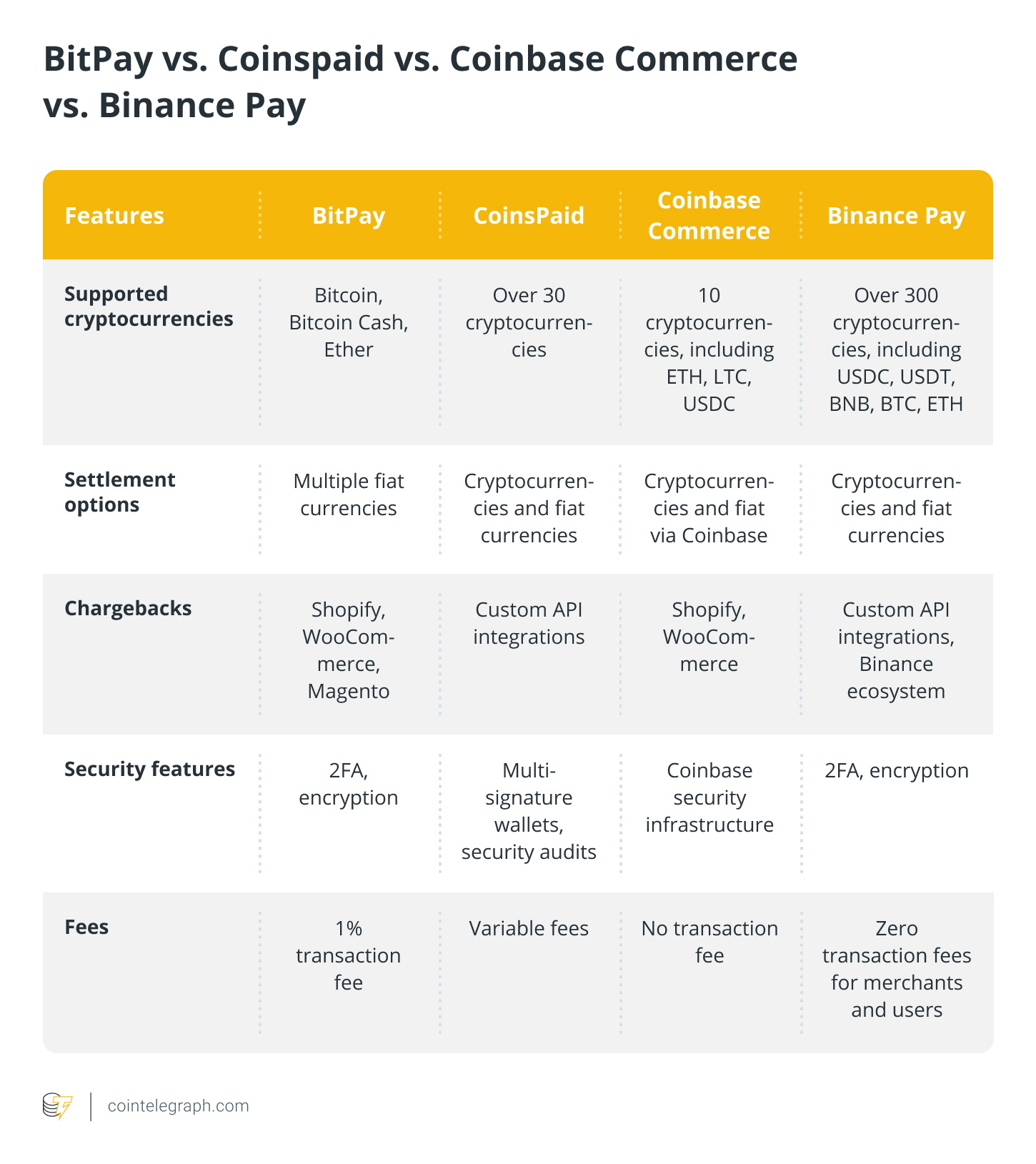

BitPay

Established in 2011, BitPay stands as a trailblazer in the realm of cryptocurrency payment processing. By 2024, it commands a 6.26% market share in Bitcoin payment processing, serving over 523 customers.

BitPay accommodates a diverse array of clients, including retailers, investment banking firms, and nonprofits. The firm facilitates direct crypto-to-fiat settlements, allowing businesses to mitigate volatility while seamlessly integrating with their existing accounting frameworks.

Its security structure includes two-factor authentication (2FA) and encrypted transactions, making it a trusted choice for enterprises looking to accept crypto payments.

CoinsPaid

Founded in 2014, CoinsPaid has evolved into a comprehensive cryptocurrency payment gateway, having processed over 41 million transactions worth approximately 23 billion euros. The platform handles about 8% of all on-chain Bitcoin transactions, marking it as a significant player in the crypto payments space.

Offering support for over 30 cryptocurrencies, CoinsPaid caters to sectors like IT, marketing, financial services, real estate, and gambling. The service includes a business wallet, an over-the-counter (OTC) desk for large transactions, and software-as-a-service solutions tailored for cryptocurrency integration.

CoinsPaid is licensed in Estonia and complies with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations, undergoing regular independent security audits to uphold its reputation for secure and compliant processing.

Coinbase Commerce

Launched in 2018, Coinbase Commerce allows businesses to receive multiple cryptocurrencies directly into user-controlled wallets. It seamlessly integrates with major e-commerce platforms like Shopify and WooCommerce, enabling businesses to accept Ethereum, Litecoin, and USD Coin.

However, in February 2024, Coinbase Commerce discontinued support for Bitcoin and other UTXO-based coins. To process Bitcoin payments, users now need a Coinbase account. This change comes as the platform faces challenges in updating its Ethereum Virtual Machine payment protocol for Bitcoin.

While specific market share information is limited, Coinbase Commerce is widely utilized by small to mid-sized businesses across sectors like software, utilities, and telecommunications.

The platform offers a hassle-free setup with no transaction fees beyond standard network costs, making it an attractive alternative for companies seeking a straightforward crypto payment solution without intermediaries.

Binance Pay

Binance Pay, developed by Binance, is a cryptocurrency payment solution enabling merchants and users to conduct transactions using various cryptocurrencies. It supports over 30 cryptocurrencies, including Bitcoin, Ethereum, and Binance Coin, offering flexible payment options.

The platform features zero transaction fees for both merchants and users, making it a compelling choice for businesses looking to incorporate crypto payments without incurring additional charges. Binance Pay prioritizes security, including features like 2FA and encrypted transactions to ensure safe and reliable payment processing.

A step-by-step guide to establishing a crypto payment gateway

After facing challenges with the Lazarus Group last year, CoinsPaid has maintained its status as a leading crypto payment gateway, ensuring competitive setup costs and fees. The following steps outline what you can expect when integrating any crypto payment processor, using CoinsPaid’s process as an example.

- Request a consultation: Businesses can kick off the process by submitting a request on the CoinsPaid website. A representative will quickly reach out to schedule a meeting to discuss requirements.

- Receive a complimentary demo and proposal: The CoinsPaid team provides a comprehensive demonstration of the system, fielding any questions and preparing a customized proposal based on the company’s needs.

- Onboarding: To finalize the contract, businesses must complete the Know Your Business (KYB) verification by submitting essential documents to meet regulatory standards.

- Integration: CoinsPaid’s team will assist in integrating the payment gateway into the company’s existing systems, ensuring a smooth and efficient setup.

- Begin accepting crypto: Once the integration is finalized, businesses can start offering cryptocurrency payment options, providing customers with a new way to pay while potentially expanding their market reach.

Following these steps will enable you to effectively integrate CoinsPaid into your operations, offering customers the ability to pay with cryptocurrencies.

Embracing cryptocurrency payments is a forward-thinking choice

The lower transaction fees, access to a worldwide customer base, and protection from chargebacks make crypto payments clearly advantageous compared to traditional payment methods.

The associated risks such as volatility, compliance, and security can be easily managed by leveraging a dependable payment processor. These platforms handle everything from instant fiat conversion to compliance and security, facilitating a seamless transition to cryptocurrency.

With renowned brands already adopting digital currencies, small and medium-sized businesses should not fall behind. Cryptocurrency payments are swift, borderless, and cost-effective, making them an obvious choice for any progressive business.

Whether you are a startup aiming for a competitive advantage or an established company seeking new revenue opportunities, integrating cryptocurrency payments represents an investment in the future.

This article does not constitute investment advice or recommendations. All investment and trading decisions carry risks, and readers should conduct independent research before making decisions.