Minnesota state Senator Jeremy Miller has put forward the Minnesota Bitcoin Act, a proposal that reflects his notable shift in perspective on cryptocurrency.

“Through my ongoing exploration of cryptocurrency and the feedback I receive from constituents, I’ve transitioned from being a skeptic to gaining knowledge about it, ultimately coming to believe in Bitcoin and other cryptocurrencies,” Miller shared in a statement on March 18.

The intent of the legislation is to “foster prosperity” for residents of Minnesota by enabling the Minnesota State Board of Investment to allocate state assets into Bitcoin (BTC) and other cryptocurrencies similarly to how it invests in conventional assets.

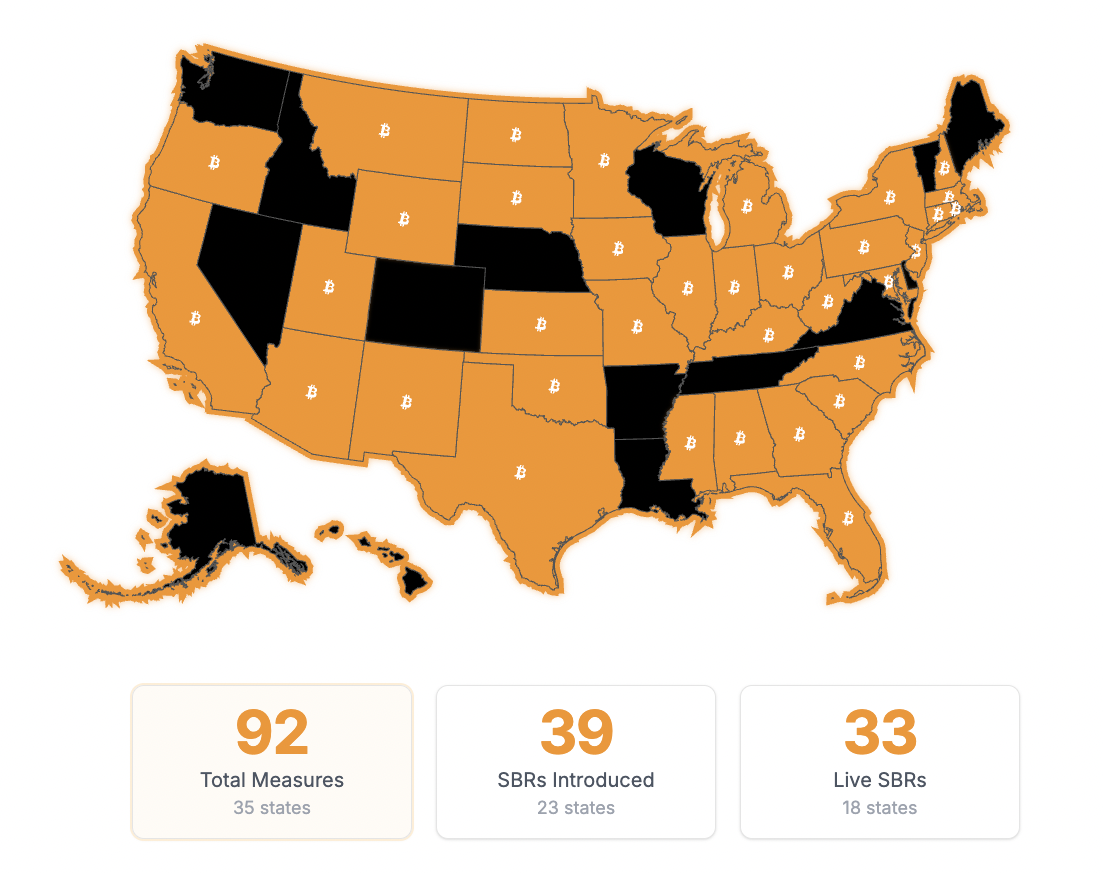

A number of states across the U.S. have also introduced comparable legislation concerning Bitcoin investments, with 23 states having proposed measures to establish a Bitcoin reserve.

A total of 39 distinct bills related to state investments in Bitcoin have been introduced across 23 U.S. states.

If passed, Miller’s bill would allow Minnesota state employees to incorporate Bitcoin and other cryptocurrencies into their retirement plans.

Additionally, it would provide residents with the option to pay state taxes and fees using Bitcoin. Colorado and Utah currently accept cryptocurrencies for tax payments, while Louisiana permits it for state services.

Profits gained from Bitcoin and other cryptocurrencies would also be exempt from state income taxes. In the U.S., up to $10,000 paid to the state can be deducted from federal taxes under the state and local tax deduction; however, amounts over that threshold are liable for both state and federal taxes.

Related: SEC may eliminate the proposed Biden administration rule on crypto custody, according to the acting chief

The rise in the number of U.S. states advocating for Bitcoin reserve legislation follows Senator Cynthia Lummis’ Strategic Bitcoin Reserve Act proposed in July, which instructs the federal government to acquire 200,000 Bitcoin each year over five years, accumulating to a total of 1 million Bitcoin.

On March 12, Lummis reintroduced the BITCOIN Act, suggesting the government could potentially hold over 1 million Bitcoin as part of a new reserve initiative.

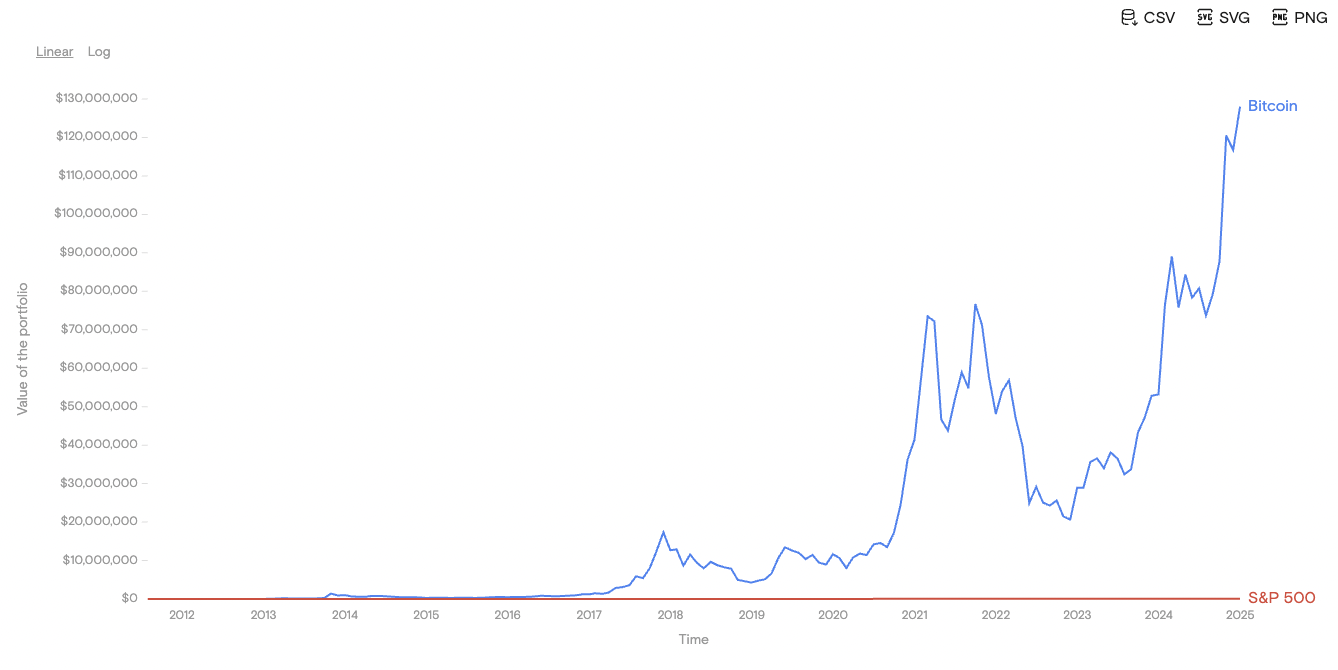

Bitcoin has registered remarkable gains relative to traditional assets in recent years. From August 2011 to January 2025, it achieved a compound annual growth rate of 102.36%, contrasting with the S&P 500’s 14.83%.

Bitcoin’s compound annual growth rate significantly surpasses that of the S&P 500.

Magazine:Crypto enthusiasts are fascinated by longevity and biohacking: Here’s the reason behind it