The North Dakota Senate has approved a bill aimed at regulating cryptocurrency ATMs, reinstating a provision that limits daily transactions to $2,000 per user, which had been removed by the House earlier on.

On March 18, the Senate voted 45 to 1 in favor of House Bill 1447, which was introduced to the legislative assembly on January 15. The bill seeks to shield residents from scams by establishing a series of new guidelines for crypto ATMs and their operators.

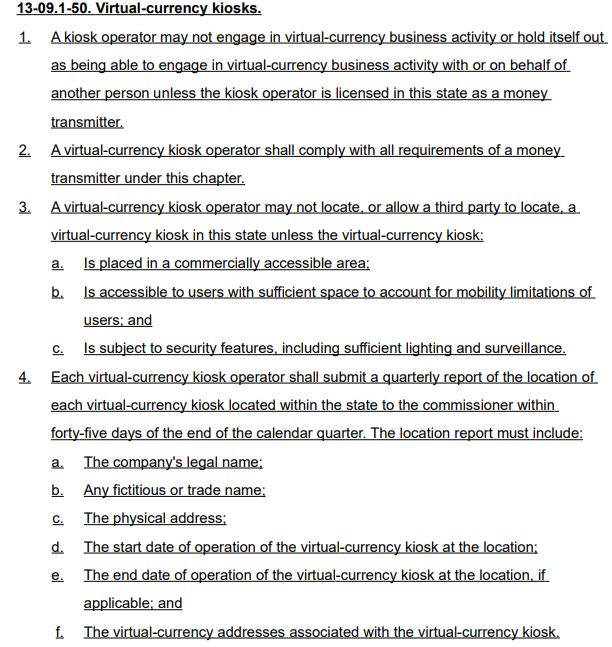

The revised version of the bill mandates that operators of cryptocurrency ATMs and kiosks obtain licenses as money transmitters in the state. It restricts customer withdrawals to $2,000 per day across their network of machines and requires issuing fraud warning notices.

Initially, customer withdrawals from crypto ATMs were capped at $1,000 daily, but a House committee recently raised this limit to $2,000 for the first five transactions within a 30-day period.

Now, with the Senate’s final decision, a $2,000 transaction limit has been established. The updated bill will return to the House for a vote on these amendments before it can be signed into law or vetoed by North Dakota Governor Kelly Armstrong.

Additionally, the legislation demands that operators utilize blockchain analytics to identify suspicious activities, such as fraud, and report these findings to authorities. Operators will also need to submit quarterly reports detailing kiosk locations, operator names, and transaction data.

The latest version of House Bill 1447 requires local crypto ATM operators to be licensed as money transmitters in the state, among other stipulations.

During a committee hearing on January 22, the principal sponsor of the bill, House Representative Steve Swiontek, noted that the absence of protective measures for crypto ATMs has enabled criminals to exploit them for theft.

Similarly, on March 13, the governor of Nebraska enacted legislation aimed at combating fraud related to electronic records.

On a federal level, U.S. Senator Dick Durbin from Illinois proposed analogous legislation on February 25, citing a constituent’s distressing experience with a scammer who falsely claimed that an arrest warrant had been issued, suggesting that a $15,000 deposit at a crypto ATM could avert jail time.

Related: ‘Victim-blaming’ Americans may deter reporting of crypto scams — Regulator

A report from the Federal Trade Commission last September highlighted that fraud losses associated with Bitcoin ATMs had surged nearly tenfold from 2020 to 2023, exceeding $65 million in the first half of 2024, with consumers aged 60 and older being particularly vulnerable.

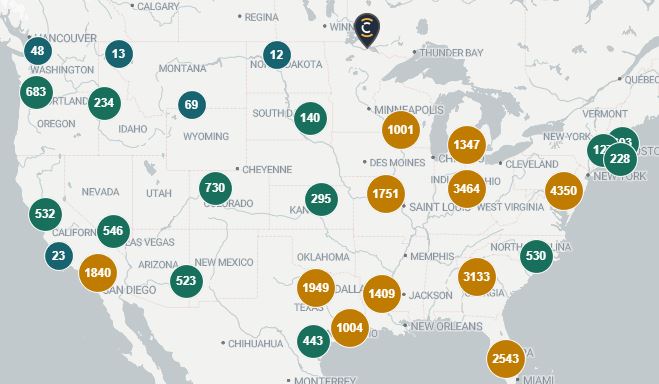

According to data, the U.S. leads the world in the number of Bitcoin ATMs, boasting 29,822 machines, which account for 78% of the global market.

The United States is at the forefront in the number of Bitcoin and crypto ATMs worldwide.

Canada follows in second place with 9.2% of the market share and 3,486 crypto ATMs, while Australia ranks third with 1,613 ATMs, representing 4.3% of the market.

Magazine: How crypto laws are evolving worldwide in 2025