Bitcoin (BTC) has been hovering around the 200-day simple moving average ($84,359), indicating that the bulls are maintaining their momentum. This increases the potential for an upward breakout, suggesting that the corrective phase may be nearing its end.

Nick Forster, the founder of Derive, remarked that the current pullback is a standard correction that Bitcoin tends to experience during extended rallies. He believes that Bitcoin’s cycle peak is still ahead.

A favorable indicator for the bulls is that US spot Bitcoin exchange-traded funds (ETFs) have begun to see inflows once more. As per Farside Investors’ data, these ETFs have observed $525 million in inflows since March 14.

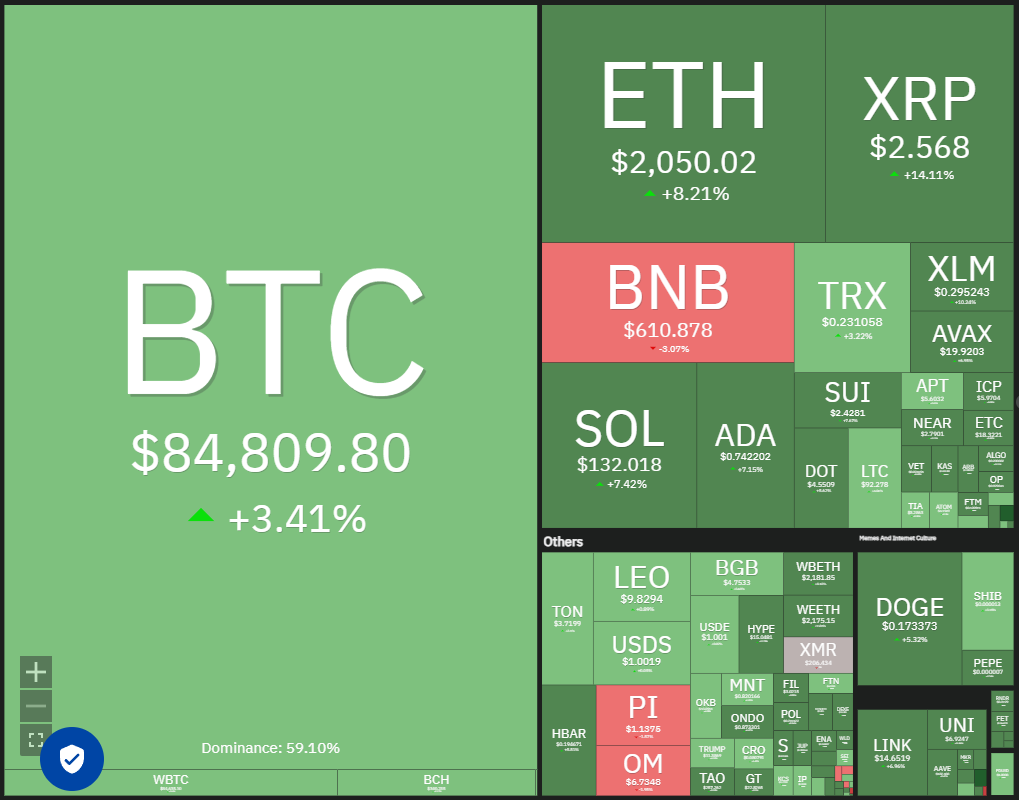

Daily view of crypto market data. Source: Coin360

However, not every analyst holds a bullish perspective on Bitcoin. Ki Young Ju, CEO and founder of CryptoQuant, stated in a post on X that Bitcoin could remain in a bearish or sideways trend for the next 6-12 months, suggesting that the bull cycle has concluded.

Will Bitcoin manage to break above the 200-day SMA, triggering a rally in altcoins? Let’s delve into the charts of the top 10 cryptocurrencies for insights.

Bitcoin price analysis

Bitcoin is encountering selling pressure at the 200-day SMA, yet the bulls have not surrendered significant ground. This implies bulls are reluctant to sell off their positions as they anticipate a breakout in the near future.

Daily chart of BTC/USDT. Source: Cointelegraph/TradingView

A surge in bullish momentum is likely if the price breaks and closes above the 20-day exponential moving average ($85,441). The BTC/USDT pair could then ascend towards the 50-day SMA ($91,904).

This optimistic outlook may be invalidated if the price sharply declines from the 20-day EMA and falls below $80,000. Should that happen, the pair could retreat to $76,606. Buyers are expected to vigorously defend the $76,606 to $73,777 support zone.

Ether price analysis

Ether (ETH) experienced a breakout from its narrow trading range on March 19, signaling that the bulls have taken control over the bears.

Daily chart of ETH/USDT. Source: Cointelegraph/TradingView

Sellers will attempt to halt the upward movement at the $2,111 level, but if the bulls succeed, the ETH/USDT pair may rise to the 50-day SMA ($2,468). Further surpassing this level could see the pair rally to $2,850.

Conversely, if the price sharply pulls back from $2,111, it would indicate that the bears are working to flip that level into resistance. The bears would gain the upper hand if they manage to push the price below $1,800.

XRP price analysis

XRP (XRP) surged above the moving averages on March 19, paving the way for a potential rally toward the resistance line.

Daily chart of XRP/USDT. Source: Cointelegraph/TradingView

If the price retreats from the resistance line, the XRP/USDT pair may find support at the 20-day EMA ($2.36). A bounce from the 20-day EMA would bolster the chances of breaking above the resistance line, with the pair potentially rising to $3.

On the flip side, if the price retreats from the resistance line and dips below the moving averages, it will increase the risk of a fall to $2. A close beneath $2 would signify sellers gaining control.

BNB price analysis

BNB (BNB) closed above the 50-day SMA ($618) on March 17, although the bulls are currently struggling to maintain those higher levels.

Daily chart of BNB/USDT. Source: Cointelegraph/TradingView

A pullback is likely to find support at the 20-day EMA ($602). If the price bounces back strongly from the 20-day EMA, it will indicate a shift in sentiment from selling on rallies to buying on dips, potentially leading to a break above $644. The BNB/USDT pair could then rally to $686.

On the other hand, a break and close below the 20-day EMA would indicate that the bulls are taking profits, which may drive the pair down to $550.

Solana price analysis

Solana (SOL) showed resilience, rebounding from the $120 to $110 support zone on March 18, demonstrating that the bulls are fiercely defending this area.

Daily chart of SOL/USDT. Source: Cointelegraph/TradingView

If buyers manage to push the price above the 20-day EMA ($137), it will signal the beginning of a sustained recovery, with the SOL/USDT pair possibly rallying to the 50-day SMA ($167) and subsequently to $180.

Conversely, should the price decline from the 20-day EMA, it would indicate that the bears are still in control. A drop below the support area suggests the initiation of a new downtrend. There is minor support at $98, but if this level is breached, the pair could nosedive to $80.

Cardano price analysis

Cardano (ADA) has been oscillating between the uptrend line and the moving averages for a few days, reflecting a lack of consensus about the next movement direction.

Daily chart of ADA/USDT. Source: Cointelegraph/TradingView

The downward-sloping moving averages combined with the RSI just below the midpoint slightly favor the bears. If the price decreases from the moving averages and fails to hold above the uptrend line, the ADA/USDT pair may drop to $0.58 and eventually to $0.50.

Conversely, if the price breaks and closes above the moving averages, it would indicate a resurgence of the bulls, pushing the pair towards $1.02, where aggressive selling from bears can be expected.

Dogecoin price analysis

Dogecoin (DOGE) is facing pressure around the 20-day EMA ($0.18), suggesting that the bears are active at these elevated levels.

Daily chart of DOGE/USDT. Source: Cointelegraph/TradingView

The bears are likely to attempt to push the price below the $0.14 support. If they succeed, it’s a signal for a continuation of the downtrend, which could see the DOGE/USDT pair plunge to psychological support at $0.10.

If buyers hold their ground at the current level, it would enhance the potential for a breakout above the 20-day EMA. Should that occur, the pair might rise to $0.25 and then to $0.29.

Related: Fund managers dump US stocks at record pace — Can recession fears impact Bitcoin?

Chainlink price analysis

Chainlink (LINK) has surged to the 20-day EMA ($14.66), but the bulls may encounter significant resistance from the bears.

Daily chart of LINK/USDT. Source: Cointelegraph/TradingView

If the price declines from the 20-day EMA, the bears will likely attempt to sink the LINK/USDT pair below the $12 support threshold. If they manage this, the pair might fall to the crucial support level at $10.

On the other hand, a break and close above the 20-day EMA would indicate that the previous breakdown was a bear trap, potentially allowing the pair to rise to the 50-day SMA ($17.22) and later to $19.25.

UNUS SED LEO price analysis

UNUS SED LEO (LEO) has been trading in a narrow range between $10 and $9.60 recently, indicating that bulls are holding their positions as they anticipate an upward movement.

Daily chart of LEO/USD. Source: Cointelegraph/TradingView

If buyers succeed in driving the price above $10, the LEO/USD pair will complete a bullish ascending triangle pattern. The pair could then embark on an upward move towards the target of $12.04.

Conversely, if the price pulls back and breaks below $9.60, it would indicate that the bulls have relinquished their positions, potentially causing the pair to fall to the uptrend line, which is expected to attract buyers again.

Toncoin price analysis

Toncoin (TON) has been facing resistance at the 50-day SMA ($3.56), but a positive development is that the bulls are not retreating in the face of pressure from the bears.

Daily chart of TON/USDT. Source: Cointelegraph/TradingView

This increases the chances of breaking and closing above the 50-day SMA. Should that occur, the TON/USDT pair might rise to $4.50 and then further to $5. A strong defense from sellers is expected around the $5 mark.

This optimistic scenario would be challenged if the price declines and breaks below the 20-day EMA ($3.26), as this would signify selling at higher levels. The pair could then face a drop to $3.

This article does not offer investment advice or recommendations. Every investment and trading decision carries risk, so readers should conduct their own research before making choices.