Bitcoin, Ethereum, and XRP saw slight gains on Wednesday as traders prepared for the U.S. FOMC rate announcement scheduled for 2 PM ET. In contrast to earlier bear markets, traders are observing shorter bear cycles followed by sudden price spikes.

The forthcoming FOMC meeting might lead to increased volatility in the prices of these top three cryptocurrencies, offering potential buy-the-dip scenarios or chances for traders to book profits amidst an extended bear market.

Trader Sentiment Shifts Risk-Averse for Bitcoin, Ethereum, and XRP

In the past day, traders of Bitcoin (BTC), Ethereum (ETH), and XRP (XRP) have decreased their participation in the derivatives market. Data indicates an approximate 11% decline in BTC trade volume and about a 7% drop for ETH. XRP experienced an even steeper decline, nearing 14% in trade volume during the same period.

Market analytics show that after nearly $89 million in liquidations occurred within the last 24 hours for the top three cryptocurrencies, traders have grown increasingly risk-averse.

In terms of Open Interest, a crucial derivatives indicator reflecting the total value of all open contracts for a specific token, there was a notable increase of 1.42%, 4.90%, and 1.49% for BTC, ETH, and XRP, respectively.

On-Chain Analysis for BTC, ETH, and XRP

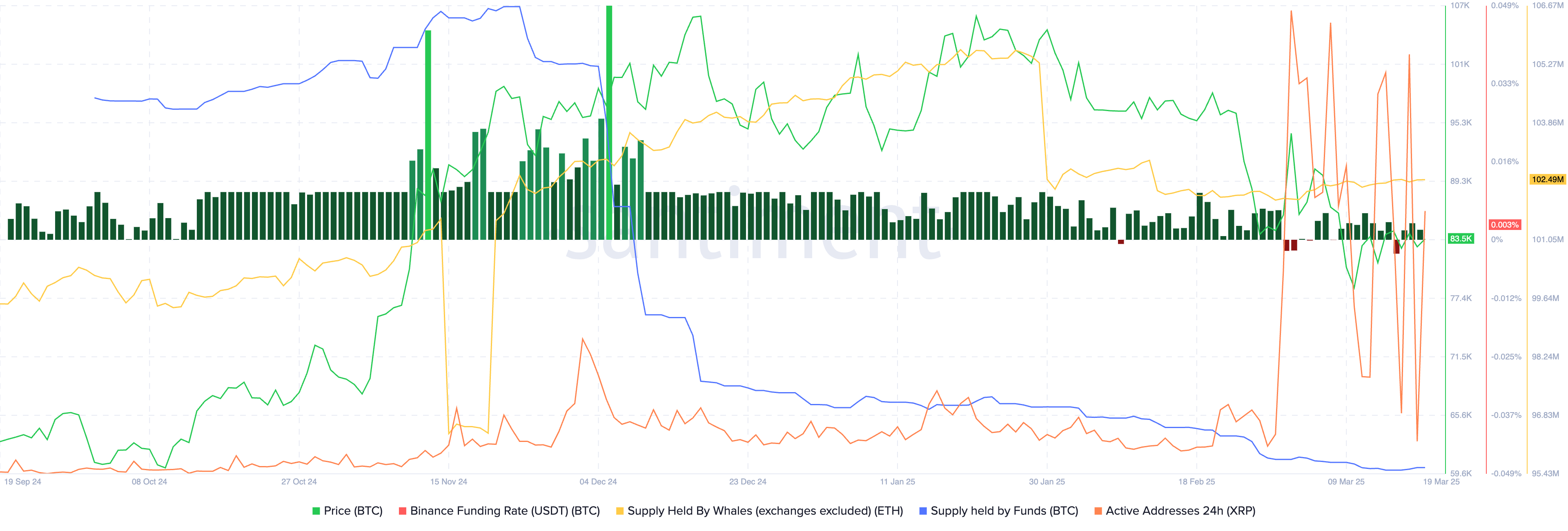

According to on-chain analysis for the top three cryptocurrencies, the Binance funding rate for Bitcoin has remained positive for three days in a row, implying that derivatives traders are expecting the price to rise, even as their activity in BTC decreases. Ethereum’s supply with whales, excluding exchanges, remains stable, while Bitcoin held by funds has seen a consistent reduction. Additionally, XRP’s active addresses increased on Wednesday after experiencing a dip the previous day.

The varied on-chain data hints at a slightly bullish outlook for Bitcoin and XRP, while Ethereum’s price could remain steady amid the anticipated volatility from the upcoming FOMC decision.

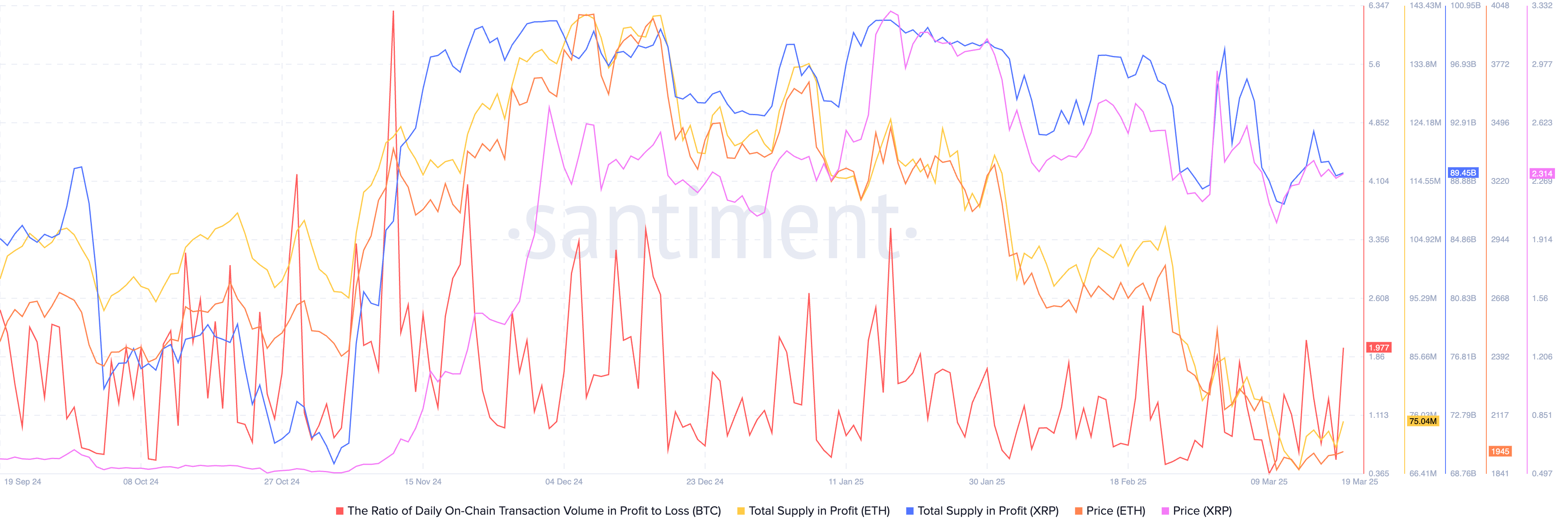

On the Bitcoin blockchain, the ratio of profitable daily on-chain transactions is nearly double that of loss-making transactions, suggesting opportunities for traders who initially purchased at lower prices. Ethereum shows a slight rise in profitable supply, a trend mirrored in XRP.

Traders in both Ethereum and XRP face limited opportunities for profit-taking, as evidenced by the accompanying charts.

Trump’s Stance and the Upcoming FOMC Rate Decision

The CEO of Bitget noted that many traders are left bewildered by Trump’s pro-crypto approach. The concept of a strategic Bitcoin reserve in the U.S. is gathering momentum, and while the government has yet to make any purchases, this may soon change.

“The Stablecoin bill is advancing in Congress, indicating a substantial shift toward a blockchain-centric financial system. Prominent figures, including Elon Musk, are looking into their own stablecoins, with Trump’s team viewing stablecoins as a way to uphold the dollar’s global standing.

Moreover, on the economic front, discussions about a potential “detox period” could suggest an impending controlled downturn. Trump’s strategy appears clear: attribute any recession to Biden, utilize tariffs and crypto narratives to contain costs, and advocate for lower interest rates to stimulate tech and AI expansion. It’s a strategy of short-term discomfort for long-term benefits.”

She remains positive about Bitcoin’s prospects, asserting that it is unlikely to dip below $70,000.

“A price drop to the range of $73-$78k is probable, presenting a solid entry point for hesitant buyers. Within the next 1-2 years, $200,000 for Bitcoin may be more achievable than most anticipate.”

With the FOMC interest rate decision on the horizon, higher volatility and price fluctuations are expected as traders react to the announcement.

The Chief Analyst at Bitget highlighted in a statement:

“The FOMC meeting on March 19, 2025, is likely to keep the federal funds rate steady at 4.25%-4.50%, with the Fed adopting a cautious, data-driven perspective amid ongoing inflation and robust economic growth.

Crypto markets might see a brief rally if the Fed hints at rate reductions, which would boost risk appetite, or a downturn if a hawkish approach tightens financial conditions. Nonetheless, Bitcoin’s increasing resilience and favorable pro-crypto policies might lessen the overall market impact.”

He anticipates volatility around the announcement, potentially influenced by remarks from Federal Reserve Chair Powell and updated rate projections.

“The crypto market might continue to display greater independence from the Fed’s decisions. Following the FOMC meeting, Bitcoin could fluctuate between $80,000 and $86,000 with 80% confidence, while Ethereum is expected to range from $1,800 to $2,100 under the same confidence level. These ranges reflect possible fluctuations influenced by macroeconomic signals, investor sentiment, and general financial conditions.”

Bitcoin Aims for $87,000, Ethereum Eyes $2,100

Bitcoin is looking to reclaim the $87,000 mark as it shows signs of recovery on Wednesday. Currently trading at $83,517, technical indicators on the daily chart suggest that gains are likely for the token.

Bitcoin’s Relative Strength Index (RSI) is at 44 and trending upward, indicating positive momentum. The MACD has displayed green histogram bars for the past four consecutive days, supporting bullish movement for Bitcoin.

Ethereum rose by 2.39% on the day, aiming to test the crucial $2,000 level before making a bid for the $2,100 support. This represents roughly a 7% increase in Ethereum’s value.

Key momentum indicators, RSI and MACD on Ethereum’s price chart, affirm the possibility of recovery on the daily timeframe.

A potential flash crash in Bitcoin could drive Ethereum down to a recent low of $1,754.

XRP Price Outlook

XRP may rise nearly 7% and test significant resistance at the upper limit of a Fair Value Gap on the daily chart, situated at $0.2707. The RSI is trending upward at 47, approaching the neutral mark of 50.

MACD signals a fundamental bullish trend for XRP’s price movement.

XRP traders are keenly anticipating developments regarding the lawsuit from U.S. regulators against Ripple. Additionally, XRP’s potential inclusion in a Strategic Reserve, as per recent executive orders, could serve as a significant catalyst for price movement in the near term amidst the volatility anticipated from the FOMC rate decision.

Disclosure: This article does not constitute investment advice. The content and materials on this page are intended for educational purposes only.