The native token of Solana, SOL, experienced an 8% increase on March 19 as investors gravitated towards higher-risk assets in anticipation of remarks from US Federal Reserve Chair Jerome Powell. Although interest rates are expected to remain steady, analysts predict a more favorable inflation outlook for 2025. Additionally, key onchain and derivatives indicators for Solana hint at potential price growth for SOL.

The cryptocurrency market reflected the intraday trends of the US stock market, indicating that SOL’s rise was not driven by specific industry news, such as the reports suggesting that the US Securities and Exchange Commission might dismiss its lawsuit against Ripple after maintaining it for four years.

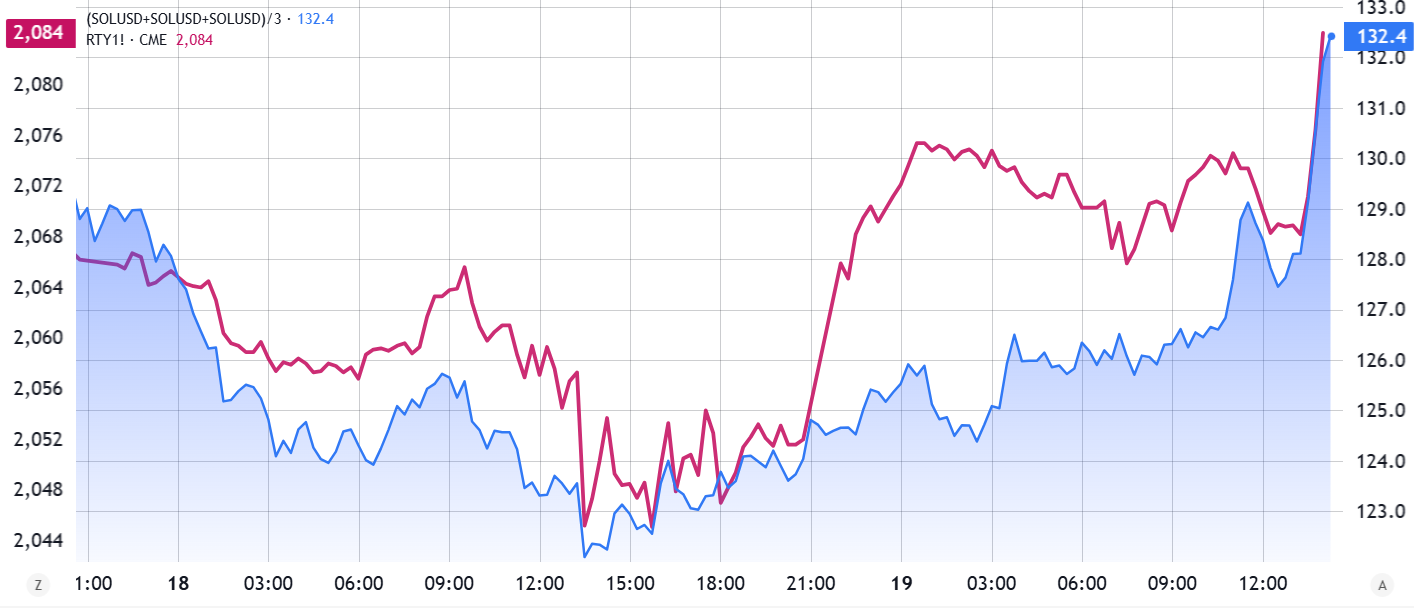

Russell 2000 small-cap index futures (left) vs. SOL/USD (right). Source: TradingView

On March 19, the Russell 2000 index futures, which track US-based small-cap firms, reached their highest level in twelve days. Despite a broader decrease in decentralized application (DApp) activity, Solana continues to stand out.

Solana’s TVL is on the rise

Although Solana’s onchain volumes fell by 47% over a two-week period, similar declines were noted across Ethereum, Arbitrum, Tron, and Avalanche, reflecting industry-wide trends rather than unique challenges for Solana. The total value locked (TVL) in the Solana network surged to its highest mark since July 2022, bolstering SOL’s optimistic outlook.

Solana total value locked (TVL), SOL. Source: DefiLlama

On March 17, Solana’s TVL reached 53.2 million SOL, signifying a 10% gain from the previous month. In comparison, the TVL for BNB Chain grew by 6% in BNB terms, while Tron’s deposits experienced an 8% drop in TRX terms during the same timeframe. Despite a slowdown in DApp activity, Solana kept attracting a consistent flow of deposits, demonstrating its resilience.

Notably, Solana witnessed strong momentum driven by Bybit Staking, which saw deposits increase by 51% since February 17, as well as Drift, a perpetual trading platform with a 36% rise in TVL. Additionally, the restaking application Fragmentic reported a remarkable 65% increase in SOL deposits over the last 30 days. In nominal terms, Solana secured the second position in TVL at $6.8 billion, surpassing BNB Chain’s $5.4 billion.

Despite the prevailing market downturn, several Solana DApps rank among the top 10 in fees, outperforming larger rivals like Uniswap and leading staking solutions on Ethereum.

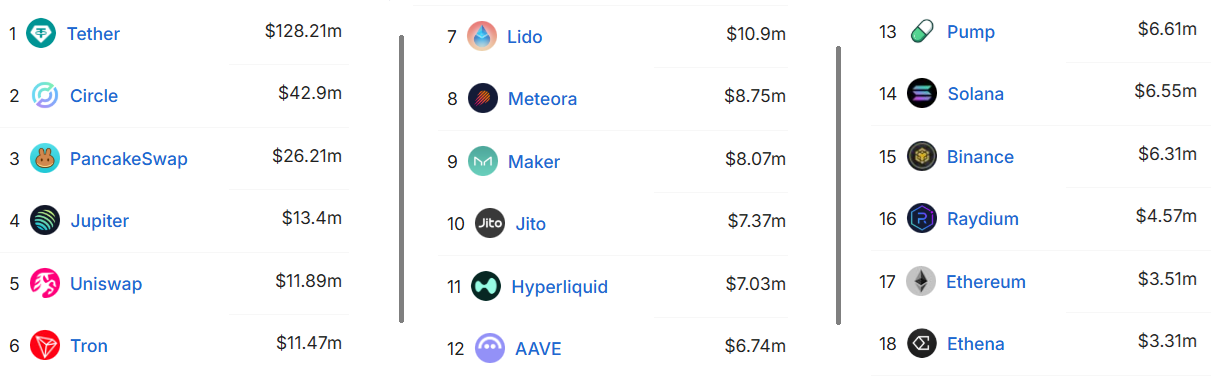

Ranking by 7-day fees, USD. Source: DefiLlama

Among the top fee-generating platforms are Solana’s memecoin launchpad Pump.fun, the decentralized exchange Jupiter, the automated market maker and liquidity provider Meteora, and the staking platform Jito. Remarkably, Solana has seen its weekly base layer fees exceed those of Ethereum, which leads with $53.3 billion in TVL.

SOL derivatives remain stable as token unlock concerns ease

Even with a 27% drop in SOL’s price over the past month, demand for leveraged positions is balanced between buyers and sellers, as reflected by the futures funding rate.

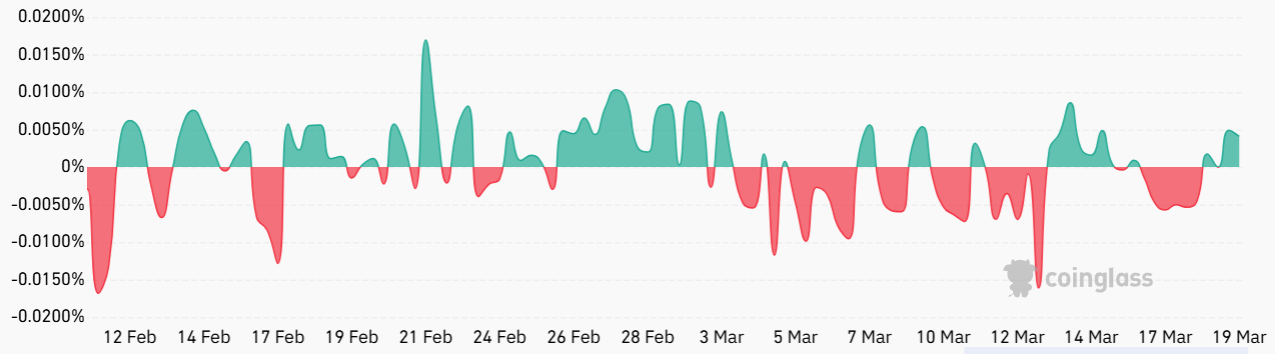

SOL futures 8-hour funding rate. Source: CoinGlass

Periods of heightened demand for bearish bets often drive the 8-hour perpetual futures funding rate to -0.02%, equating to 1.8% monthly. When the rate is negative, shorts incur costs to uphold their positions. Conversely, optimism regarding SOL’s price elevates the funding rate beyond 0.02%.

The recent price decline hasn’t been sufficient to cultivate strong confidence among bears, particularly regarding the addition of leveraged positions. One factor contributing to this may be the anticipated slowdown in SOL supply growth moving forward, akin to trends in inflation. A total of 2.72 million SOL is scheduled to be unlocked in April, with only 0.79 million anticipated for May and June.

In conclusion, SOL is well-situated to reclaim the $170 mark seen on March 3, propelled by sustained deposit resilience, a lack of bearish leverage demand, and a decrease in supply growth in the upcoming months.

This article is intended for informational purposes only and should not be construed as legal or investment advice. The views and opinions expressed herein are solely those of the author and do not necessarily reflect the opinions of any other party.