To stay competitive in the era of borderless and permissionless finance, the United States must create a robust protective barrier around highly secure tokenized real-world assets (RWAs), as highlighted by Sergey Nazarov, co-founder of Chainlink.

In a discussion with Turner Wright at the Digital Asset Summit in New York, Nazarov pointed out that blockchain represents a global trend driven by open-source software and decentralized technology, distinguishing it from earlier technological evolutions.

The executive emphasized that the transition to online commerce—which previously gave the US an edge with a five- to ten-year lead in internet infrastructure development—does not translate to the current landscape of digital finance. He remarked:

“The US really needs to leverage its two other strengths: a robust domestic market and the capability to generate these highly dependable financial assets. I believe this is becoming clear to the administration and legislative bodies.”

Nazarov predicted that tokenized real-world assets could evolve into a massive $100 trillion market as global assets transition on-chain.

Sergey Nazarov participating in a panel at the 2025 Digital Asset Summit.

Tokenized RWAs Reach New Heights

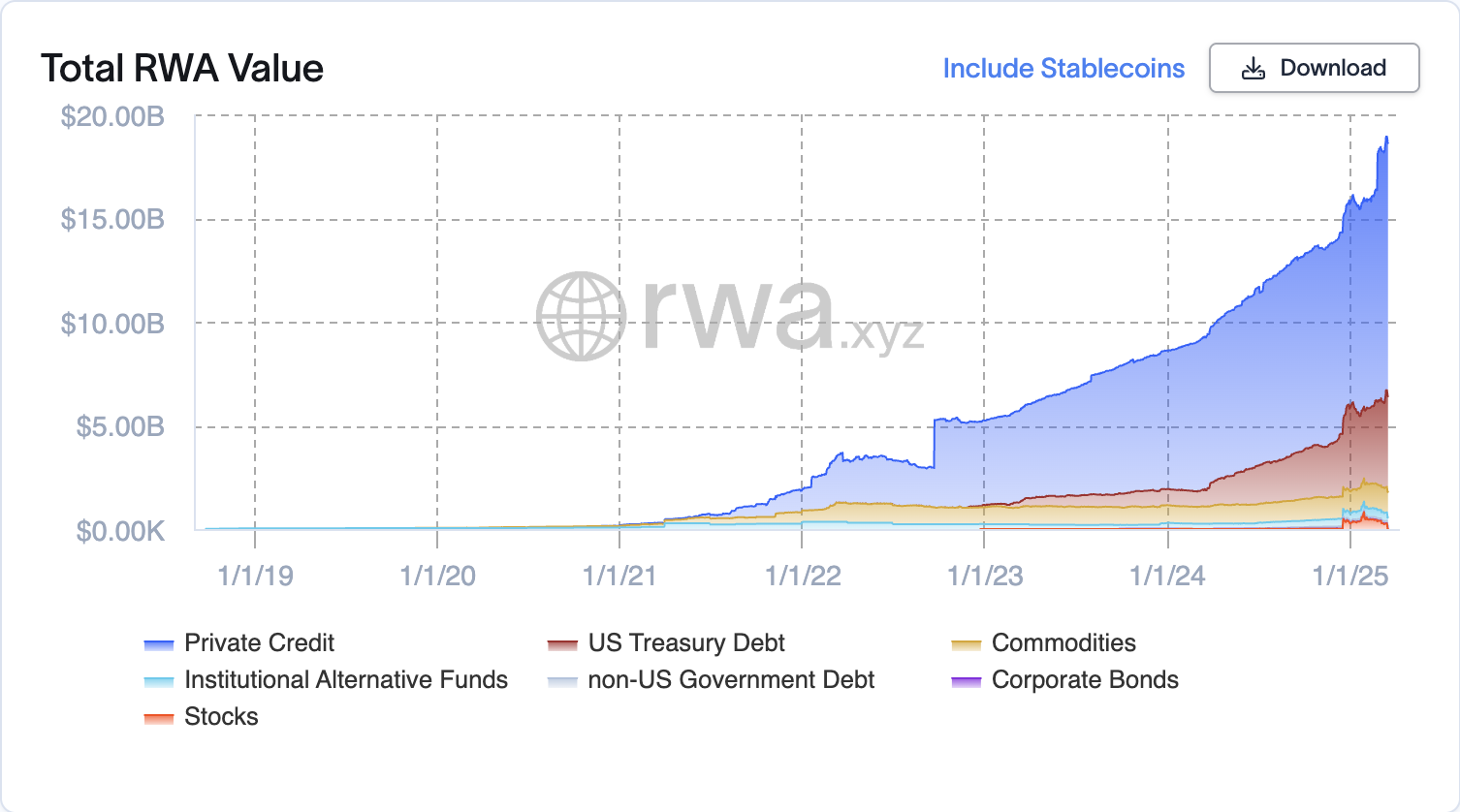

As reported by RWA.xyz, real-world tokenized assets, not including stablecoins, surged to an all-time high of $18.8 billion in 2025.

The bulk of this market capitalization was dominated by private credit, with over $12.2 billion in tokenized private credit instruments circulating at that time.

Total tokenized real-world assets, excluding stablecoins.

Tokenization of assets can enhance liquidity for traditionally illiquid asset classes, such as real estate, effectively removing the inherent illiquidity discount associated with physical properties.

In February, the CEO of Polygon, Marc Boiron, remarked that tokenizing real estate could lead to fractional ownership, eliminate the need for intermediaries, and reduce settlement costs—revolutionizing a generally sluggish sector.

This transformation in real estate is observable in Turkey, with initiatives like Lumia Towers, a 300-unit mixed-use commercial development that has been tokenized using Polygon’s technology.

The trend is also evident in the United Arab Emirates, renowned as one of the globe’s hottest property markets. Progressive regulations surrounding digital assets are fueling a tokenized RWA boom in the Gulf region, attracting institutional investors and developers looking to tokenization as an innovative method of raising capital.

Magazine: Real Life Yield Farming: How Tokenization is Transforming Lives in Africa