Two new futures exchange-traded funds (ETFs) focused on Solana (SOL) will be launched on March 20. These funds are named the Solana ETF (SOLZ) and the 2X Solana ETF (SOLT).

As per the regulatory filings, SOLZ will have a management fee of 0.95% that will rise to 1.15% after June 30, 2026.

The 2X Solana ETF provides investors with double the leverage, accompanied by a management fee of 1.85%.

Solana ETF SEC filing.

These filings mark the first ETFs based on Solana in the United States and follow the introduction of SOL futures contracts by the Chicago Mercantile Exchange (CME) Group.

In light of recent leadership changes at the SEC and the reelection of a former president, asset managers and ETF issuers have flooded the SEC with applications seeking approvals for a variety of ETFs.

CME Group launches SOL futures

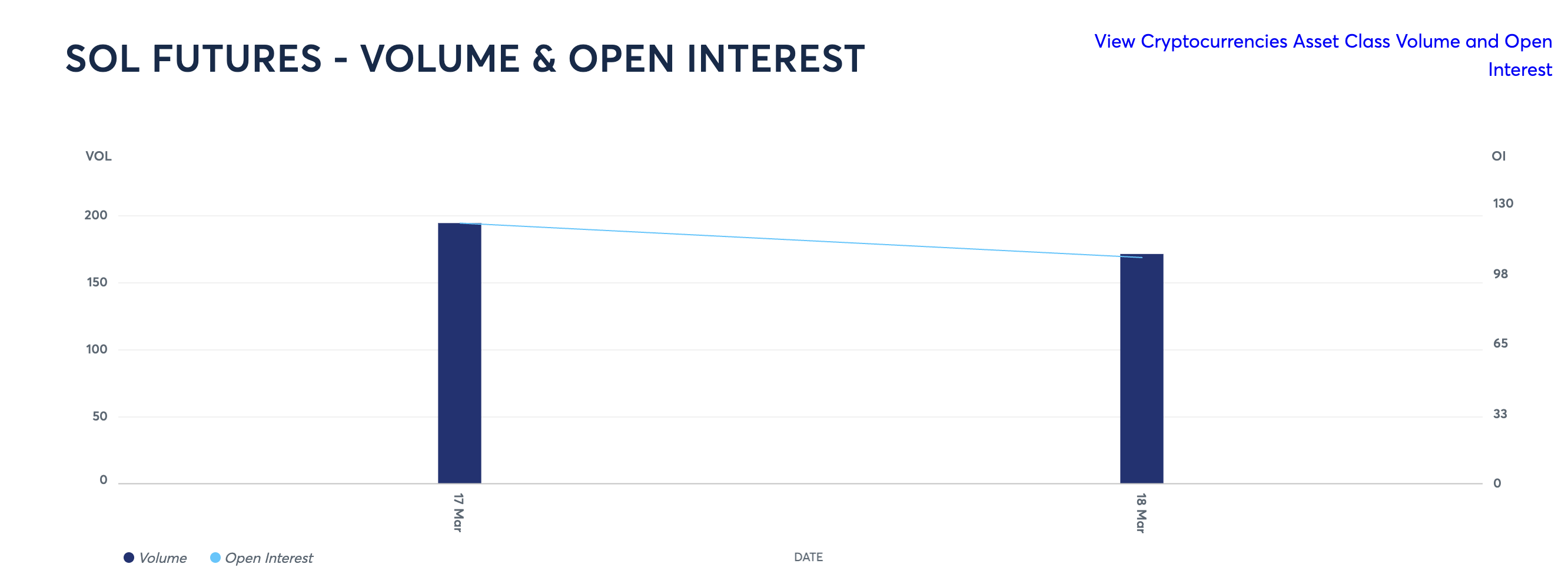

SOL futures were introduced on March 17, with an initial trading volume of around $12.1 million on their debut.

For comparison, Bitcoin (BTC) futures saw opening volumes exceeding $102 million, while Ether (ETH) futures had over $30 million on their launch day.

Although the opening volume for SOL was relatively modest, these futures contracts could increase institutional interest in the cryptocurrency and aid in price discovery.

SOL futures volume and open interest.

The introduction of SOL futures has essentially paved the way for the approval of SOL ETFs in the U.S. as regulatory attitudes towards digital assets evolve.

Chris Chung, the founder of Titan, a platform utilizing Solana for swaps, remarked that the CME’s futures signal SOL’s maturation as an asset capable of attracting institutional players.

Chung further asserted that the arrival of SOL futures and ETFs places Solana as a blockchain ready for real-world applications, such as payments, rather than merely serving as a speculative asset.

ETFs could drive significant investment towards SOL, potentially leading to a prolonged upward trend that rival projects without their own ETFs might not experience.

The anticipated debut of Bitcoin ETFs in 2024 is expected to have redirected institutional investment away from other segments of the crypto market, disrupting the typical flow of capital into altcoins.

Magazine: Memecoins are dead — But Solana is ‘100x better’ despite a revenue drop