The price of Ether (ETH) surged nearly 8% within the last 24 hours, reaching a peak of $2,064 on March 19. The daily trading volume for the altcoin rose to $17.4 billion as ETH reclaimed the $2,000 threshold.

Ethereum 1-hour chart. Image source: TradingView

ETH shows a breakout from the ascending triangle

The price of Ether has increased following a successful breakout from an ascending triangle formation. After dipping below $2,000 on March 10, Ether established higher lows and made several attempts to retest the immediate resistance at $1,950, the neckline of the pattern.

A bullish divergence also formed between the price and the relative strength index (RSI), signifying a local bottom at $1,752. Such technical indicators suggest that bullish momentum is taking precedence over the bearish trend.

Bitcoin 4-hour chart. Image source: TradingView

With a confirmed breakout from the triangle pattern, the technical target remains at $2,142, which is approximately a 5% increase from ETH’s current price. However, the 100-day exponential moving average (marked by the blue line) is acting as resistance at $2,050, which needs to be converted into support for ETH to aim for $2,142.

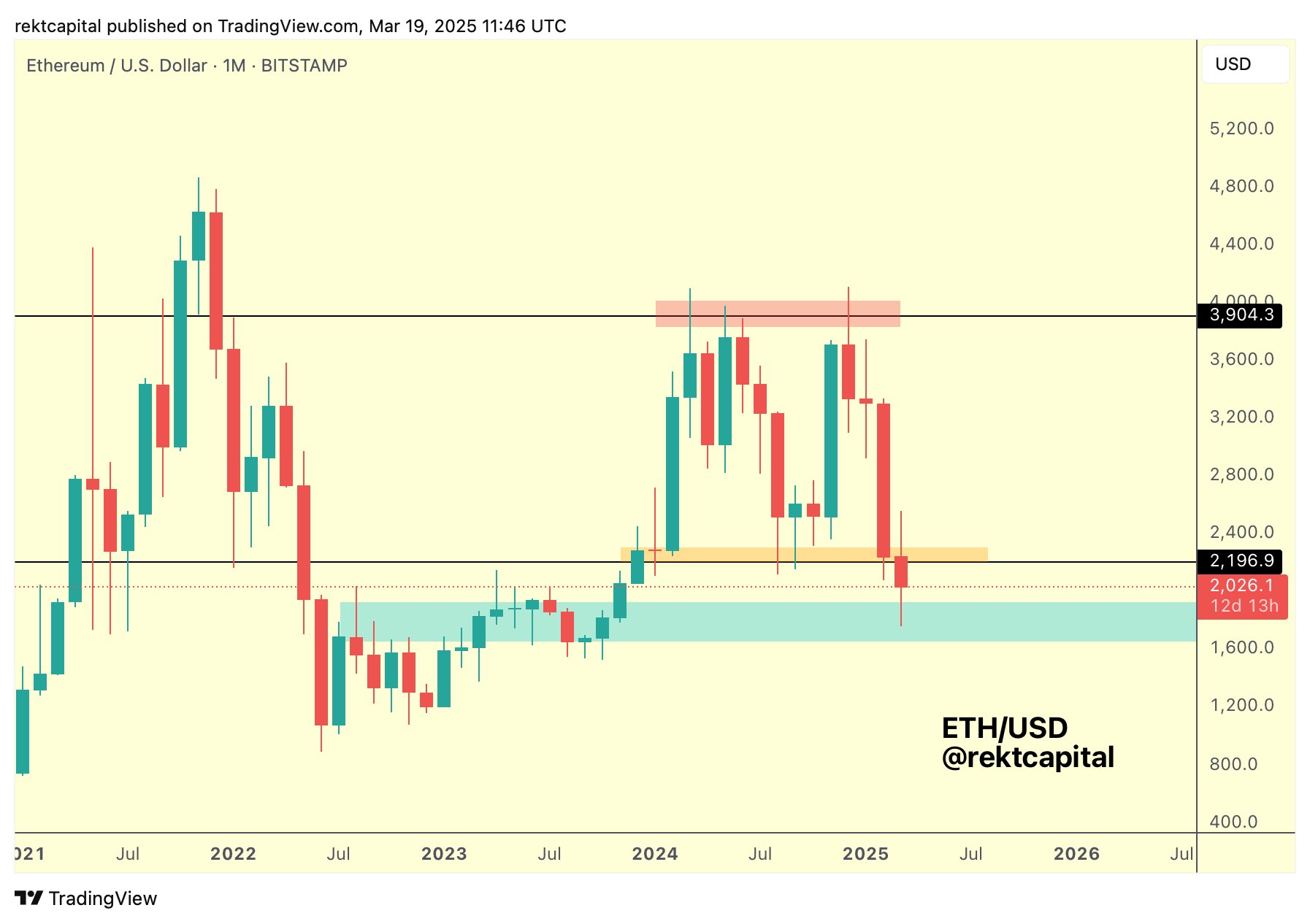

An anonymous crypto analyst noted that ETH recently tested its multi-year demand area below the $2,000 mark. Regarding a potential bullish reversal, the trader remarked,

“If the price can generate a strong enough reaction here, then ETH will have the opportunity to reclaim the $2196-$3900 macro range (highlighted in black).”

Monthly analysis of Ethereum from the analyst’s perspective.

Related: ETH price outlook clouded as Ethereum DEX volumes decline by 34% in a week

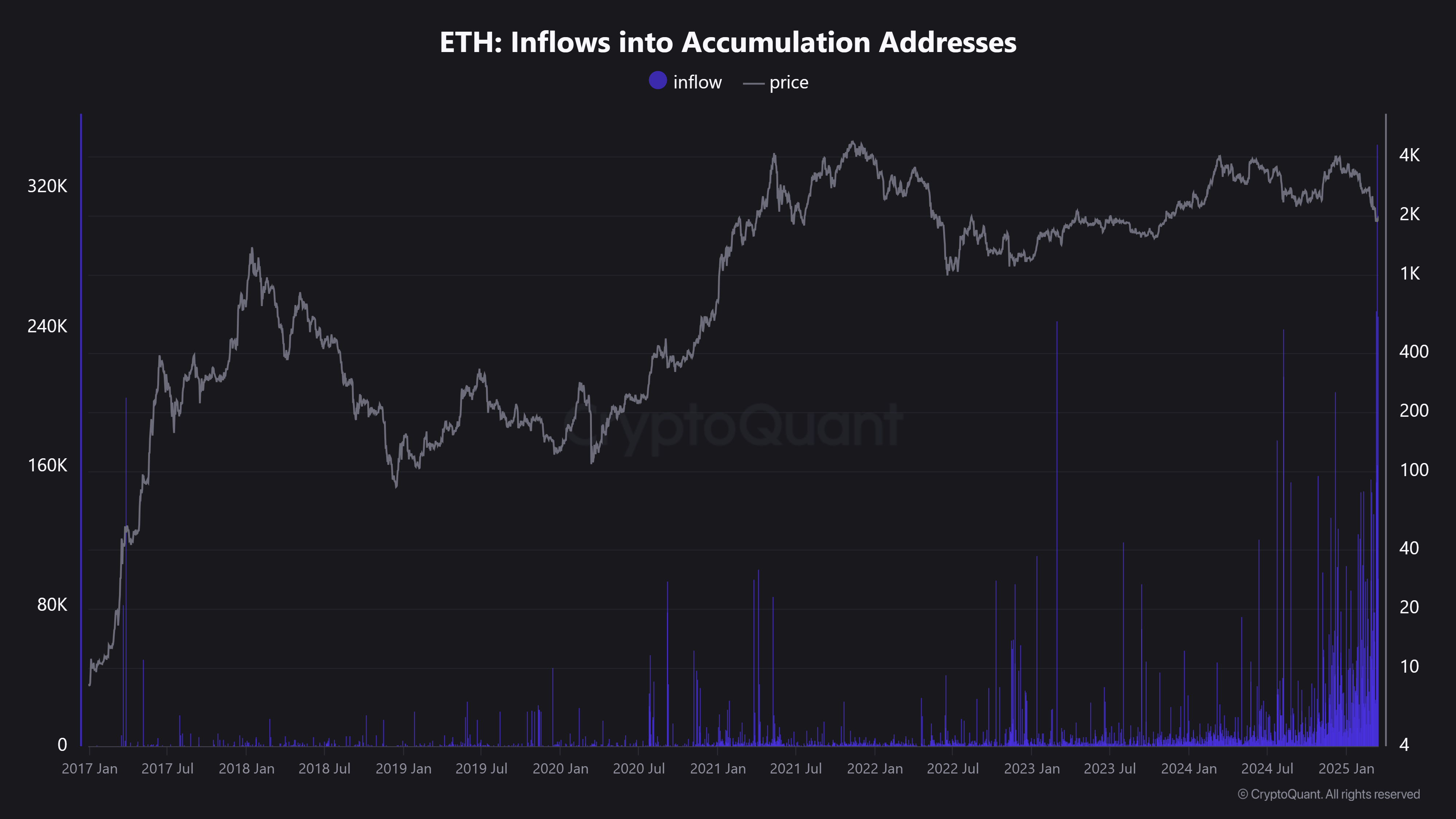

Ethereum accumulation addresses see record inflows

Despite recent price fluctuations, ETH accumulation addresses have been accumulating at a rapid pace. On March 12, inflows into these accumulation addresses reached a single-day record of 345,210 ETH.

ETH inflows into accumulation addresses.

Accumulation addresses refer to a type of wallet that tracks long-term holding behavior within the Ethereum network. These wallets typically do not have outgoing transactions, indicating that the ETH is not being used for spending or moved elsewhere.

Throughout 2024, these addresses accumulated over 5.8 million ETH over a 12-month period. In just under three months of 2025, this accumulation rate has dramatically increased, with the same addresses acquiring 4.73 million ETH.

Onchain data shows that larger holders may be taking advantage of ETH’s lower price by purchasing the altcoin at a discount, which is currently 58.4% below its all-time high.

This article does not include investment advice or recommendations. All investment and trading activities carry risks, and readers should perform their own research before making decisions.