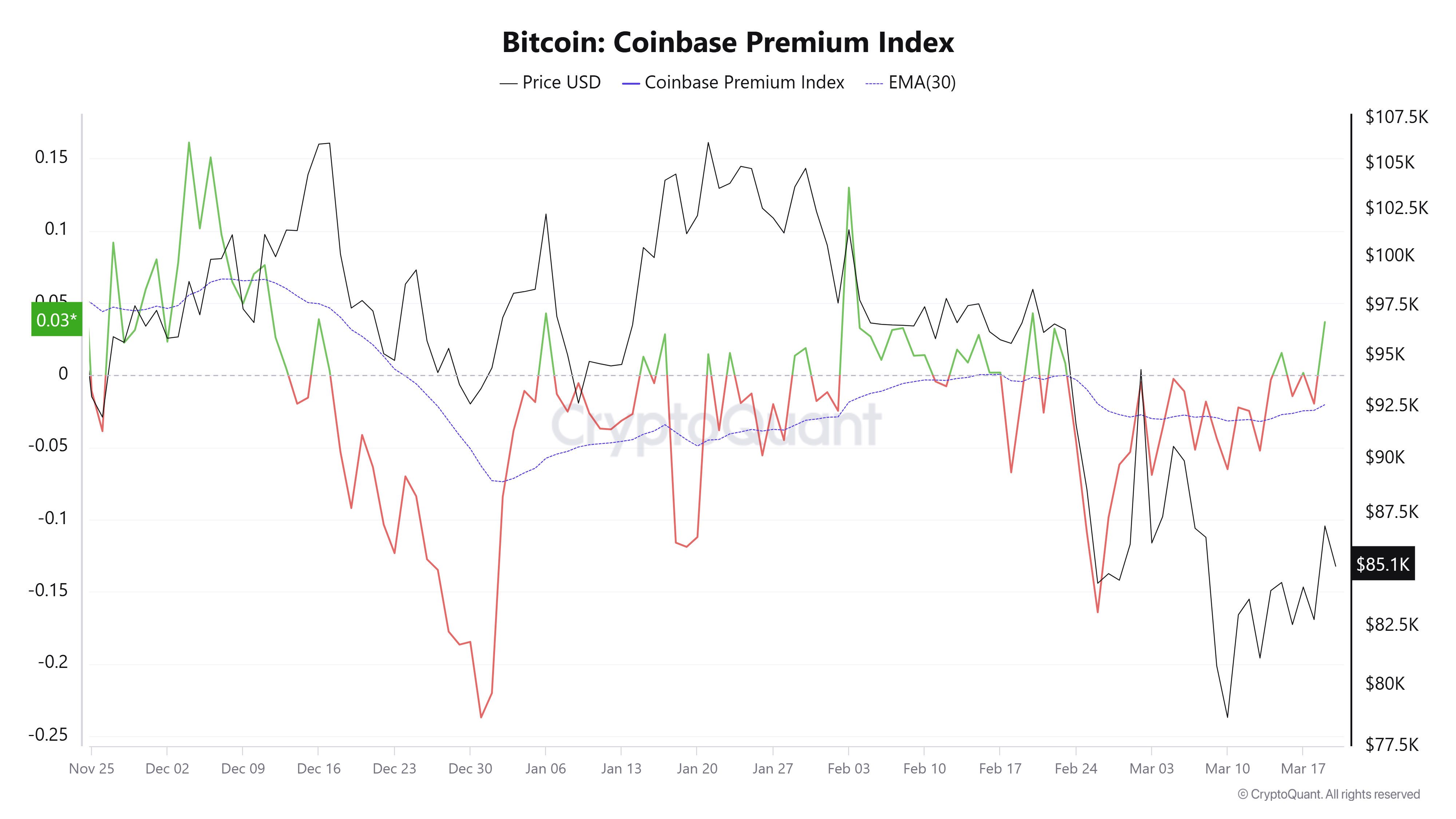

The Coinbase premium index for Bitcoin (BTC) has reached its highest point since February 20, following a 5% price surge on March 19.

Bitcoin’s Coinbase premium index analysis.

Resurgence of Coinbase premium indicates Bitcoin accumulation

This premium index reflects the price disparity between BTC on Coinbase and Binance; a higher index value suggests increased buying pressure from US investors. Although it primarily measures retail interest in the US, a verified analyst noted it could also indicate significant accumulation by US institutions and large investors.

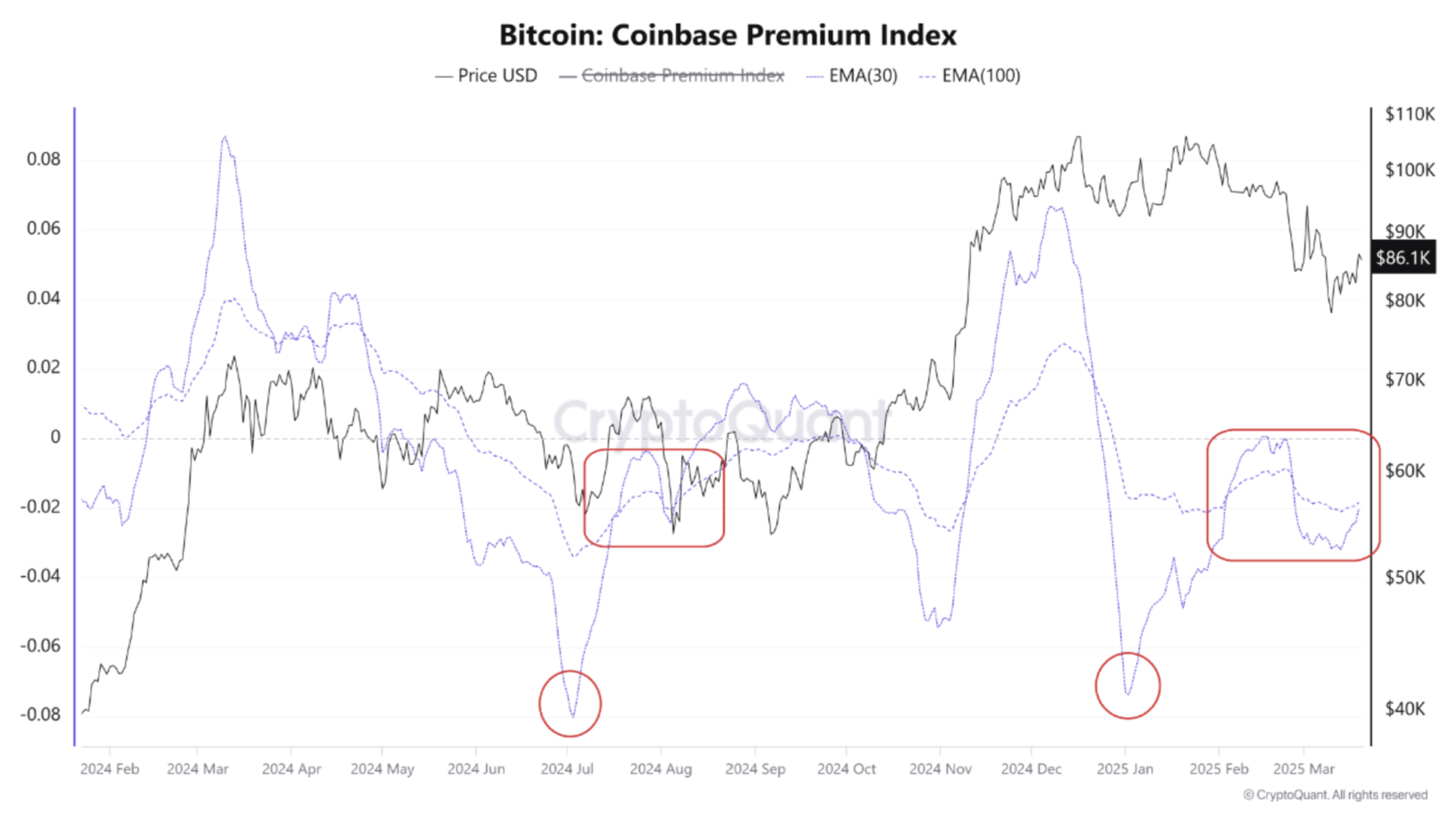

Analysis of Coinbase premium.

The analyst highlighted that the index’s 30-day exponential moving average (EMA) has crossed above the 100-day EMA, signaling the involvement of major players. They also commented,

“Historical data indicates that when this indicator climbs, BTC bull markets usually endure. There’s a strong probability of an accumulation phase, making it an important moment to observe BTC’s momentum.”

Coinbase Pro was incorporated into Coinbase Advanced at the beginning of 2024, a platform utilized by companies like Strategy and Tesla for BTC transactions. Thus, it is likely that the Coinbase premium reflects some level of institutional interest from the US.

Related: Analysts speculate $77K could be the Bitcoin bottom with QT effectively finished.

Is Bitcoin poised to reach $90K in March?

One significant positive noted in BTC’s 1-day chart is its bullish rebound on the 200-day exponential moving average (denoted by the orange line). Sustained prices above this EMA indicate an increased likelihood for BTC to establish higher highs on the chart.

Bitcoin 1-day chart.

Having successfully broken past the $85,000 resistance level, converting it into support enhances the chances for a retest of $90,000. Furthermore, the price of Bitcoin bounced from the lower boundary of the Bollinger Bands (BB), while the moving average of this metric stays above the $90,000 mark.

The bullish scenario would be negated if a daily candle closes below $85,000 before the week’s end. An expert has expressed optimism, stating they foresee a continuing run toward retesting $90,000 in the coming days.

Conversely, another analyst noted that BTC might need a “little more work.” They indicated that the EMA cloud indicators are still hindering BTC from moving beyond the $88,000 and $90,000 regions. The analyst added,

“Bitcoin is trending upwards on all time frames except for the Daily & Weekly (RSI).”

Similarly, a crypto trader has advised caution until there is a definitive change in the market structure. They pointed out that Bitcoin (BTC) prices are at a critical threshold beneath $90,000, with the risk of a correction to below $73,000 remaining a significant concern.

Related: What is driving the current rise in Bitcoin prices?

This article is not intended as investment advice or recommendations. All forms of investing and trading involve risk, and it is crucial for readers to perform their own research when making decisions.