Leverage-based bullish positions in Bitcoin (BTC) on the Bitfinex exchange have surged to their highest level in almost six months, reaching 80,333 BTC as of March 20—amounting to $6.92 billion. The 27.5% rise in Bitcoin margin longs since February 20 has sparked speculation that the 12.5% price increase from the $76,700 low on March 11 may be fueled by leverage and could lack sustainability.

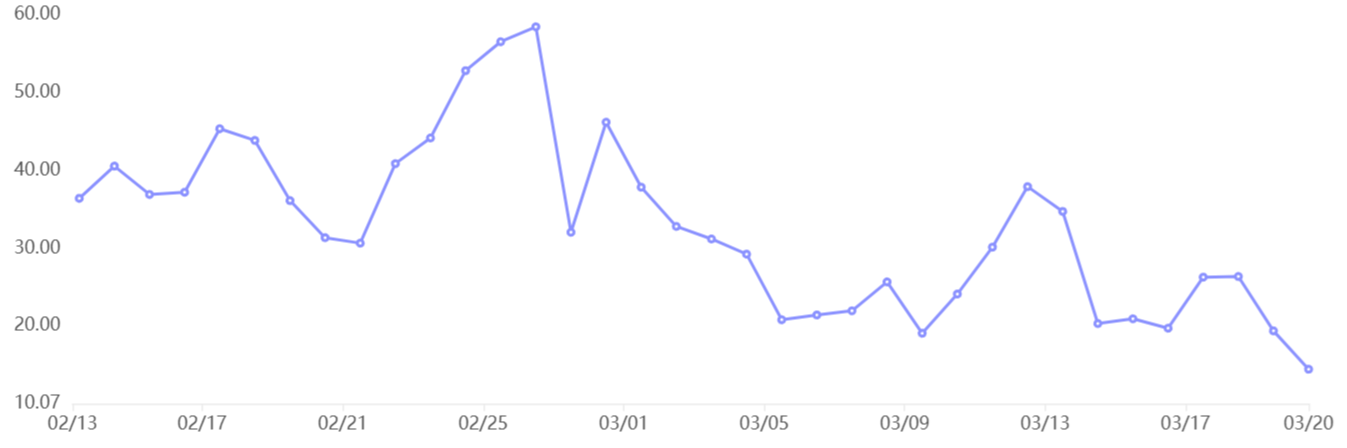

Margin long positions in BTC. Data from TradingView

Nonetheless, Bitcoin’s price doesn’t always move in sync with the bullish leverage positions seen on Bitfinex. For example, during the three weeks ending on July 12, 2024, significant investors added 13,620 BTC in margin longs, yet Bitcoin’s price declined from $65,500 to $58,000. Additionally, a similar uptick with 8,990 BTC in margin longs occurred leading up to September 11, 2024, coinciding with a price drop from $60,000.

Margin traders often reap large profits but carry higher risks

Over the long haul, these expert investors have successfully timed their entries, as Bitcoin’s price ultimately exceeded $88,000 in November 2024, even though margin long positions were reduced by 30% by the end of the year. Essentially, these traders enjoy substantial profits but demonstrate a significantly higher risk appetite and patience compared to the average market participant. Thus, a rise in demand for leverage doesn’t automatically equate to upward pressure on Bitcoin’s price.

Moreover, the cost of borrowing Bitcoin remains relatively low, providing avenues for market-neutral arbitrage, allowing traders to take advantage of low interest rates. Currently, borrowing BTC for a 60-day period on Bitfinex incurs an annualized cost of 3.14%, while the funding rate for Bitcoin perpetual futures is at 4.5%. Traders can potentially profit from this spread through ‘cash and carry’ arbitrage without facing direct exposure to price movements.

Even if we assume that a substantial portion of the $1.48 billion in margin longs are not arbitrage plays—indicating that these major investors are indeed betting on Bitcoin’s price rise—other exchanges might have offset some of this activity. For instance, there has been a significant decline in demand for Bitcoin margin longs on other platforms over the same timeframe.

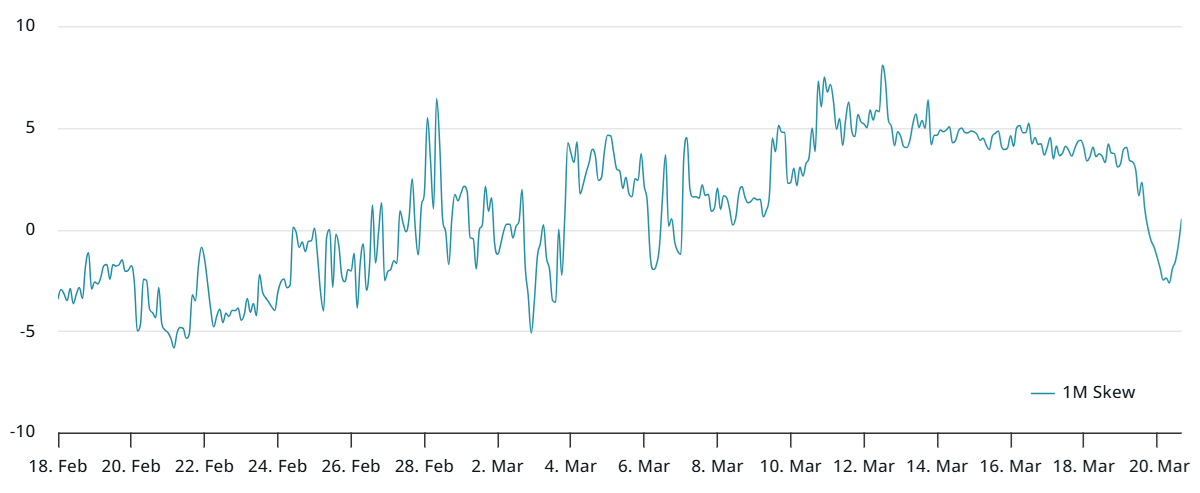

Long-to-short margin ratio for Bitcoin at another exchange.

The current long-to-short margin ratio shows that longs outnumber shorts by a factor of 15, the lowest point in over three months. Historically, an overabundance of confidence has pushed this ratio above 40, as seen most recently in late February when Bitcoin’s price surged above $105,000. Conversely, a ratio below 5 usually indicates strong bearish sentiments.

Bitcoin options pricing reflects risks of price fluctuations

To eliminate variability from margin markets, it’s also crucial to examine Bitcoin options. If traders predict a downturn, demand for put options increases, causing the 25% delta skew to rise above 6%. In contrast, during bullish phases, this indicator typically falls below -6%.

Delta skew for 30-day Bitcoin options.

Between March 10 and March 18, the Bitcoin options market displayed signs of bearish sentiment but has recently transitioned to a neutral outlook. This indicates that whales and market makers are pricing in similar risks for both upward and downward movements in price. Given the trends in the margin market and the present pricing of BTC options, a Bitcoin bull run is far from being a widely held expectation.

Bitcoin’s lack of upward momentum can be partly attributed to the higher inflation forecasts and weaker economic growth projections presented by monetary authorities on March 19. Fears of a potential recession, heightened by ongoing global trade conflicts, have caused investors to become more risk-averse. Consequently, even as major investors are increasing their exposure through Bitcoin margin longs, the overall sentiment in the market remains tepid.

This text serves general informational purposes and is not meant to serve as legal or investment advice. The views and opinions expressed herein are solely those of the author and do not necessarily reflect the views and opinions of any affiliated parties.