- On Thursday, Bitcoin’s price slipped slightly to around $85,500 after experiencing a nearly 5% increase the day before.

- President Trump urged the Federal Reserve to reduce interest rates as tariffs begin to negatively impact the economy.

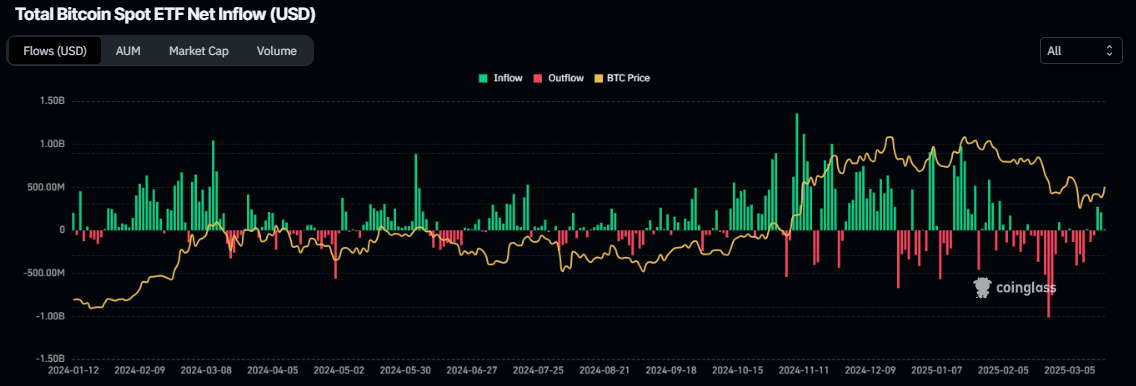

- U.S. spot Bitcoin Exchange Traded Funds (ETFs) have seen inflows for the third consecutive day this week.

- Thursday’s Digital Asset Summit features a historic moment, as it marks the first time a sitting U.S. president has spoken at a cryptocurrency conference.

At the time of writing on Thursday, Bitcoin (BTC) was trading around $85,500, experiencing a slight decrease after a recovery of nearly 5% the previous day, following the Federal Reserve’s announcement to maintain interest rates and its forecast for rate cuts this year. Additionally, President Trump took to the Truth Social platform on Wednesday, calling on the Fed to cut interest rates due to the damaging effects of tariffs on the economy. Meanwhile, U.S. spot Bitcoin Exchange Traded Funds (ETFs) have recorded a third straight day of inflows this week, indicating a decline in sell-side pressure.

On Thursday, Trump’s speech at the Digital Asset Summit is notable as it marks the first occasion a sitting president has addressed a cryptocurrency conference, which signals increasing acknowledgment of the industry at the highest levels.

Discussions around Russia-Ukraine conflict boost crypto investor optimism

On Tuesday, President Trump and President Putin of Russia agreed to an immediate halt in strikes against energy infrastructure as part of the ongoing Ukraine conflict.

Furthermore, President Zelenskiy of Ukraine and Trump have agreed to collaborate to bring an end to the prolonged conflict, which has further encouraged investor enthusiasm for risky assets like Bitcoin.

However, traders should remain vigilant regarding the escalating tensions in Gaza. The Israeli military announced a limited ground incursion into Gaza following an aerial bombardment that broke the recent ceasefire with Hamas. Israeli Prime Minister Netanyahu has warned of a potential expansion of the conflict, which may dampen investor confidence and instigate a risk-averse sentiment in the cryptocurrency market.

Trump urges Fed to reduce rates

On Wednesday, Bitcoin’s price surged nearly 5%, peaking at $87,000, spurred by the Federal Reserve’s decision to maintain interest rates and its rate cut forecast for the remainder of the year.

Analyst Haresh Menghani stated, “As expected, the Federal Reserve opted to keep interest rates steady for the second consecutive meeting and indicated the potential for two 25 basis point cuts before the year ends.”

However, Fed officials have lowered their growth outlook for the year amidst growing uncertainties regarding the effects of the current administration’s aggressive trade policies on economic performance. Since February, Trump has implemented a 25% tariff on steel and aluminum and threatened to introduce reciprocal and sector-specific tariffs, raising concerns about a potential global trade conflict.

On Wednesday, Trump used his Truth Social platform to call for the Fed to lower interest rates in light of the economic harm caused by tariffs.

Trump stated: “The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to ease into the economy. Do the right thing. April 2nd is Liberation Day in America!!!”

Trump to speak at Digital Asset Summit in New York

President Trump’s address at the Digital Asset Summit in New York on Thursday represents a historic moment, as it is the first occurrence of a sitting president speaking at a cryptocurrency conference, indicating growing recognition of the industry among top officials.

This event comes on the heels of Trump’s recent executive order aimed at establishing a strategic Bitcoin reserve, utilizing seized Bitcoin within his administration’s broader strategy to position the U.S. as the “crypto capital of the world.”

The summit, taking place in New York City, features discussions about the future of digital assets, with key representatives from the cryptocurrency sector and policymakers involved, showcasing the administration’s swift actions to support and regulate the industry.

BREAKING: President Trump will address DAS tomorrow

This is the first time a sitting President has addressed a crypto conference. pic.twitter.com/x3gnGP0yAN

— Blockworks (@Blockworks_) March 19, 2025

Experts in the cryptocurrency markets were interviewed regarding the Digital Asset Summit, with their insights presented below:

Tracy Jin, COO of MEXC

Q: What impact do you foresee from President Trump’s upcoming address at the Digital Asset Summit in New York on Bitcoin’s market sentiment and future cryptocurrency regulations?

The president’s speech at a cryptocurrency conference is a significant event for the market, and its effects are already manifesting—Bitcoin has stabilized around $85,000. Should this level falter, a short-term sell-off could ensue, potentially nudging prices back to the $81,000–$83,000 range.

Trump’s comments may yield unexpected results. A supportive statement towards the industry and a commitment to relieving regulatory burdens could trigger a strong market reaction, driving Bitcoin’s price higher. A resurgence to early February highs of $103,000, or even a new all-time peak, isn’t out of the question. How Trump’s address is perceived and if other figures, like Elon Musk and Trump Jr., express support will influence price movement significantly.

A more stringent stance emphasizing tighter oversight of the crypto sector could result in a short-term dip in Bitcoin’s price. Nevertheless, given the prevailing bearish market sentiment, a drop below $80,000 seems unlikely.

Investors are seeking clarity—bold proclamations followed by concrete actions are necessary. Even suggestions of regulatory easing could rekindle interest and enhance participation from institutional investors. The market has been driven by speculation and news for months, leaving uncertainty about the strength of the response this time.”

James Toledano, COO of Unity Wallet

His forthcoming address at the Digital Asset Summit (DAS) in New York could be crucial for DeFi, as it marks the first instance of a serving U.S. president addressing such an event. This opportunity also presents Trump with a platform to clarify his administration’s position on the strategic reserve and wider regulations. Bitcoin has recently recovered above $86,000. If the price spikes following his address, it would send a strong signal.”

Institutional interest in Bitcoin shows slight improvement

This week has seen a slight rebound in institutional interest in Bitcoin. According to Coinglass data, the Bitcoin spot ETF recorded $11.80 million in net inflow on Wednesday, following net inflows of $483.7 million over the previous two days. Continued and escalating inflows could further bolster Bitcoin’s price, suggesting a decrease in sell-side pressure.

Total Bitcoin spot ETF net inflow chart.

Bitcoin Price Outlook: Bulls eye $90,000 if the 200-day EMA holds up

Bitcoin’s price broke above and closed over its 200-day Exponential Moving Average (EMA) on Wednesday, achieving a high of $87,000 that day. As of Thursday’s writing, it is slightly down, retesting the 200-day EMA at $85,540.

If BTC maintains support and bounces off the 200-day EMA, it could extend the rally and revisit the critical psychological level of $90,000.

The Relative Strength Index (RSI) on the daily chart stands at 48 after facing rejection at the neutral mark of 50 on Wednesday, reflecting faint bearish momentum. The RSI needs to ascend above its neutral level of 50 for a sustained recovery rally.

The Moving Average Convergence Divergence (MACD) indicator indicated a bullish crossover on the daily chart last week, issuing a buy signal and suggesting a positive trend ahead. Furthermore, rising green histogram levels above the neutral level of zero show strength in upward momentum.

BTC/USDT daily chart

However, if BTC fails to find support at the 200-day EMA level of $85,540, it might experience a further decline toward its subsequent support level at $78,258.

Bitcoin, altcoins, stablecoins FAQs

Bitcoin is the leading cryptocurrency by market capitalization, functioning as a virtual currency intended for transactions. It is decentralized, meaning no single person, group, or entity controls it, which removes the need for third-party involvement in financial transactions.

Altcoins encompass all cryptocurrencies other than Bitcoin, although some consider Ethereum a non-altcoin due to the forking that occurs from these two. If true, Litecoin is the first altcoin, having forked from the Bitcoin protocol and thus represented an “enhanced” iteration.

Stablecoins refer to cryptocurrencies designed to maintain a stable value, supported by a reserve of the asset they represent. Their value is typically pegged to a commodity or financial instrument, such as the U.S. Dollar (USD), while their supply is regulated by algorithms or demand. The primary goal of stablecoins is to serve as a bridge for investors looking to trade and invest in cryptocurrencies, while also providing a means to store value, given the inherent volatility of cryptocurrencies.

Bitcoin dominance refers to the proportion of Bitcoin’s market capitalization relative to the total market capitalization of all cryptocurrencies combined. It provides insight into Bitcoin’s appeal among investors. A high Bitcoin dominance often occurs before and during a bullish market phase, when investors flock to relatively stable and high market capitalization cryptocurrencies like Bitcoin. Conversely, a decrease in Bitcoin dominance typically indicates a shift where investors move their funds and/or profits into altcoins in search of superior returns, which usually sparks altcoin rallies.