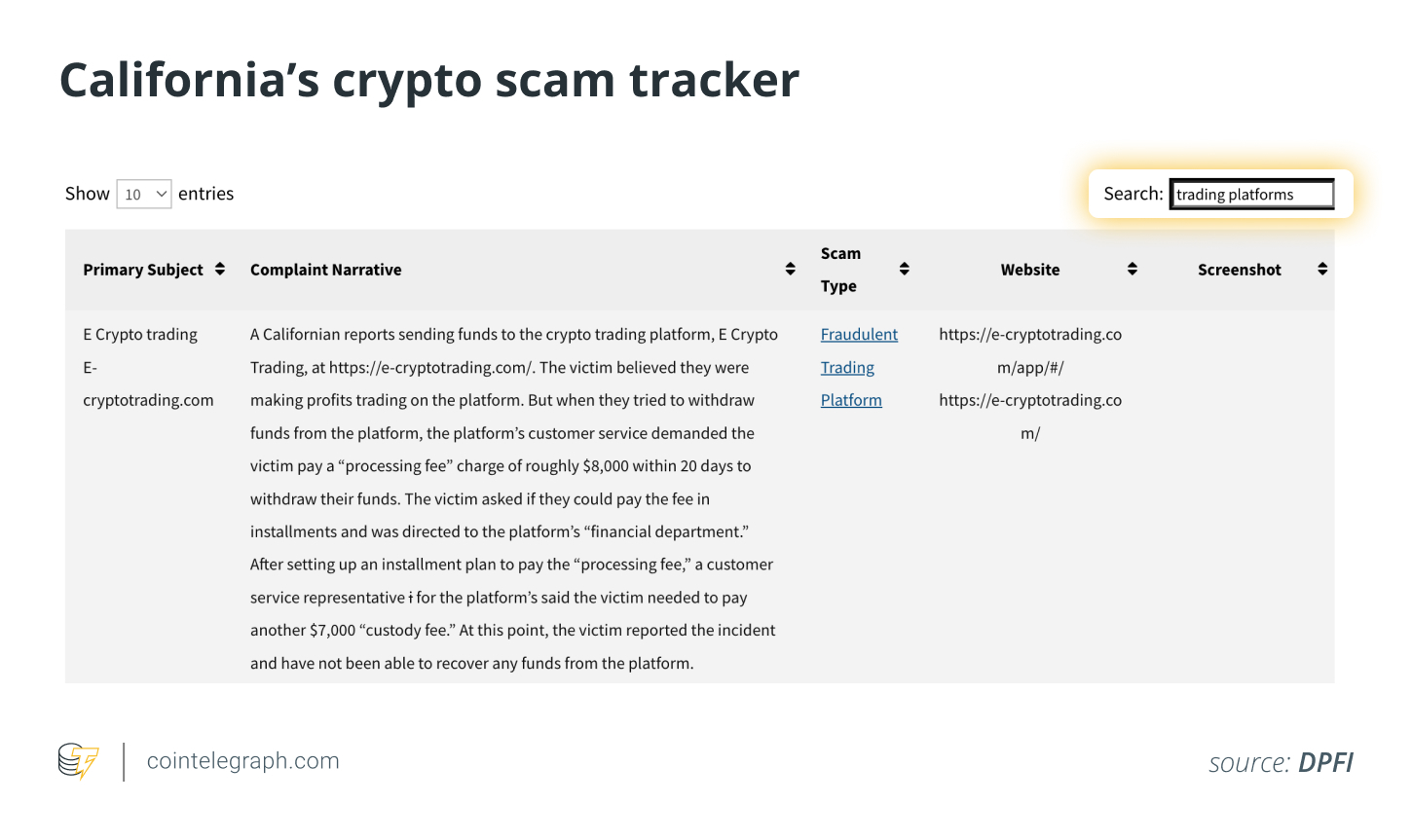

What is California’s cryptocurrency scam tracker?

On February 16, 2023, California unveiled a cryptocurrency scam tracker to assist residents in recognizing and steering clear of scams in the crypto realm. This tool showcases various fraudulent schemes identified through an analysis of public complaints.

The crypto scam tracker in California acts as a searchable database that aggregates reports concerning deceptive practices. Investors can utilize this resource to pinpoint and evade potential scams, searching by company name, type of scam, or relevant keywords.

This tracker features a glossary that clarifies commonly used terms in the cryptocurrency space and is updated frequently with new scam information. While the glossary may not cover all prevalent scams in detail, it provides essential insights to help you identify and protect against deceitful activities.

The tracker aggregates data from public complaints but does not independently validate reported losses. As new complaints arise, the tracker is updated, ensuring investors remain informed about recent scams.

If you believe you’ve been scammed or know of a scam not yet included in the tracker, you can report it. Submissions can be made online or by reaching out through a toll-free phone number. Companies that feel they have been wrongly listed can also contact the department for resolution.

Did you know? In 2024, the agency received upwards of 2,668 investor complaints from California and beyond. From these complaints, it collaborated with the state’s Department of Justice to take down over 26 crypto scam websites, recovering $4.6 million in consumer losses.

How to utilize California’s cryptocurrency scam tracker

This scam tracker is a crucial tool for uncovering patterns in scammer behavior, aiding investors in avoiding similar pitfalls. It also motivates individuals to report scams, enhancing community safety.

The tracker can be used in three primary manners:

- Due diligence: Search for specific companies or websites to discover existing complaints, providing valuable insights into others’ experiences and allowing for an initial risk assessment. It’s crucial to remember, however, that a lack of complaints doesn’t guarantee authenticity; scammers may frequently change names or brands.

- Messaging analysis: Use the tracker to scrutinize suspicious communications by searching relevant keywords. Terms like “lending” or “insurance” can reveal patterns that match with past complaints, helping you to identify potential warning signs and recognize scam tactics.

- Education and prevention: The glossary serves as an educational resource, detailing various terms associated with crypto scams. By understanding these tactics, you can significantly elevate your awareness and defend against fraudulent offers, which is vital for navigating the often complex and perilous cryptocurrency landscape.

Did you know? The FBI’s 2023 Cryptocurrency Fraud Report indicates that California faced the highest crypto-related losses in the country, totaling $1.15 billion. In the jurisdiction of the San Francisco Field Office, losses reached $260,313,902, affecting 1,226 victims across 15 counties.

How does California’s cryptocurrency scam tracker function?

The tracker collects reports directly from consumers, detailing their experiences and losses. You can use the search feature to explore complaints based on company details, scam type, or keywords.

For instance, by searching “trading platforms,” the tracker will display scams linked to that keyword. The results are organized into five columns: primary subject, complaint narrative, scam type, website, and screenshots.

You can change the order of the results by clicking the arrow next to the column header. You also have the option to adjust the number of entries displayed at once by choosing from the dropdown menu at the bottom of the list.

To navigate through the pages of results, simply use the “Previous” and “Next” buttons.

Fraudulent schemes highlighted by California’s cryptocurrency scam tracker

The crypto scam tracker reveals numerous deceitful schemes affecting the cryptocurrency market. From phony job offers to sophisticated scams, this tool sheds light on the methods employed by fraudsters.

Below are some scams outlined in the tracker’s glossary:

- Pig butchering scam: This scam involves fraudsters gaining your trust through social, romantic, or business interactions before leading you to invest in a false scheme that requires transferring funds to a fake platform, often showcasing fake profits to entice further deposits. Victims are eventually denied access to their funds and the scammer disappears with their money.

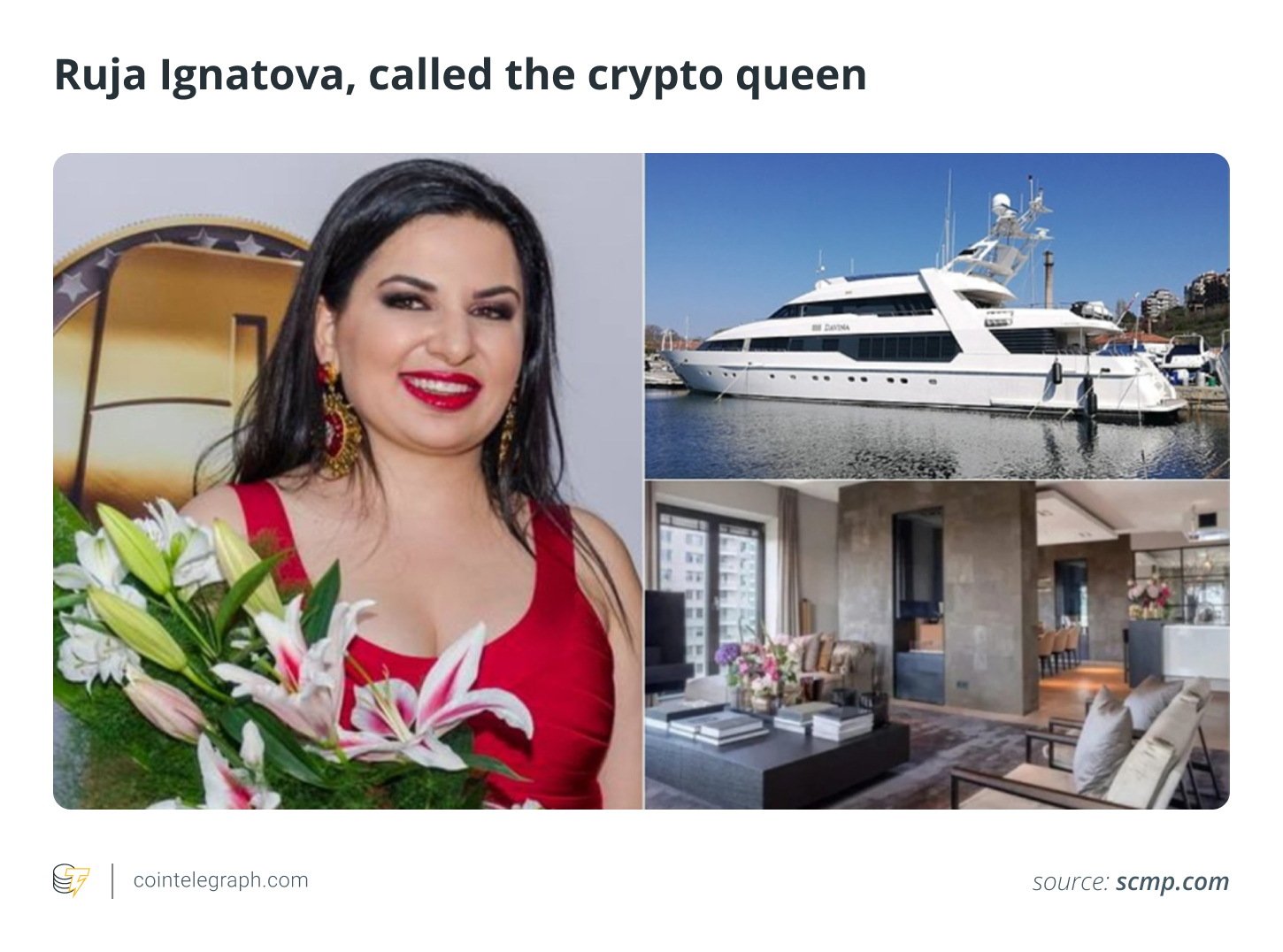

- Rug pull scams: These involve developers who mislead investors with unrealistic promises of substantial returns, only to vanish with their funds later. They often create hype on social media with celebrity endorsements, inflating token prices before profiting by selling their tokens, leaving investors with worthless assets.

Did you know? A single social media post from Argentine President Javier Milei promoting the LIBRA token caused its market cap to soar to $4 billion. However, the rapid deletion of this post led to a swift crash, resulting in considerable losses for investors.

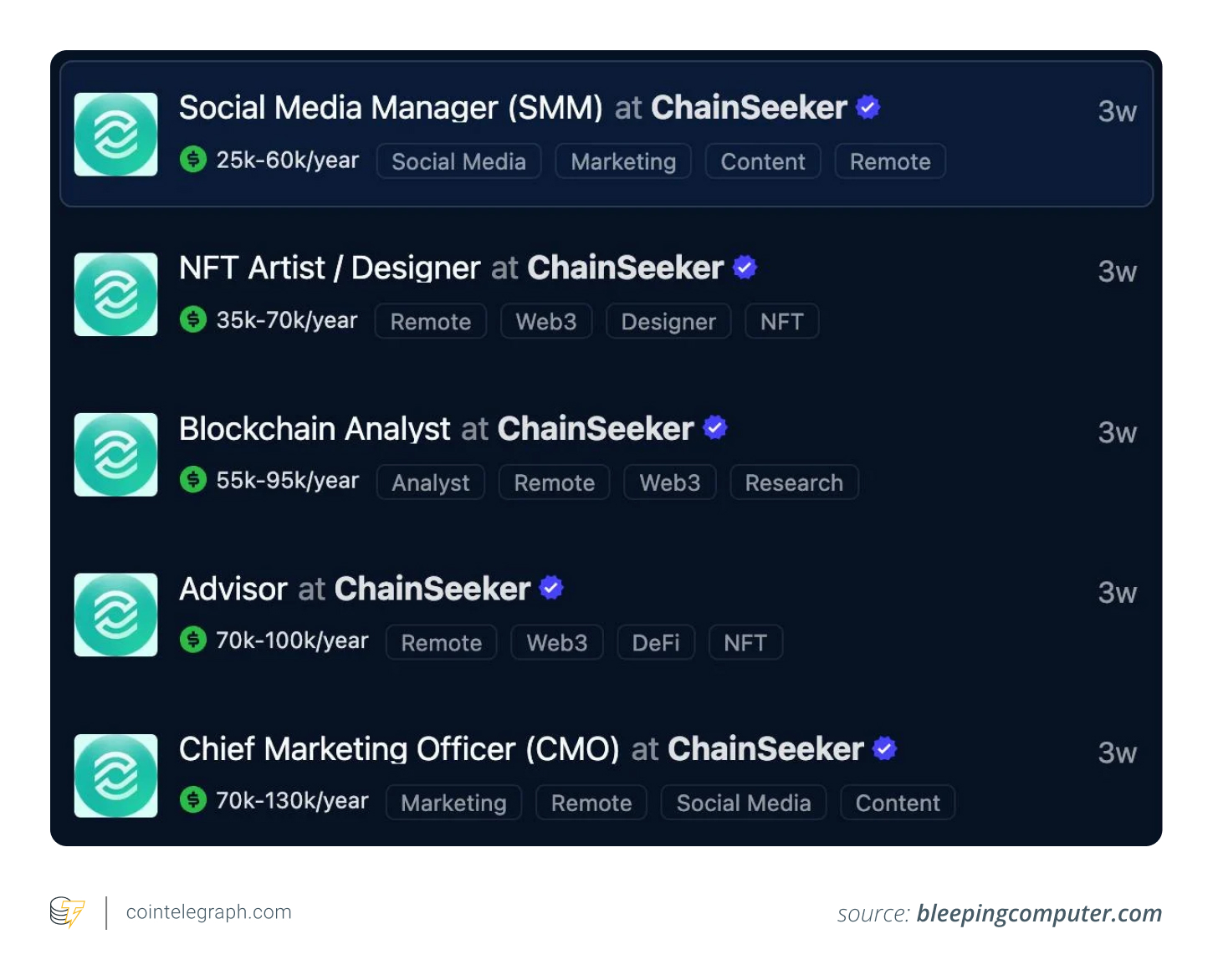

- Crypto job scams: Scammers impersonate recruiters, enticing victims with fake job offers to steal cryptocurrency and sensitive data. These positions typically promise easy money for tasks requiring little to no expertise, such as watching advertisements for compensation. These scams aim to trick individuals into depositing crypto with fraudsters and obtaining access to personal information like crypto wallet passwords.

- Wallet drainer scams: These schemes are designed to steal your digital assets by transferring them to a scammer’s wallet. Fraudsters often engage in social engineering, establishing trust through deceptive communication methods. They might create fake crypto sites, promising attractive rewards, only for victims to unknowingly approve transactions that empty their wallets.

- Fraudulent trading platforms: Scammers craft deceptive websites or applications, convincing victims to invest by claiming to offer unique opportunities. These platforms are designed to mimic authentic market movements, presenting fake profits to create an illusion of legitimacy.

- Imposter scams: In these scams, fraudsters impersonate credible figures to manipulate victims into sending money or providing sensitive information. They often utilize fake websites and social media profiles to create credibility.

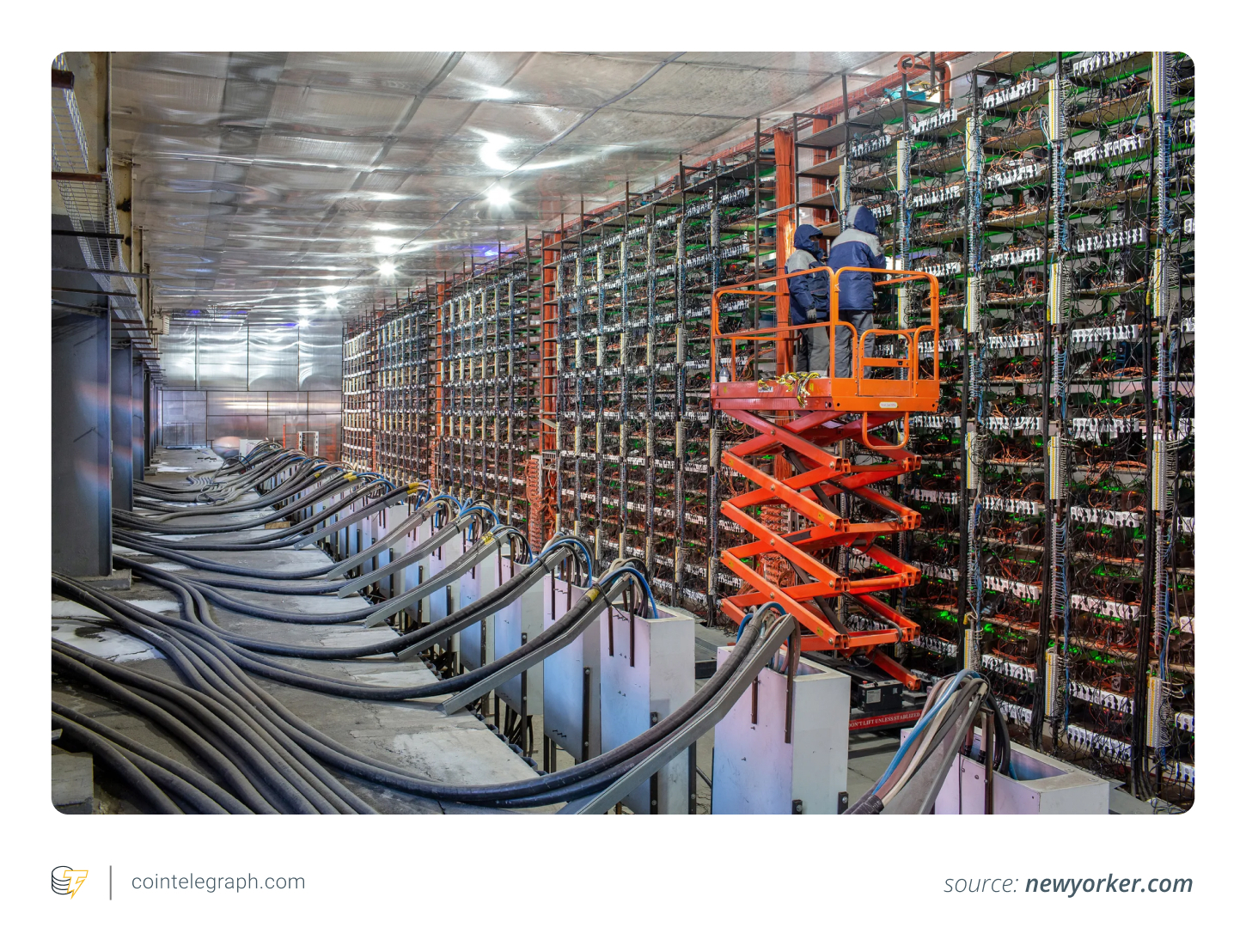

- Bitcoin mining scams: These scams entice investors with dubious offers to fund mining operations, promising returns in mined Bitcoin. However, these operations typically do not exist, and investments are lost to fraud.

Measures taken by other US agencies and states to enhance crypto scam awareness

Safeguarding crypto investors against these fraudulent activities demands a strong and diverse strategy. Federal and state regulators across the United States are joining forces to educate investors about new scam trends and to build comprehensive defenses against fraud.

The Federal Trade Commission (FTC) works to protect consumers from scams. Users can report fraudulent activities on the FTC website and explore information on various scam types. The FTC also oversees the National Do Not Call Registry, helping consumers reduce unwanted calls.

Another important agency, the Consumer Financial Protection Bureau (CFPB), plays a proactive role in regulating cryptocurrencies by issuing fraud warnings, investigating companies, and reviewing consumer complaints.

Several states in the US have initiated their own measures against scams:

- New York: The New York Attorney General’s Office operates the Consumer Frauds and Protection Bureau, which investigates scams and provides advice to consumers for their safety.

- Massachusetts: The Massachusetts Attorney General’s Office employs advanced tools like the TRM Labs blockchain intelligence platform to follow the trail of stolen funds and combat crypto-related scams.

- Texas: The Texas Attorney General’s Consumer Protection Division supports scam victims and provides guidance on avoiding fraud.

- Florida: The Florida Department of Agriculture and Consumer Services offers a Consumer Protection webpage that includes scam prevention strategies and options for submitting complaints.

The United States embraces a multilayered approach to crypto scam prevention and consumer safety. Federal agencies like the FTC and CFPB provide broad oversight and resources relating to the crypto space, while local initiatives offer focused assistance. This collaborative strategy, integrating education with enforcement, underscores the necessity of vigilance and proactive measures in addressing the complicated landscape of scams.

Nonetheless, the crypto crime reporting system in the US remains fragmented, leading industry leaders to advocate for a centralized platform for data consolidation and for victims to track their complaints. While this system is still in development, recognizing the need for it helps manage expectations and bolster critical reforms.

As diverse stakeholders advocate for standardized measures, such a platform could greatly enhance transparency, support victims, and strengthen accountability within the cryptocurrency sector.