During the Digital Asset Summit, Joe Lubin, co-founder of Ethereum, shared insights about the future of the smart contract platform, emphasizing that layer-2 (L2) scaling solutions will remain pivotal to the Ethereum ecosystem.

In an exclusive interview, Lubin indicated that applications will need advanced databases supported by high-throughput blockchain technologies. He elaborated:

“The Ethereum ecosystem is so expansive and developed that it will be most advantageous for new types of databases—new layer 2 networks—to establish themselves as Ethereum’s layer 2s. We have our own, known for its impressive features, called Linea.”

“Another promising layer 2 that is set to launch soon is MegaETH,” Lubin added.

Ultimately, Lubin remarked that newer layer-1 chains will struggle to compete with the Ethereum network, which boasts an established architecture and strong security measures.

Joe Lubin at the Digital Asset Summit.

Related: Ethereum delays Pectra upgrade for a third testnet ‘Hoodi’

Investors question the layer-2 model

According to recent data, over 140 unique scaling solutions exist for Ethereum, including around 60 rollup networks.

Investors have voiced concerns, describing Ethereum’s layer-2 networks as parasitic, siphoning revenue from the layer-1 network while providing minimal economic benefit to the underlying layer.

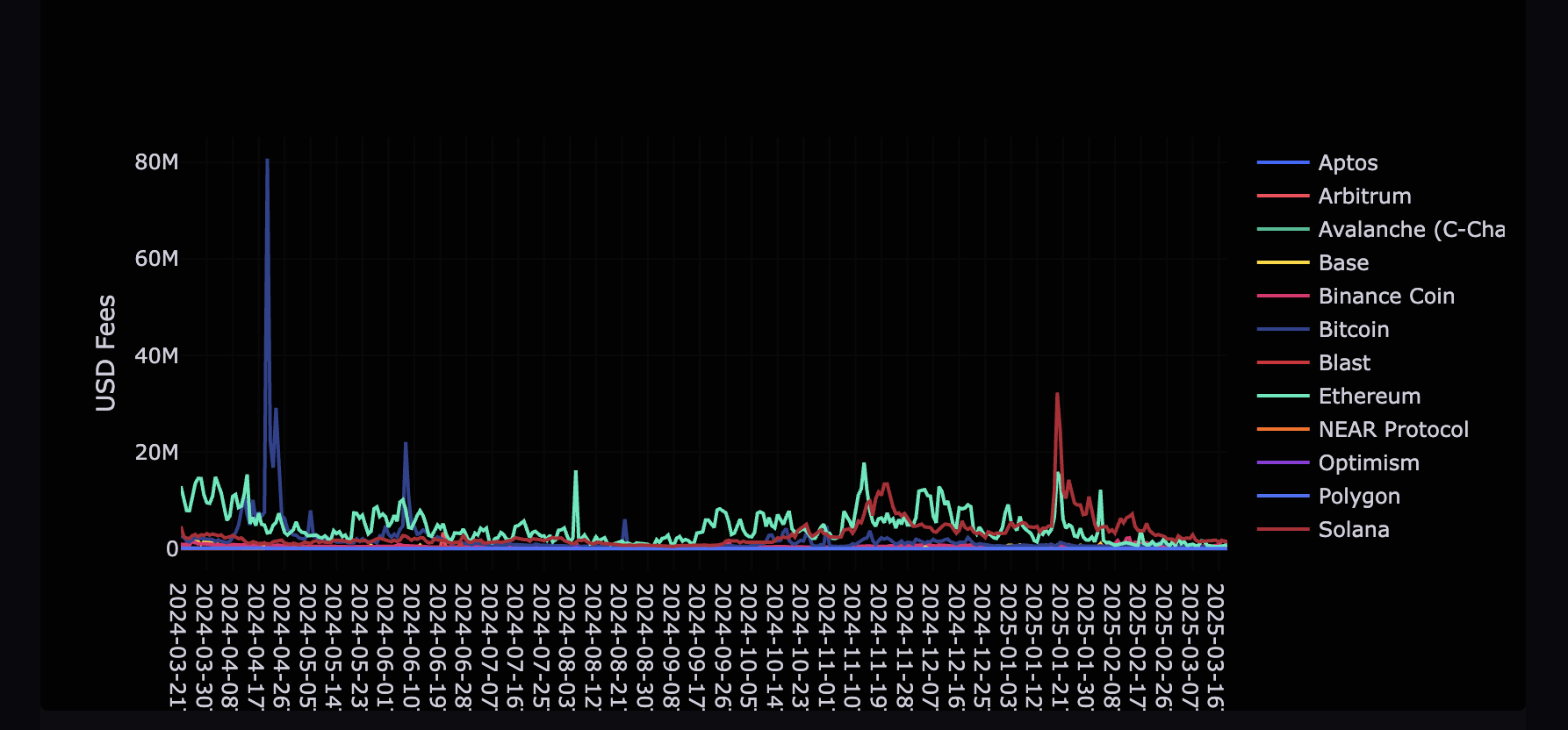

Following the Dencun upgrade in March 2024, Ethereum’s average gas fees dropped by 95%, significantly reducing transaction costs for layer-2 networks.

This decline in fees resulted in a staggering 99% drop in revenue for the Ethereum base layer by September 2024.

Layer-1 network fees on Ethereum stagnated post-Dencun upgrade.

Since then, the price of Ether (ETH) has generally trended downward, recently hitting a low of about $1,759 on March 11, prompting analysts to forecast further price declines for 2025.

Recent reports show that outflows from Ether exchange-traded funds (ETFs) have persisted for eleven straight days amid a wider downturn in the crypto markets.

The largest single day of outflows occurred on March 13, when investors withdrew a total of $73.6 million from ETH ETFs as they moved away from riskier assets to more stable alternatives like cash, government securities, and dollar-pegged stablecoins.

Magazine: MegaETH launch could rescue Ethereum… but at what price?