- On Thursday, March 20, Bitcoin reached a new 10-day high of $85,900, just prior to the speech by US President Trump at Blockwork’s crypto digital asset summit.

- Following Trump’s address, the price of BTC dropped to $83,400; however, data from derivatives trading indicates that significant reversals are not anticipated.

- Technical metrics suggest that a substantial increase in trading volumes is necessary for BTC to exceed the $90,000 mark.

Bitcoin hit a new 10-day high of $85,900 on March 20, shortly before President Trump’s speech at the crypto digital asset summit. Although BTC declined 4% from its peak after Trump’s remarks, derivatives market signals imply that sharp declines are not likely.

Analysis of Bitcoin’s 4% Drop Following Trump’s Speech

On Thursday, Bitcoin (BTC) experienced notable volatility as President Trump delivered his speech at Blockwork’s Digital Asset Summit.

During his address, Trump reiterated his support for the cryptocurrency sector and expressed his commitment to advancing the proposed Crypto Strategic Reserve initiative.

However, as investors had already internalized many of these points during earlier rallies this month, Trump’s statements did not create the fresh bullish momentum that some were hoping for.

Bitcoin Price Analysis | BTCUSDT

Within mere hours after the speech, Bitcoin saw a decline to $83,600, representing a 4% drop from the day’s high of $85,900.

This price movement formed a long upper shadow, indicating rejection at elevated levels, which could signal a potential bearish trend.

However, despite this drop, trading volumes were considerably lower than the previous session, implying that the sell-off did not possess enough strength to instigate a more significant downward shift.

Market Signals Indicate Continued Bullish Sentiment Despite Mild Bitcoin Dip

Although Bitcoin experienced a brief 4% decline after Trump’s speech, data from the derivatives market suggests that bullish sentiment remains strong.

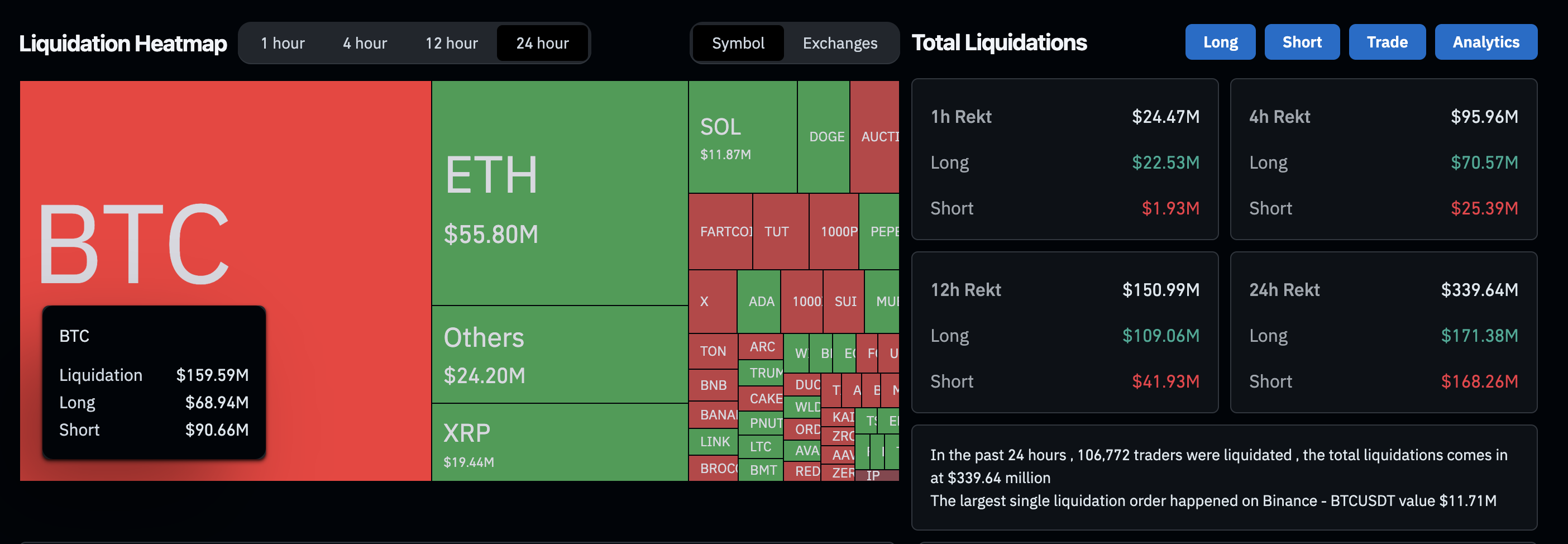

The liquidation heatmap shows that Bitcoin faced $159.59 million in total liquidations over the past 24 hours, with short positions accounting for $90.66 million, outpacing the $68.94 million in long liquidations.

Crypto Market Liquidation Heatmap

This trend contrasts with the wider cryptocurrency market, where total liquidations reached $339.64 million, with long positions worth $171.38 million closing, exceeding the $168.26 million in shorts.

This indicates that while the sentiment among altcoin traders is more cautious, short-term traders in Bitcoin maintain a distinctly bullish outlook, as evidenced by the higher rate of short liquidations suggesting those betting against Bitcoin are facing pressure.

Moreover, prior on-chain data indicated a $14 billion surge in large Bitcoin transactions leading up to the pause in interest rate hikes by the Federal Reserve, highlighting robust institutional demand.

While Trump’s speech did not introduce new bullish catalysts, the derivative market signals seen on Thursday imply that BTC is less likely to experience a prolonged sell-off.

Bitcoin Price Outlook: Consolidating Above $82,000 May Lead to a Rally towards $90,000

Bitcoin’s price prediction suggests that a sustained consolidation above the $82,000 support level might facilitate a move towards the $90,000 mark.

The liquidation heatmap indicates that short liquidations in Bitcoin have surpassed long ones, signaling that bearish positions are being pressured.

This pattern typically reflects strong buying interest at crucial support points, reinforcing the prospect of upward movement.

Bitcoin Price Prediction | BTCUSD

Bitcoin Price Prediction | BTCUSD

Technical indicators also lend support to a cautiously optimistic outlook.

The current price action of BTC is stabilizing within a range of $83,600 to $85,900, with resistance observed near the upper Bollinger Band at $92,252.

The lower Bollinger Band, located at $78,065, serves as an essential support level should selling pressure escalate.

The Parabolic SAR indicator, which identifies trend direction, remains below the price action, indicating underlying bullish support.

However, the Average Daily Range (ADR) of 0.80 implies diminishing volatility, suggesting that Bitcoin requires a surge in trading volume to sustain a significant breakout.

In an optimistic scenario, reclaiming $86,000 with robust volume could see BTC pushing towards the $90,000 resistance zone.

Conversely, should Bitcoin fail to maintain levels above $84,000, a retest of the $80,000–$78,000 range appears likely, with further downside risk down to $76,600 if accumulation by larger holders diminishes.