A cryptocurrency trader has cautioned that using high leverage before the United States’ monthly interest rate decision is a guaranteed method for losing money in the crypto market.

Following the Federal Reserve’s announcement indicating that it plans to keep interest rates steady within the target range of 4.25% to 4.5%, there was minimal movement in Bitcoin’s price, as the market had largely anticipated this outcome.

However, after Federal Reserve Chair Jerome Powell remarked that the chance of a recession is “not high”—contrary to predictions from independent economists—there was a noticeable uptick in the broader crypto market, catching many downside-betting traders off guard.

“This is a guaranteed recipe for financial loss,” stated Michael van de Poppe, founder of MN Trading Capital, in a post on March 19.

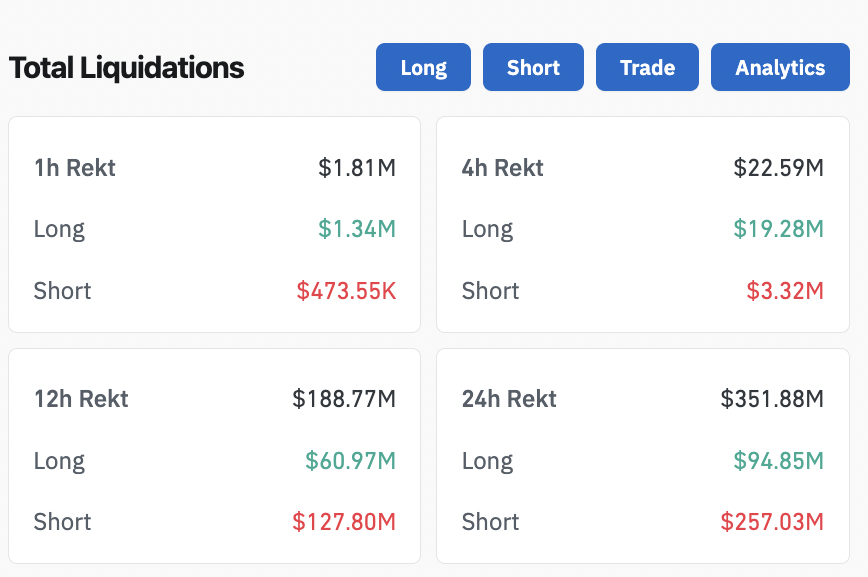

Data from CoinGlass shows that $188.77 million was liquidated from the crypto markets in a 12-hour window, with $127.80 million of that representing short positions.

Approximately $257.03 million in short positions have been liquidated over the last 24 hours.

Bitcoin (BTC) rose by 3.84% within six hours following Powell’s remarks, reaching $87,427 before settling back to $85,760 at press time. Ether (ETH) saw a 2.27% increase during the same period, while XRP (XRP) gained 2.40%, adding to its 7.50% surge leading up to the interest rate announcement, as per CoinMarketCap data.

“The initial statement isn’t as significant; it’s Powell’s words that matter most,” van de Poppe mentioned, emphasizing that this will likely dictate Bitcoin’s price movement in the near future.

Bitcoin has grown by 3.49% over the last 24 hours.

Related: Bitcoin faces new ‘death cross’ as BTC price tests $84K resistance

Crypto analyst predicts a short-lived Bitcoin rally

The crypto trading account BitcoinHyper noted, “The FOMC meeting caused Bitcoin to surge right into the major liquidation level.”

“Even if BTC climbs higher, this isn’t an ideal point for new long positions,” the account warned.

Matt Mena, a crypto research strategist at 21Shares, echoed this sentiment, suggesting that while the Fed’s “dovish shift” on interest rates might provide a temporary boost for Bitcoin, its sustainability is doubtful.

“Bitcoin is likely to stay in a consolidation phase until a clear catalyst arises,” Mena added. “However, looking ahead, the overall macroeconomic environment remains supportive for a bullish outlook on BTC,” he remarked.

According to Powell, the median forecast from FOMC members indicates that interest rates will be at 3.9% by the end of 2025 and 3.4% by the end of 2026.

Magazine: Classic Sega, Atari, and Nintendo games are receiving crypto updates: Web3 Gamer

This article is not intended as investment advice or as a recommendation. Every investment and trading decision involves risk, and readers should perform their own research before making any choices.